1040 Schedule 2 2019

What is the 1040 Schedule 2

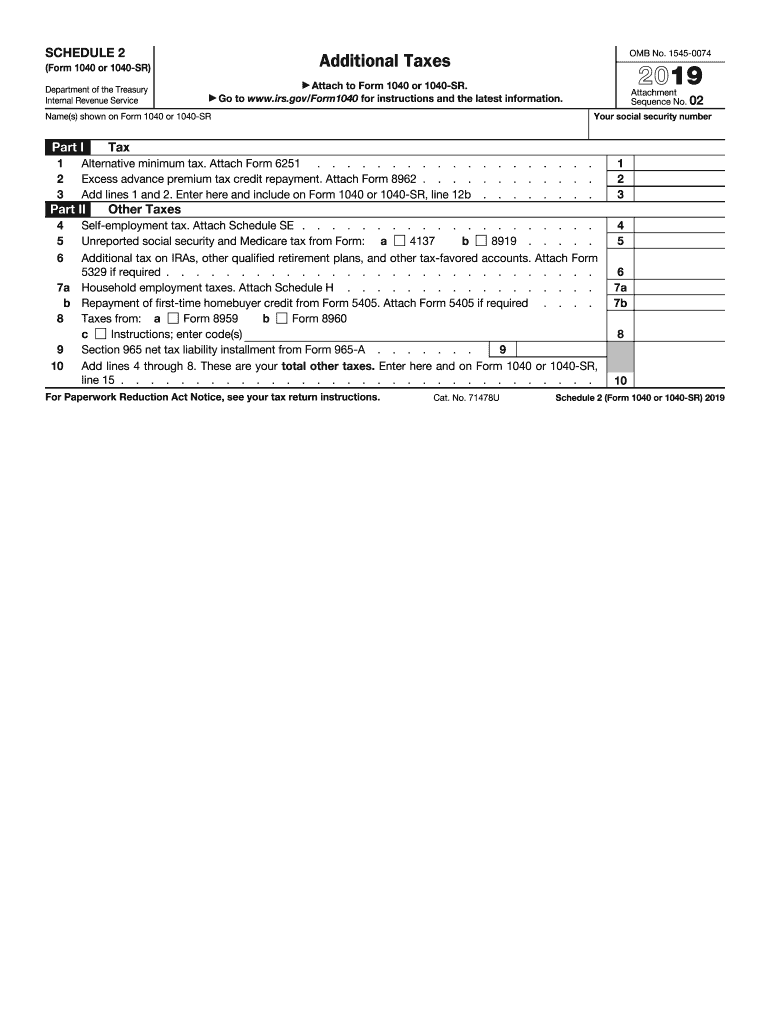

The 1040 Schedule 2 is an essential tax form used by U.S. taxpayers to report additional taxes owed. This form is part of the IRS Form 1040 series and is specifically designed for individuals who need to report various types of taxes that are not included on the main Form 1040. Common situations that require the use of Schedule 2 include self-employment tax, alternative minimum tax, and certain other taxes related to health care and retirement accounts.

How to use the 1040 Schedule 2

To effectively use the 1040 Schedule 2, taxpayers must first determine if they have any additional taxes to report. If applicable, they will fill out the form by providing the necessary information regarding the specific taxes owed. This information will then be transferred to the main Form 1040. It is crucial to ensure that all calculations are accurate, as errors can lead to delays in processing or potential penalties.

Steps to complete the 1040 Schedule 2

Completing the 1040 Schedule 2 involves several steps:

- Gather all necessary documents, including income statements and records of any additional taxes owed.

- Fill out the form by entering the appropriate information for each line item, ensuring accuracy.

- Double-check calculations to confirm that all amounts are correct.

- Attach the completed Schedule 2 to your Form 1040 when filing your taxes.

Legal use of the 1040 Schedule 2

The legal use of the 1040 Schedule 2 requires compliance with IRS regulations. This form must be filled out accurately and submitted on time to avoid penalties. Taxpayers should keep a copy of the completed form for their records, as it may be required for future reference or in the event of an audit. Understanding the legal implications of the information reported is essential for maintaining compliance with tax laws.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the 1040 Schedule 2. Typically, the deadline for submitting Form 1040, along with any attached schedules, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website for any updates or changes to deadlines to ensure timely filing.

Examples of using the 1040 Schedule 2

There are several scenarios in which a taxpayer might need to use the 1040 Schedule 2. For instance:

- A self-employed individual may need to report self-employment tax on Schedule 2.

- Taxpayers with certain retirement account distributions may have to report additional taxes.

- Individuals subject to the alternative minimum tax must also use this schedule to report their liability.

Quick guide on how to complete 1040 2019 schedule 2

Prepare 1040 Schedule 2 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, adjust, and eSign your documents swiftly without delays. Handle 1040 Schedule 2 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign 1040 Schedule 2 with ease

- Locate 1040 Schedule 2 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign 1040 Schedule 2 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040 2019 schedule 2

Create this form in 5 minutes!

People also ask

-

What is the 2019 IRS Schedule 2?

The 2019 IRS Schedule 2 is an important tax form used to report additional taxes owed, including self-employment tax and additional tax on IRAs. Understanding this form is crucial for accurate tax filing, especially if you have unique income situations. Having the right tools like airSlate SignNow can simplify document management related to your tax forms.

-

How can airSlate SignNow help with the 2019 IRS Schedule 2?

airSlate SignNow provides an efficient platform for businesses to eSign and manage documents, including tax forms like the 2019 IRS Schedule 2. With our user-friendly interface, you can streamline the process of collecting signatures and ensure that all necessary tax forms are filed correctly. This will keep your business compliant while saving you time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs. Our plans are designed to be cost-effective while providing essential features for handling documents like the 2019 IRS Schedule 2. You can choose from monthly or annual subscriptions based on your usage and preferences.

-

Is airSlate SignNow secure for signing sensitive tax documents?

Yes, airSlate SignNow employs advanced encryption and security measures to protect your documents, including sensitive tax information on the 2019 IRS Schedule 2. We prioritize data security, ensuring that your eSigned documents are safe from unauthorized access. Trust us to handle your document needs securely.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow seamlessly integrates with a variety of popular applications, enhancing your workflow when dealing with documents like the 2019 IRS Schedule 2. Whether you're using accounting software or project management tools, our integrations can streamline your processes for maximum efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features designed for effective document management, such as customizable templates, automatic reminders, and real-time tracking. These tools make it easier to manage files associated with the 2019 IRS Schedule 2 and ensure you meet all deadlines. Simplify your workflow with our comprehensive features.

-

How does airSlate SignNow improve efficiency in signing tax documents?

With airSlate SignNow, you can speed up the signing process for tax documents like the 2019 IRS Schedule 2 dramatically. Our platform allows multiple parties to sign electronically, reducing the usual back-and-forth of traditional methods. This means you can file your taxes more quickly and efficiently.

Get more for 1040 Schedule 2

Find out other 1040 Schedule 2

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document