Internal Revenue Service Taxes 2021

What is the Internal Revenue Service Taxes

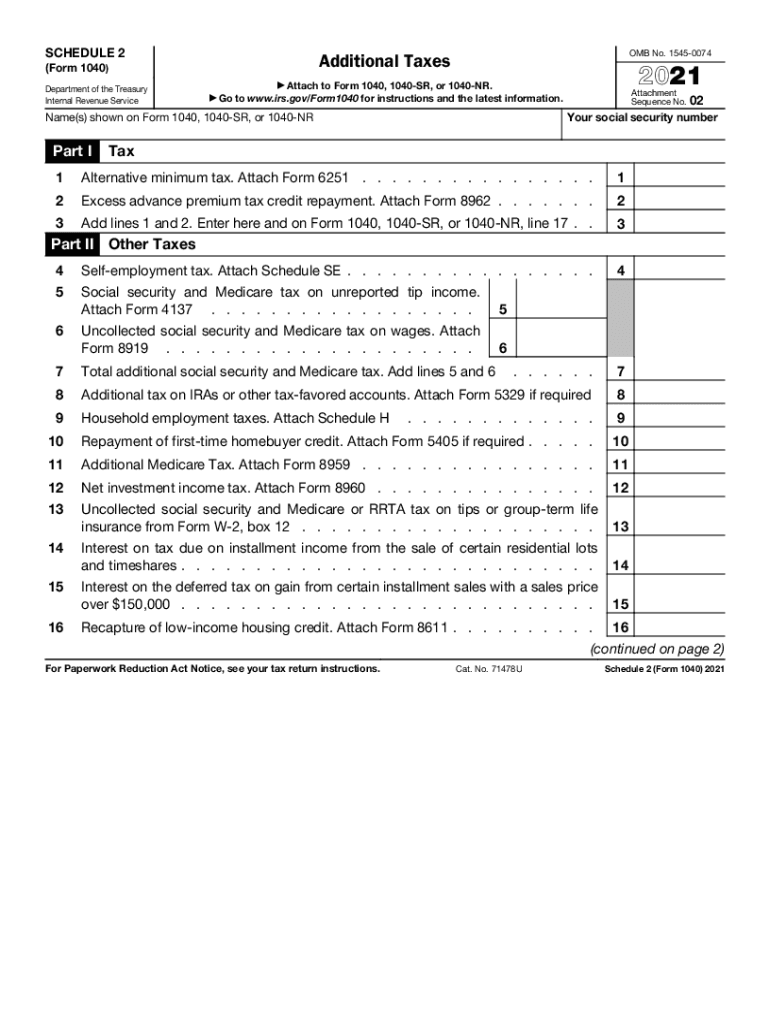

The Internal Revenue Service (IRS) taxes refer to the federal taxes imposed by the United States government on income, payroll, and various other financial transactions. The IRS is responsible for administering and enforcing federal tax laws, collecting taxes, and processing tax returns. These taxes fund essential services and programs that benefit the public, including education, infrastructure, and healthcare. Understanding the different types of IRS taxes, such as income tax, self-employment tax, and capital gains tax, is crucial for taxpayers to ensure compliance and avoid penalties.

Steps to complete the Internal Revenue Service Taxes

Completing IRS taxes involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099 forms, and any relevant receipts for deductions. Next, choose the appropriate tax form, such as the IRS 1040 or the IRS Schedule 2, depending on your income sources and deductions. After selecting the correct form, fill it out carefully, ensuring all information is accurate and complete. Once completed, review the form for any errors before submitting it. Finally, file your taxes either electronically through approved software or by mailing a paper form to the IRS.

Legal use of the Internal Revenue Service Taxes

Legal use of IRS taxes entails adhering to federal tax laws and regulations. Taxpayers must accurately report their income, claim eligible deductions, and pay the correct amount of taxes owed. Utilizing eSignature solutions, like signNow, can facilitate the signing and submission of tax documents securely and legally. Compliance with laws such as the Electronic Signatures in Global and National Commerce Act (ESIGN) ensures that electronic signatures hold the same legal weight as traditional handwritten signatures, making it easier for taxpayers to manage their IRS obligations digitally.

Filing Deadlines / Important Dates

Filing deadlines for IRS taxes are crucial for taxpayers to avoid penalties. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Extensions can be requested, allowing additional time to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties. It's important to stay informed about specific deadlines for various forms, such as the IRS 1040 and Schedule 2, to ensure timely compliance.

Required Documents

To complete IRS taxes accurately, several documents are required. Key documents include W-2 forms from employers, 1099 forms for freelance or contract work, and any receipts or records for deductible expenses. Additionally, taxpayers may need documentation for other income sources, such as investment income or rental properties. Keeping organized records throughout the year simplifies the tax preparation process and helps ensure that all necessary information is available when filing.

Penalties for Non-Compliance

Failing to comply with IRS tax regulations can result in significant penalties. Common penalties include failure-to-file penalties, which occur when a tax return is not submitted by the deadline, and failure-to-pay penalties for not paying taxes owed on time. Interest may also accrue on unpaid taxes, increasing the total amount owed. Understanding these penalties emphasizes the importance of timely and accurate tax filing to avoid financial repercussions.

Quick guide on how to complete internal revenue service taxes

Effortlessly Create Internal Revenue Service Taxes on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary format and securely save it online. airSlate SignNow equips you with all the resources needed to produce, alter, and electronically sign your documents promptly without delays. Handle Internal Revenue Service Taxes on any device using the airSlate SignNow applications for Android or iOS and simplify your document-related processes today.

The easiest way to modify and electronically sign Internal Revenue Service Taxes effortlessly

- Obtain Internal Revenue Service Taxes and click on Get Form to commence.

- Utilize the tools we provide to finalize your document.

- Emphasize signNow portions of the documents or conceal confidential information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Internal Revenue Service Taxes to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct internal revenue service taxes

Create this form in 5 minutes!

People also ask

-

What are internal revenue service taxes, and how do they affect me?

Internal revenue service taxes refer to the taxes you owe to the IRS on your taxable income. These taxes can affect your financial planning and require accurate document handling, making tools like airSlate SignNow essential for smooth eSigning workflows and compliance.

-

How can airSlate SignNow help with managing internal revenue service taxes?

airSlate SignNow simplifies the process of sending and eSigning crucial tax documents associated with internal revenue service taxes. By using our platform, you can ensure that all your tax forms are properly signed and stored for easy access during tax season.

-

Is airSlate SignNow a cost-effective solution for managing internal revenue service taxes?

Absolutely! airSlate SignNow offers a range of affordable pricing options that cater to businesses of all sizes. With our solution, you can save on resources and avoid the costly delays often associated with filing internal revenue service taxes.

-

What key features does airSlate SignNow offer for handling internal revenue service taxes?

Our platform provides features like templates for tax documents, automated reminders for signing, and secure document storage. These features ensure that managing internal revenue service taxes is efficient, compliant, and hassle-free.

-

Can I integrate airSlate SignNow with accounting software for internal revenue service taxes?

Yes, airSlate SignNow easily integrates with various accounting and financial software solutions. This integration simplifies the workflow for managing internal revenue service taxes, ensuring a seamless transfer of signed documents and data.

-

What are the benefits of using airSlate SignNow for internal revenue service taxes?

Using airSlate SignNow for internal revenue service taxes enhances efficiency and accuracy in document handling. It minimizes the risk of errors and provides a user-friendly platform for all your eSigning needs, contributing to a smooth tax process.

-

How secure is airSlate SignNow when dealing with internal revenue service taxes?

airSlate SignNow prioritizes security with advanced encryption and compliance measures. You can rest assured that your sensitive information related to internal revenue service taxes is securely handled and safely stored.

Get more for Internal Revenue Service Taxes

- Letter from tenant to landlord with demand that landlord repair broken windows virginia form

- Virginia letter demand form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497428082 form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring virginia form

- Virginia tenant landlord form

- Letter landlord demand 497428085 form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles virginia form

- Letter from tenant to landlord about landlords failure to make repairs virginia form

Find out other Internal Revenue Service Taxes

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy