N 30 Hawaii Form 2016

What is the N-30 Hawaii Form

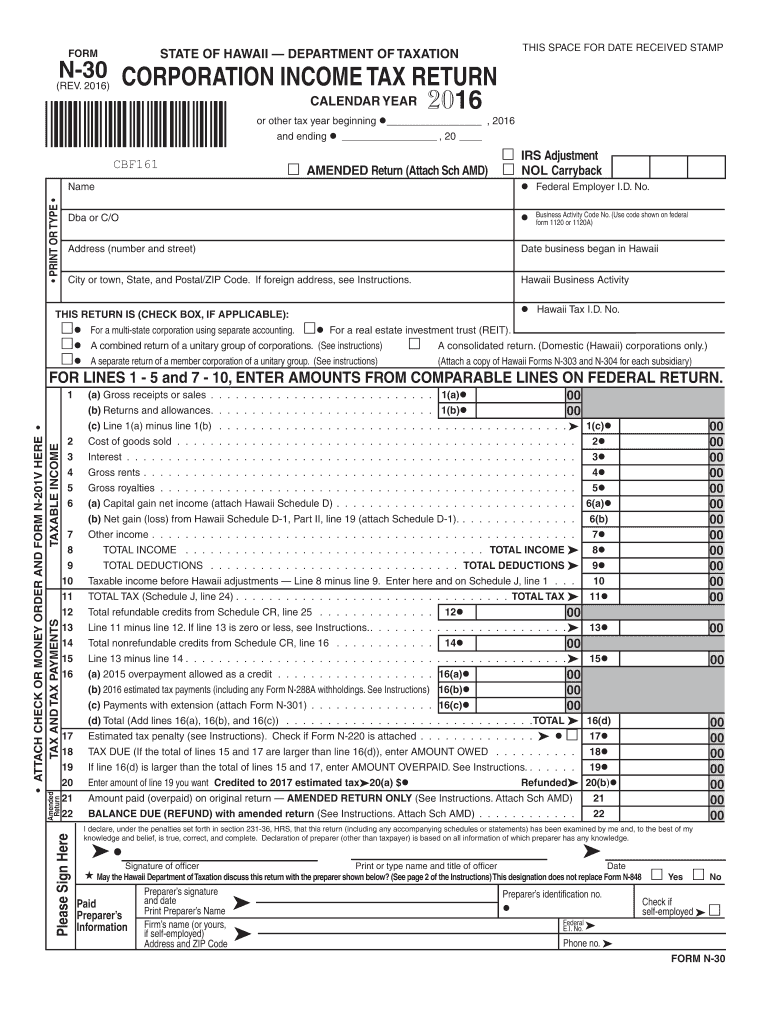

The N-30 Hawaii Form is a tax document used by businesses and individuals to report income and calculate tax liabilities within the state of Hawaii. This form is essential for ensuring compliance with state tax regulations and is required for various types of entities, including corporations and partnerships. By accurately completing the N-30, taxpayers can fulfill their obligations while also potentially qualifying for certain deductions or credits available under Hawaii tax law.

Steps to Complete the N-30 Hawaii Form

Completing the N-30 Hawaii Form involves several key steps to ensure accuracy and compliance:

- Gather all necessary financial documents, including income statements and expense records.

- Fill in the identification section with your business name, address, and tax identification number.

- Report your total income and any adjustments as required by the form.

- Calculate your total tax liability based on the income reported.

- Review the form for accuracy and completeness before submission.

How to Obtain the N-30 Hawaii Form

The N-30 Hawaii Form can be obtained through several methods. It is available for download from the official Hawaii Department of Taxation website. Additionally, physical copies may be requested at local tax offices or through mail. Ensure you have the most current version of the form to comply with any recent tax law changes.

Legal Use of the N-30 Hawaii Form

The N-30 Hawaii Form is legally binding when filled out correctly and submitted to the appropriate tax authorities. It is important to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or legal issues. The form must be signed by an authorized representative of the business, affirming that the information is complete and accurate.

Filing Deadlines / Important Dates

Filing deadlines for the N-30 Hawaii Form are typically aligned with the end of the tax year. Businesses must file their forms by the 20th day of the fourth month following the close of their tax year. For most entities operating on a calendar year, this means the deadline is April 20. It is crucial to adhere to these deadlines to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The N-30 Hawaii Form can be submitted through multiple methods. Taxpayers have the option to file online through the Hawaii Department of Taxation's e-filing system, which offers a convenient way to submit forms securely. Alternatively, the form can be mailed to the designated tax office or submitted in person at local tax offices. Each method has its own processing times and requirements, so choose the one that best fits your needs.

Quick guide on how to complete n 30 hawaii 2016 form

Your assistance manual on how to prepare your N 30 Hawaii Form

If you’re wondering how to create and send your N 30 Hawaii Form, here are a few straightforward instructions on how to simplify tax submission.

First, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to modify, create, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revisit to adjust responses as necessary. Streamline your tax management with enhanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your N 30 Hawaii Form in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Get form to access your N 30 Hawaii Form in our editor.

- Fill in the necessary fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to insert your legally-binding eSignature (if required).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes online with airSlate SignNow. Please be aware that paper submissions may lead to increased errors and delayed refunds. Certainly, before e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct n 30 hawaii 2016 form

FAQs

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

If I publish on Smashwords and tick on the option to take a 30 percent tax, do I still need to fill out the tax form?

If you want to get any of that tax money back in your pocket, you will have to fill out the forms.Are you a US citizen? If not, you will need to obtain an ITIN using IRS form W-7. This will allow you to file the appropriate US tax return forms and claim a refund. Depending on your country of residence, the refund could be up to 100% of the tax collected. With an ITIN, you will usually be exempt from the 30% withholding and will not be required to fill out any US tax returns at the end of the year (unless you actually reside in the US, but that is a far more complicated situation). The ITIN application process can be a royal pain in the behind, especially if you wait until after the taxes have been withheld.If your book only makes a few dollars, the hassle is not worth it. But if you hit the self-publishing lottery, you will definitely want to apply for that refund.

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

Create this form in 5 minutes!

How to create an eSignature for the n 30 hawaii 2016 form

How to create an electronic signature for the N 30 Hawaii 2016 Form in the online mode

How to generate an electronic signature for your N 30 Hawaii 2016 Form in Google Chrome

How to make an eSignature for signing the N 30 Hawaii 2016 Form in Gmail

How to generate an eSignature for the N 30 Hawaii 2016 Form from your smart phone

How to create an electronic signature for the N 30 Hawaii 2016 Form on iOS

How to create an eSignature for the N 30 Hawaii 2016 Form on Android devices

People also ask

-

What is the N 30 Hawaii Form?

The N 30 Hawaii Form is a specific tax document used for reporting business income and expenses in Hawaii. Businesses in Hawaii are required to submit this form to the Department of Taxation to comply with state tax regulations. Using airSlate SignNow, you can easily gain access to this form, fill it out, and eSign it efficiently.

-

How can airSlate SignNow help with the N 30 Hawaii Form?

airSlate SignNow offers a seamless way to prepare, sign, and send the N 30 Hawaii Form. With our user-friendly platform, you can quickly fill in the necessary fields, add electronic signatures, and ensure timely submission. Our document management features increase efficiency and reduce the risk of errors during the process.

-

Is airSlate SignNow cost-effective for managing the N 30 Hawaii Form?

Yes, airSlate SignNow provides a cost-effective solution for managing the N 30 Hawaii Form. Our competitive pricing plans cater to businesses of all sizes, allowing you to save time and money by streamlining your document signing processes. Efficient management of tax forms like the N 30 Hawaii Form can signNowly decrease administrative costs.

-

What features does airSlate SignNow offer for the N 30 Hawaii Form?

airSlate SignNow offers a variety of features to enhance your experience with the N 30 Hawaii Form. These include eSignature capabilities, document templates, and secure storage options. Additionally, you can track the status of the form, ensuring it's completed and submitted on time.

-

Are there any integrations available for the N 30 Hawaii Form?

Absolutely! airSlate SignNow integrates with various platforms to facilitate handling of the N 30 Hawaii Form. You can connect it with productivity tools, CRMs, and other applications, making it easier to personalize and automate your document workflows. This integration enhances the overall efficiency of your tax filing process.

-

How secure is the information on the N 30 Hawaii Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the N 30 Hawaii Form. We use industry-leading encryption and compliance measures to protect your data throughout the signing process. You can trust that your information is safe and secure with us.

-

Can I edit the N 30 Hawaii Form after signing it in airSlate SignNow?

Once the N 30 Hawaii Form has been signed in airSlate SignNow, editing it is not possible as it ensures the integrity of the signed document. However, you can create draft versions prior to signing, allowing you to make adjustments as needed. This ensures your form is accurate before the official submission.

Get more for N 30 Hawaii Form

- Hollard claim form

- Loma application form

- Basketball score sheet providing help creating hope form

- Breast cancer golf day flyer pacific harbour golf ampamp country form

- Statement of financial position ing direct form

- 12 004 044 937 form

- Purchasertransferee declaration explanatory notes and supporting evidence purchaser transferee declaration explanatory notes form

- Affidavit in support of enforcement of monetary order vcat form

Find out other N 30 Hawaii Form

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract