Federal and State Form W 4 Compliance EY 2014

What is the Federal And State Form W-4 Compliance EY

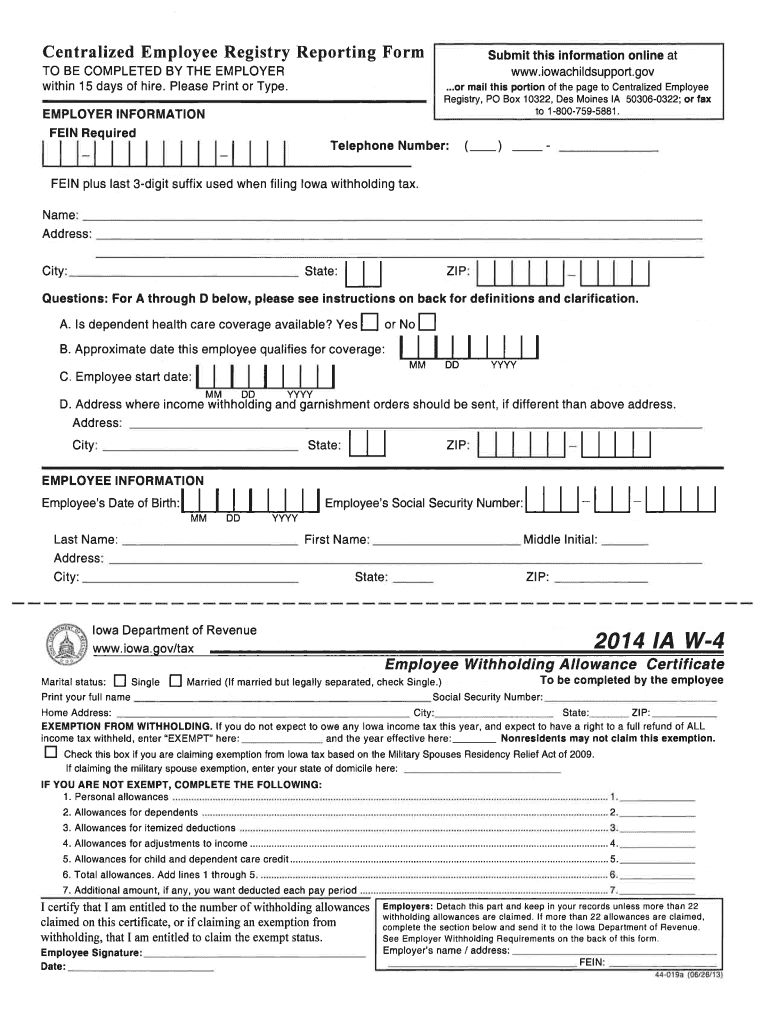

The Federal and State Form W-4 Compliance EY is a crucial document used by employees in the United States to indicate their tax withholding preferences. This form is essential for employers to determine the correct amount of federal income tax to withhold from employees' paychecks. It is designed to ensure that the withholding aligns with the employee's financial situation, including their marital status, number of dependents, and any additional income or deductions they may have. Compliance with this form is necessary for both federal and state tax regulations, making it a vital part of the payroll process.

Steps to complete the Federal And State Form W-4 Compliance EY

Completing the Federal and State Form W-4 Compliance EY involves several clear steps:

- Personal Information: Fill in your name, address, Social Security number, and filing status.

- Multiple Jobs or Spouse Works: If applicable, indicate if you have multiple jobs or if your spouse works. This helps in accurately determining your withholding.

- Claim Dependents: If you have dependents, provide the necessary details to claim any applicable tax credits.

- Other Adjustments: Specify any additional income or deductions that may affect your tax withholding.

- Signature: Sign and date the form to validate it, ensuring that all information provided is accurate.

Once completed, the form should be submitted to your employer, who will then use it to adjust your payroll withholding accordingly.

Legal use of the Federal And State Form W-4 Compliance EY

The legal use of the Federal and State Form W-4 Compliance EY is governed by both federal and state tax laws. It is essential for employees to provide accurate information to avoid under-withholding or over-withholding of taxes. Employers are required to keep this form on file for their records and must ensure that the information is used solely for the purpose of calculating tax withholdings. Misuse of the form or providing false information can lead to penalties for both the employee and employer, highlighting the importance of compliance with all relevant tax regulations.

Filing Deadlines / Important Dates

Understanding filing deadlines is critical for compliance with the Federal and State Form W-4 Compliance EY. Generally, employees should submit their completed W-4 to their employer before the first paycheck of the year or whenever there are changes in their personal or financial situation. Employers must ensure that they implement the changes in withholding as soon as possible, typically within one pay period. Additionally, it is advisable for employees to review their W-4 at least annually or after significant life events, such as marriage or the birth of a child, to ensure accurate withholding.

Form Submission Methods (Online / Mail / In-Person)

The Federal and State Form W-4 Compliance EY can be submitted through various methods, depending on the employer's policies. Common submission methods include:

- Online: Many employers offer a digital platform for employees to fill out and submit their W-4 forms electronically.

- Mail: Employees may also print the form and mail it directly to their employer's payroll department.

- In-Person: Submitting the form in person is another option, allowing employees to discuss any questions or concerns directly with HR or payroll staff.

It is essential to confirm with your employer which method they prefer for submission to ensure timely processing.

Penalties for Non-Compliance

Failure to comply with the Federal and State Form W-4 Compliance EY can result in significant penalties. Employees who do not provide accurate information may face under-withholding, leading to a tax bill at the end of the year, along with potential penalties and interest from the IRS. Employers who fail to maintain accurate records or do not implement the withholding changes may also face penalties. It is crucial for both parties to ensure compliance to avoid financial repercussions.

Quick guide on how to complete federal and state form w 4 compliance ey

Your assistance manual on how to prepare your Federal And State Form W 4 Compliance EY

If you’re curious about how to finalize and submit your Federal And State Form W 4 Compliance EY, here are some straightforward guidelines on how to simplify tax declaration.

To begin, you just need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and effective document solution that allows you to edit, create, and complete your income tax documents with ease. Utilizing its editor, you can toggle between text, check boxes, and electronic signatures and return to modify information as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to finalize your Federal And State Form W 4 Compliance EY in just minutes:

- Create your account and start working on PDFs in no time.

- Consult our catalog to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to access your Federal And State Form W 4 Compliance EY in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and correct any errors.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper filing can lead to higher return errors and slower refunds. Of course, prior to e-filing your taxes, verify the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct federal and state form w 4 compliance ey

FAQs

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

I want to invest my IRS withholdings. How do I fill out a W-4 so my employer does not do federal withholding?

Legally you can’t. Those withholdings are not yours. They are payments towards your tax liability, made at the time that you earn the income. Pay as you go. It makes sense.So what you want to do is borrow money that isn’t really yours, interest free, invest it for a few months, and then pay it back the next year. Is that correct? While it’s not really permitted you can manage to get away with it. You can’t easily get away with stopping all withholding. That requires stating that you expect to pay zero taxes for the year, which you know is false. It looks suspicious and is easy for the feds to check. Instead, what you can do is reduce your withholding by claiming a large number of exemptions. That’s not nearly as suspicious. When you complete your return you’ll owe a lot of tax, which is clearly against the rules, but you’ll probably get away with it at least for a year or two and maybe longer depending on how lax the IRS is in enforcing the law on scamsters like yourself.I used to claim a large number of exemptions. It was legitimate since I actually had a lot of deductions at that time. But a couple of years I accidentally withheld too little money, more than a couple of thousand dollars. I paid the tax with my return and adjusted my withholding going forward and the IRS didn’t penalize me or question it afterwards. But if you’re talking about under withholding by a lot more than that and year after year then good luck. You might get caught, forced to pay a penalty and interest, and be flagged for special attention in the future.

-

How much do accountants charge for helping you fill out a W-4 form?

A W-4 is a very simple form to instruct your employer to withhold the proper tax. It's written in very plain English and is fairly easy to follow. I honestly do not know of a CPA that will do one of these. If you're having trouble and cannot find a tutorial you like on line see if you can schedule a probing meeting. It should take an accounting student about 10 minutes to walk you through. There is even a worksheet on the back.If you have mitigating factors such as complex investments, partnership income, lies or garnishments, talk to your CPA about those, and then ask their advice regarding the W4 in the context of those issues.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

Create this form in 5 minutes!

How to create an eSignature for the federal and state form w 4 compliance ey

How to generate an eSignature for your Federal And State Form W 4 Compliance Ey in the online mode

How to create an electronic signature for your Federal And State Form W 4 Compliance Ey in Google Chrome

How to generate an electronic signature for signing the Federal And State Form W 4 Compliance Ey in Gmail

How to create an eSignature for the Federal And State Form W 4 Compliance Ey straight from your mobile device

How to create an electronic signature for the Federal And State Form W 4 Compliance Ey on iOS

How to generate an eSignature for the Federal And State Form W 4 Compliance Ey on Android devices

People also ask

-

What is airSlate SignNow's approach to Federal And State Form W 4 Compliance EY?

airSlate SignNow offers a streamlined solution for managing Federal And State Form W 4 Compliance EY by providing templates that are easy to use and ensure adherence to regulatory requirements. Our platform allows users to eSign and send these forms quickly, reducing the risk of non-compliance with tax regulations.

-

How does airSlate SignNow ensure compliance with Federal And State Form W 4 regulations?

Our platform incorporates the latest updates and guidelines for Federal And State Form W 4 Compliance EY, ensuring that all your documents meet current legal standards. Regular updates and a user-friendly interface help businesses maintain compliance effortlessly.

-

What features does airSlate SignNow provide for handling Federal And State Form W 4 Compliance EY?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure eSigning to facilitate seamless Federal And State Form W 4 Compliance EY. These tools help businesses manage their documentation efficiently and ensure timely submissions.

-

Is airSlate SignNow affordable for small businesses focusing on Federal And State Form W 4 Compliance EY?

Yes! airSlate SignNow offers competitive pricing plans designed to fit the budget of small businesses while still providing essential features for Federal And State Form W 4 Compliance EY. Our cost-effective solutions empower organizations to manage compliance without breaking the bank.

-

Can airSlate SignNow integrate with other software for Federal And State Form W 4 Compliance EY?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, allowing for enhanced workflow management regarding Federal And State Form W 4 Compliance EY. This integration capability streamlines processes and ensures that your compliance efforts are supported by your existing tools.

-

How does airSlate SignNow enhance the user experience for Federal And State Form W 4 Compliance EY?

Our platform is designed with user experience in mind, making it simple to navigate and manage Federal And State Form W 4 Compliance EY. With intuitive features, users can quickly find templates, complete forms, and eSign documents without hassle.

-

What support does airSlate SignNow offer for questions about Federal And State Form W 4 Compliance EY?

airSlate SignNow provides robust customer support, including live chat, email assistance, and extensive knowledge resources to help users with Federal And State Form W 4 Compliance EY questions. Our dedicated team is ready to assist you in achieving full compliance.

Get more for Federal And State Form W 4 Compliance EY

- The company that no one leaves form

- Assessment of lagging skills amp unsolved problems form

- Form 8396 1651966

- College vocational tap card form

- Medical device evaluation form

- Sole proprietorship letter sample form

- National insurance company form nriol

- Undertaking by local guardian to the administrato form

Find out other Federal And State Form W 4 Compliance EY

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors