Internal Revenue Service Publication 2021

What is the Internal Revenue Service Publication

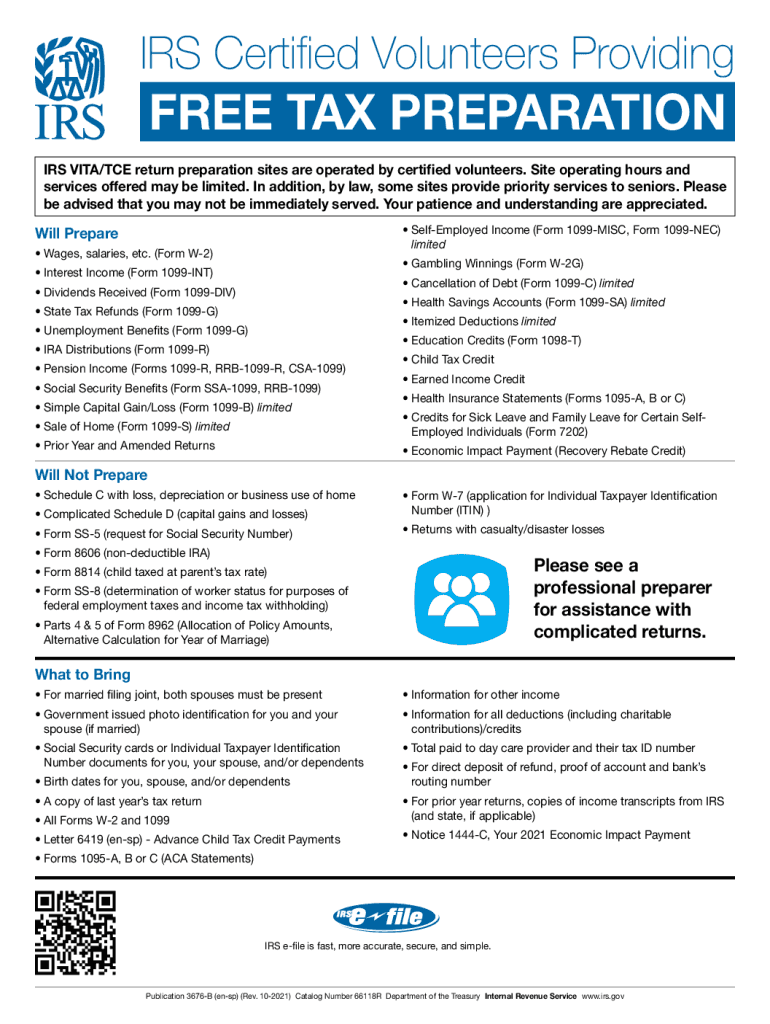

The Internal Revenue Service (IRS) Publication is a crucial resource that provides taxpayers with detailed information about various tax topics, forms, and procedures. Each publication is designed to clarify specific aspects of the tax code, helping individuals and businesses understand their obligations and rights. These documents cover a wide range of subjects, including tax deductions, credits, and filing requirements, making them essential for accurate IRS preparation.

How to Use the Internal Revenue Service Publication

Using the Internal Revenue Service Publication effectively involves identifying the relevant publication for your needs and understanding its content. Start by locating the publication that corresponds to your tax situation, such as those related to self-employment or specific deductions. Once you have the correct publication, read through it carefully to grasp the guidelines and instructions provided. This will help ensure compliance with IRS regulations and aid in the accurate completion of your IRS tax forms.

Steps to Complete the Internal Revenue Service Publication

Completing the Internal Revenue Service Publication involves a few key steps:

- Identify the specific publication relevant to your tax situation.

- Gather all necessary documentation and information required for completion.

- Follow the instructions outlined in the publication carefully, ensuring all details are accurate.

- Review the completed publication for any errors or omissions before submission.

- Submit the publication as directed, either electronically or by mail, depending on the form type.

Legal Use of the Internal Revenue Service Publication

The legal use of the Internal Revenue Service Publication is vital for ensuring compliance with federal tax laws. These publications are considered authoritative sources of information from the IRS, and utilizing them correctly can help prevent legal issues related to tax filing. Taxpayers should ensure they are referencing the most current version of the publication, as tax laws and regulations can change. Following the guidelines provided in these publications helps protect against potential penalties for non-compliance.

Filing Deadlines / Important Dates

Understanding filing deadlines and important dates is essential for compliance with IRS requirements. Each year, the IRS sets specific deadlines for filing various tax forms and publications. For individual taxpayers, the primary deadline for filing income tax returns is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, certain forms may have different due dates, so it is important to consult the relevant IRS publications for the most accurate information.

Required Documents

To complete the Internal Revenue Service Publication accurately, certain documents are typically required. These may include:

- Personal identification information, such as Social Security numbers.

- Income statements, including W-2s and 1099 forms.

- Documentation for deductions or credits, such as receipts and invoices.

- Previous year’s tax return for reference.

Having these documents ready will streamline the process of completing the publication and ensure that all information is accurate and compliant with IRS standards.

Who Issues the Form

The Internal Revenue Service is the authoritative body that issues the Internal Revenue Service Publication. As a federal agency, the IRS is responsible for administering and enforcing tax laws in the United States. This includes providing taxpayers with the necessary resources, such as publications, to facilitate understanding and compliance with tax requirements. Taxpayers can trust that the information provided in these publications is accurate and up-to-date, reflecting the current tax code.

Quick guide on how to complete internal revenue service publication

Prepare Internal Revenue Service Publication smoothly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow offers all the tools you need to create, edit, and eSign your documents quickly and efficiently. Manage Internal Revenue Service Publication on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Internal Revenue Service Publication without hassle

- Obtain Internal Revenue Service Publication and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you want to send your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Internal Revenue Service Publication and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct internal revenue service publication

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's relationship with the internal revenue service?

airSlate SignNow helps businesses comply with the internal revenue service by allowing users to electronically sign and send tax-related documents securely. This feature is essential for ensuring that all necessary forms are filed accurately and on time, in adherence to the regulations set by the internal revenue service.

-

How does airSlate SignNow ensure the security of documents related to the internal revenue service?

Security is a top priority at airSlate SignNow. The platform utilizes advanced encryption protocols to protect documents, ensuring that any submissions to the internal revenue service are secure and confidential during the signing and sending processes.

-

Is airSlate SignNow compliant with the internal revenue service guidelines?

Yes, airSlate SignNow is designed to comply with the internal revenue service guidelines for electronic signatures, making it a reliable choice for businesses. This compliance ensures that your electronically signed documents will be accepted by the internal revenue service for filing purposes.

-

What features does airSlate SignNow offer for handling internal revenue service forms?

airSlate SignNow offers a range of features specifically designed for managing internal revenue service forms, including templates for common tax documents and autofill capabilities. These features streamline the preparation process and help businesses manage their tax compliance more efficiently.

-

What pricing options does airSlate SignNow provide for businesses dealing with the internal revenue service?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses dealing with the internal revenue service. These plans include various features that enable efficient document management and signing, making it cost-effective for companies looking to simplify their tax processes.

-

Can airSlate SignNow integrate with accounting software to support internal revenue service requirements?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions, enabling efficient handling of documents required by the internal revenue service. This integration supports businesses in maintaining accurate records and simplifies the submission process.

-

What benefits does airSlate SignNow provide for submitting documents to the internal revenue service?

airSlate SignNow enhances the efficiency of submitting documents to the internal revenue service by allowing quick electronic signatures and secure transmissions. This not only saves time but also reduces the risk of errors, ensuring compliance with IRS regulations.

Get more for Internal Revenue Service Publication

Find out other Internal Revenue Service Publication

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation