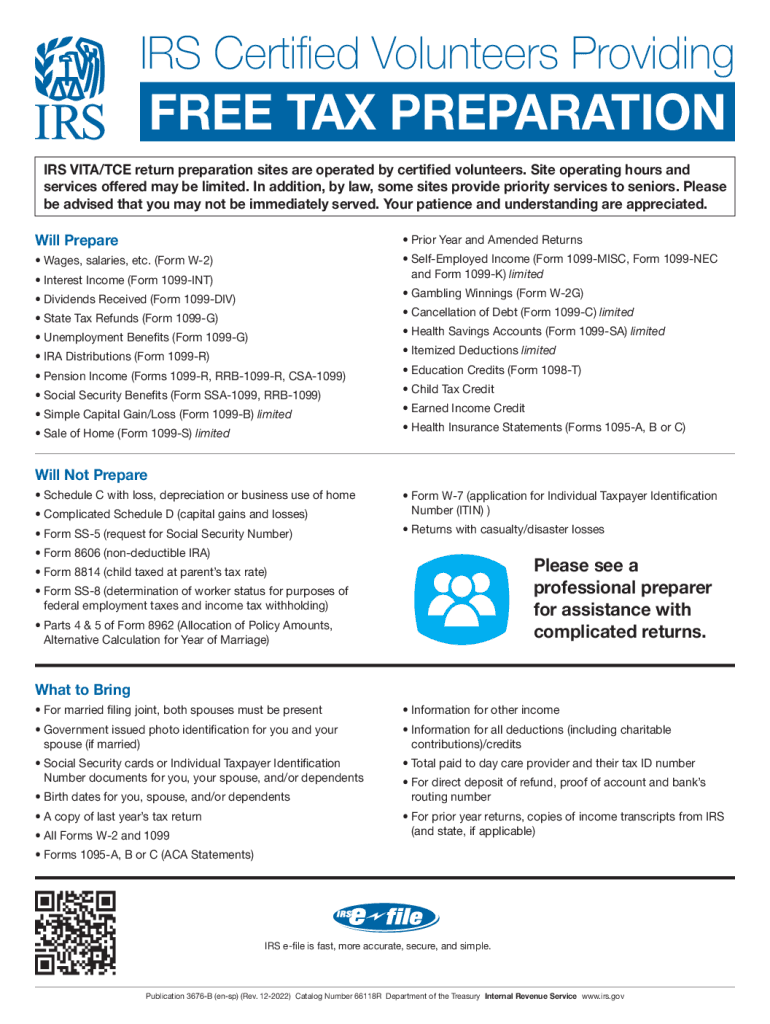

Publication 3676 B EN SP Rev 12 IRS Certified Volunteers Providing Tax Preparation English Spanish 2022-2026

Understanding the IRS Printable I-9 Form

The IRS printable I-9 form is a crucial document used for verifying the identity and employment authorization of individuals hired for work in the United States. This form is mandated by the U.S. government and must be completed by both the employer and the employee. It includes sections that require personal information, such as name, address, and Social Security number, as well as details about the employee's eligibility to work in the country.

Steps to Complete the IRS Printable I-9 Form

Completing the IRS printable I-9 form involves several key steps:

- Section One: The employee fills out their personal information, including their name, address, and date of birth. They must also attest to their citizenship or immigration status.

- Section Two: The employer reviews the employee's documents that establish identity and employment authorization. This section must be completed within three business days of the employee's start date.

- Section Three: This section is used for reverification and updating information if the employee's work authorization expires.

It is essential to ensure that all information is accurate and complete to avoid potential issues with compliance.

Legal Use of the IRS Printable I-9 Form

The IRS printable I-9 form is legally required for all employers in the United States. It serves as a safeguard against hiring individuals who are not authorized to work in the country. Employers must retain completed forms for a specific period, typically three years after the date of hire or one year after the employee's termination, whichever is longer. Failure to comply with these regulations can lead to penalties and fines.

Filing Deadlines and Important Dates

While there are no specific filing deadlines for submitting the IRS printable I-9 form to the IRS, employers must complete it within three business days of an employee's start date. Keeping track of these timelines is crucial to ensure compliance with federal regulations and avoid potential penalties.

Required Documents for the IRS Printable I-9 Form

To complete the IRS printable I-9 form, employees must provide documentation that proves their identity and employment authorization. Acceptable documents are categorized into three lists:

- List A: Documents that establish both identity and employment authorization, such as a U.S. passport.

- List B: Documents that establish identity, such as a driver's license.

- List C: Documents that establish employment authorization, such as a Social Security card.

Employers must review and retain copies of these documents as part of the I-9 process.

IRS Guidelines for Completing the I-9 Form

The IRS provides specific guidelines for completing the I-9 form accurately. Employers should ensure that:

- The form is filled out in English.

- All sections are completed without leaving any blanks.

- Employees are informed about the documents they need to present.

Following these guidelines helps maintain compliance with federal regulations and protects both the employer and employee.

Quick guide on how to complete publication 3676 b en sp rev 12 irs certified volunteers providing tax preparation english spanish

Complete Publication 3676 B EN SP Rev 12 IRS Certified Volunteers Providing Tax Preparation English Spanish effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without holdups. Manage Publication 3676 B EN SP Rev 12 IRS Certified Volunteers Providing Tax Preparation English Spanish on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign Publication 3676 B EN SP Rev 12 IRS Certified Volunteers Providing Tax Preparation English Spanish without hassle

- Locate Publication 3676 B EN SP Rev 12 IRS Certified Volunteers Providing Tax Preparation English Spanish and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your documentation needs in just a few clicks from any device you prefer. Alter and electronically sign Publication 3676 B EN SP Rev 12 IRS Certified Volunteers Providing Tax Preparation English Spanish and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 3676 b en sp rev 12 irs certified volunteers providing tax preparation english spanish

Create this form in 5 minutes!

How to create an eSignature for the publication 3676 b en sp rev 12 irs certified volunteers providing tax preparation english spanish

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS printable I-9 form and why is it important?

The IRS printable I-9 form is a document used by employers to verify the identity and employment authorization of individuals hired for work in the United States. It is crucial for compliance with federal regulations and helps prevent illegal employment practices.

-

How can airSlate SignNow help me with the IRS printable I-9 form?

airSlate SignNow provides an efficient platform for creating, sending, and signing the IRS printable I-9 form electronically. This streamlines the onboarding process for new hires and ensures that you remain compliant with IRS regulations.

-

Is there a cost associated with using airSlate SignNow for the IRS printable I-9 form?

Yes, airSlate SignNow offers various pricing plans to meet different business needs. Our plans are affordable and provide features specifically designed to manage documents like the IRS printable I-9 form effectively.

-

Can I customize the IRS printable I-9 form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the IRS printable I-9 form to fit your business requirements. You can add your logo and make other adjustments to ensure it aligns with your branding.

-

What are the benefits of using airSlate SignNow for the IRS printable I-9 form?

Using airSlate SignNow for the IRS printable I-9 form offers numerous benefits, including enhanced security, faster processing times, and an all-digital workflow that saves time and reduces paper waste. Additionally, it improves the user experience for both employers and employees.

-

Does airSlate SignNow integrate with other HR tools for processing the IRS printable I-9 form?

Yes, airSlate SignNow integrates seamlessly with various HR tools and applicant tracking systems. This integration allows you to streamline the process of completing and managing the IRS printable I-9 form within your existing workflows.

-

How does eSigning the IRS printable I-9 form work with airSlate SignNow?

eSigning the IRS printable I-9 form with airSlate SignNow is straightforward. You simply send the form to the employee via email, and they can sign it electronically from any device, ensuring a quick turnaround and easy compliance.

Get more for Publication 3676 B EN SP Rev 12 IRS Certified Volunteers Providing Tax Preparation English Spanish

- Dekalb medical doctors note form

- Silverback care management form

- Lifeline telephone bapplicationb brib cox communications form

- Click here to add photo form

- U s bank add person to checking account form

- Addl bar c ode premise id barcode purdue university form

- Ruminant submission formpdf purdue university

- Behavioral health services telephone 1 800 454 3730fax 1 800 505 1193 form

Find out other Publication 3676 B EN SP Rev 12 IRS Certified Volunteers Providing Tax Preparation English Spanish

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online