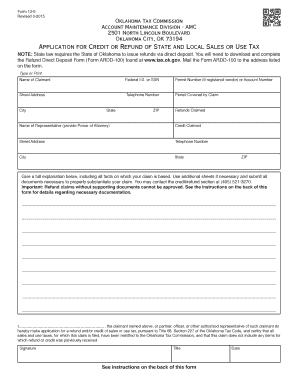

Application for Credit or Refund of State and Local Sales or Use Tax Ok 2015

What is the Application for Credit or Refund of State and Local Sales or Use Tax OK

The Application for Credit or Refund of State and Local Sales or Use Tax OK is a formal document that allows taxpayers in Oklahoma to request a refund or credit for sales or use taxes they have paid. This form is particularly useful for individuals or businesses who believe they have overpaid taxes or are eligible for a refund due to various circumstances, such as purchasing exempt items or errors in tax calculation. Understanding the purpose and function of this form is essential for ensuring compliance with state tax regulations.

Steps to Complete the Application for Credit or Refund of State and Local Sales or Use Tax OK

Completing the Application for Credit or Refund involves several key steps:

- Gather necessary documentation, including receipts and proof of payment.

- Clearly identify the specific tax periods for which you are requesting a refund.

- Fill out the application form accurately, ensuring all required fields are completed.

- Attach any supporting documents that substantiate your claim.

- Review the application for accuracy before submission.

Following these steps carefully will help streamline the process and reduce the likelihood of delays in processing your request.

Eligibility Criteria for the Application for Credit or Refund of State and Local Sales or Use Tax OK

To qualify for a refund or credit using this application, taxpayers must meet specific eligibility criteria. Generally, these include:

- Proof of overpayment or erroneous payment of sales or use tax.

- Documentation supporting the claim, such as invoices or receipts.

- Compliance with filing deadlines set by the state tax authority.

- Submission of the application within the time limits specified by Oklahoma tax laws.

Ensuring that you meet these criteria is crucial for a successful refund request.

Required Documents for the Application for Credit or Refund of State and Local Sales or Use Tax OK

When submitting the Application for Credit or Refund, certain documents are necessary to support your claim. These typically include:

- Receipts or invoices showing the tax paid.

- Proof of exempt status, if applicable.

- Any previous correspondence with the tax authority regarding the tax in question.

Having these documents ready will facilitate a smoother review process by the tax authorities.

Form Submission Methods for the Application for Credit or Refund of State and Local Sales or Use Tax OK

The Application for Credit or Refund can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the Oklahoma state tax website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if preferred.

Each method has its advantages, so choose the one that best fits your needs and circumstances.

Legal Use of the Application for Credit or Refund of State and Local Sales or Use Tax OK

The Application for Credit or Refund is legally recognized under Oklahoma tax law, allowing taxpayers to reclaim overpaid taxes. It is essential to use this form correctly to ensure compliance with state regulations. Misuse or incorrect submission may result in delays or denial of the refund request. Understanding the legal framework surrounding this application helps taxpayers navigate the process effectively.

Quick guide on how to complete application for credit or refund of state and local sales or use tax ok

Your assistance manual on preparing your Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok

If you’re interested in learning how to generate and dispatch your Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok, here are a few brief instructions on making tax submission more manageable.

To begin, simply register your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an extremely intuitive and robust document solution that enables you to edit, draft, and finalize your income tax documents seamlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures and revert to modify any details as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow these steps to complete your Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok in just a few minutes:

- Establish your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through various versions and schedules.

- Hit Get form to access your Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok in our editor.

- Populate the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding electronic signature (if needed).

- Examine your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically using airSlate SignNow. Keep in mind that filing on paper can increase mistakes in your returns and cause delays in refunds. Naturally, before e-filing your taxes, verify the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct application for credit or refund of state and local sales or use tax ok

FAQs

-

Which areas are considered part of Yonkers when applying for a job in NY state? I noticed there's a separate tax form to fill out where you check off if you presently live in Yonkers or not. Are Tuckahoe and/or Crestwood included?

Crestwood IS a neighborhood in the city of Yonkers. Tuckahoe is NOT. Tuckahoe is a village in the town of Eastchester. Tuckahoe Road however is a street in Yonkers. It does not run through any other municipality. Another way for you to tell if you live in the city of Yonkers is if Mayor Mike Spano is your mayor. If he is, you are a resident of Yonkers.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

How is it possible for California politicians to keep finding ways to raise taxes on its citizens and local businesses? Why are other states ok without taxing its citizens very much or not at all?

California relies mostly on income tax to fund state and local government. Due to proposition 13, which limits property tax to 1% of the last sale price + 1% per year, the counties, cities and special purpose districts cannot usually raise enough in property taxes and rely on subsidies from the state. States which tout their low or no income tax all have much higher real rates of property tax, and in some cases sales tax. So while California income tax rates are high, the overall tax burden isn’t disproportionate.Its not in fact true that the state keeps finding ways to raise taxes. The last income tax increase was in 2012. There is a gas tax increase this year, but that’s specifically for road maintenance, which is sorely needed. Other than that, there haven’t been any state-wide tax increases that I can think of.The state does provide a relatively generous service level, on par with rich states like Connecticut that don’t have California’s level of poverty, and unlike, say, Texas, which gets by on less money by underfunding services to a level that should be unconscionable.

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

-

How do I get admission to TU if I have qualified for the JEE Mains? I am from Assam, and I want to do so under the state quota. Will there be any state rank list to be released, or do I have fill out any form?

If you haven't filled up any form then I am not sure if you are gonna get any chance now….This is the procedure they follow--- after you have qualified in JEE-MAINS. You have to fill up a form through which they come to know that you have qualified. Then they give a list of student according to their ranks (both AIR & state ranks). Then according to that there's three list A,B & C in which there's all the quota and all. And they relaese one list in general. According to that list theu release a date of your counselling .Note- The form fillup is must.

-

How do I fill the portion of a Schengen visa application form that has to do with the purpose of stay for a conference and scholarship induction programme? Is it business, tourist or others?

The correct Schengen visa type for attending a scientific/academic meeting is technically "Business."Annex II of the Schengen Visa Code (EU regulation 810/2009)Ask the conference to provide the supporting documents.

-

How do you think Mexico can stop the US from charging Mexico for the wall using tariffs on goods manufactured in Mexico for sale in the US, and/or for taxing money sent out of the US to Mexico?

Mexico can't stop America from doing that. They also can't stop America from charging tariffs and taxing Americans to pay for Trump's hair treatments. Mexico has no control over America's tariff and taxation policy, that's run by the US government, and is ultimately only accountable to the American people.What Mexico can, and absolutely will do, is retaliate by imposing tariffs on American goods, effectively kicking off a trade war which will hurt both countries. American farmers, ranchers, manufacturers, etc., who sell things to Mexico will lose business, and some will go out of business. American consumers will pay more for everything from gas to grapes, and American manufacturers who buy materials and components from Mexico (and there are many), will find their expenses going up. Some will have lay offs or go out of business.As for the taxation, if Trump can convince a Republican congress to raise taxes, Mexico has no say in it. I mean, to 100% certainty it will increase the market for illegal smuggling of money and other financial interests across international borders. Some of the more tech-savvy organizations might use BitCoin, or some other digital currency. America will likely try to crack down on this, occasionally confiscate an envelope of money to wave around on the news as a sign they're doing their job, but the additional federal money gained from this program will probably be less than the additional money we have to spend on border enforcement just chasing the dark money. But that's ultimately a US thing. Sure, it would be hypocritical of a Republican congress to raise federal taxes, but hypocrisy has never stopped them before. And it would have massive political backlash from every American with friends or relatives in Mexico who wants to send them money for any reason. But this administration has basically written of the support of everyone with Mexican ties in the entire US, so that's probably not such a big thing.So, if destruction of trade and onerous taxes on the poorest of our workers is what Trump wants to build his wall on, all Pena can do is try to tie his country closer with other, more reasonable global powers.

-

Which state between Maharashtra or OMS should I choose while filling out the application form for a BSc at Fergusson College if my home state is Maharashtra and I belong to the OBC category but I completed my studies in Gujarat?

check on your documents.like residential proof .and select that place.

Create this form in 5 minutes!

How to create an eSignature for the application for credit or refund of state and local sales or use tax ok

How to create an eSignature for the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok in the online mode

How to create an electronic signature for your Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok in Google Chrome

How to make an eSignature for signing the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok in Gmail

How to make an electronic signature for the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok right from your smart phone

How to create an electronic signature for the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok on iOS devices

How to make an eSignature for the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok on Android devices

People also ask

-

What is the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok?

The Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok is a formal request to reclaim sales or use tax that was previously paid. Businesses can utilize this application to receive refunds for overpaid taxes or taxes paid under incorrect circumstances. Being familiar with this application can streamline your tax processes and improve cash flow.

-

How does airSlate SignNow help in completing the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok?

airSlate SignNow simplifies the process of completing and submitting the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok by providing easy-to-use templates and eSigning features. This allows users to fill out applications quickly and securely, ensuring that all necessary information is included. With airSlate SignNow, businesses can save time and reduce errors when processing these applications.

-

Are there any costs associated with using airSlate SignNow for the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok?

Yes, airSlate SignNow offers affordable pricing plans tailored to different business needs. The costs will depend on the features and level of usage, but the platform provides a cost-effective solution for managing the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok and other document-related workflows. You can choose a plan that fits your budget while maximizing efficiency.

-

What features does airSlate SignNow offer for handling tax-related documents like the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok?

airSlate SignNow offers features such as document templates, secure eSignature collection, and tracking capabilities to manage tax-related documents efficiently. These features help ensure that your Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok is filled out accurately and submitted on time. Additionally, you can collaborate with team members within the platform for enhanced workflow.

-

Can I integrate airSlate SignNow with other software to streamline the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok process?

Absolutely! airSlate SignNow offers numerous integrations with popular business applications such as CRM systems, accounting software, and cloud storage solutions. This allows you to automate workflows, reduce manual entry, and make the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok process more seamless and efficient.

-

How secure is the submission of the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok through airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption and compliance with industry standards to protect your information while you complete and submit the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok. With secure access controls, you can ensure that sensitive data remains safe throughout the document workflow.

-

What benefits can businesses expect when using airSlate SignNow for the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok?

By using airSlate SignNow for the Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok, businesses can expect increased efficiency, reduced processing time, and lower operational costs. The platform's ease of use and automation features can help streamline tax refund processes and provide better visibility into document status. Overall, this leads to improved productivity and faster access to crucial tax refunds.

Get more for Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok

- Personal protective equipment hazard analysis train printable forms

- Hunter credit no credit form

- 05 163 texas franchise tax annual no tax due information report window state tx

- Advanced pain management general referral form

- Revolving loan agreement template 787747070 form

- Revolving line of credit agreement template form

- Rider agreement template form

- Right of first offer agreement template form

Find out other Application For Credit Or Refund Of State And Local Sales Or Use Tax Ok

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF