ScheduleW PDF Reset Form Schedule W Michigan Department

Understanding the Michigan 3421 Form

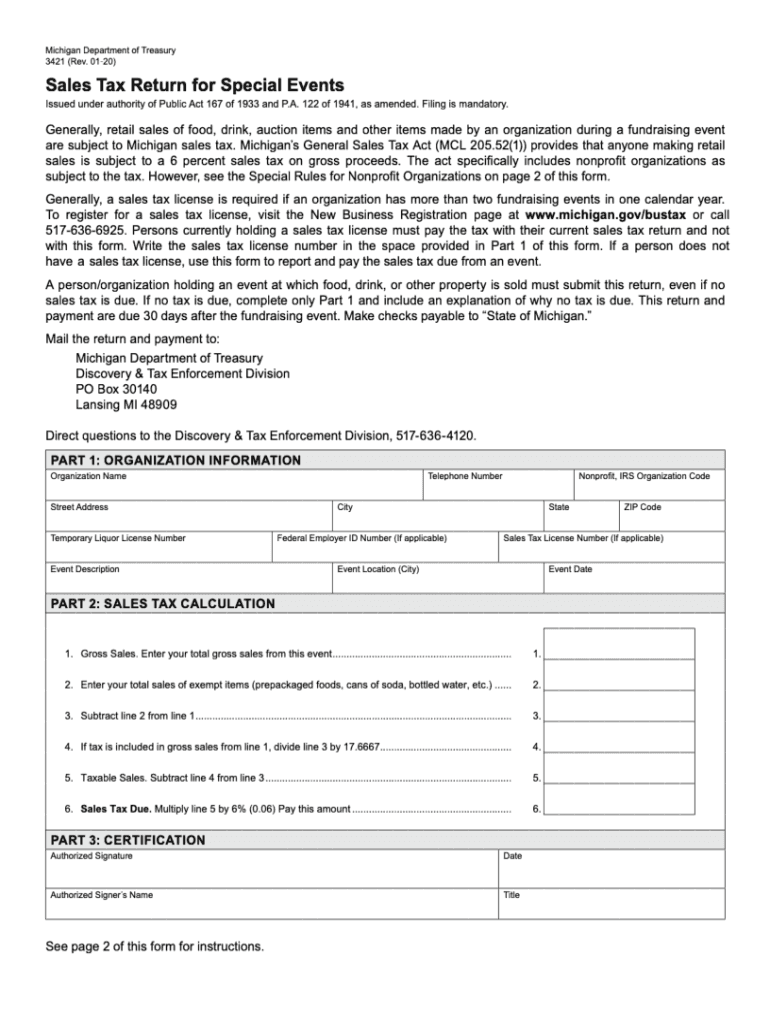

The Michigan 3421 form is a crucial document used for reporting specific tax events associated with sales tax. This form is essential for businesses operating within Michigan, allowing them to comply with state tax regulations. The 3421 form serves as a declaration of sales tax collected and is necessary for accurate tax reporting. Understanding its purpose ensures that businesses can maintain compliance and avoid potential penalties.

Steps to Complete the Michigan 3421 Form

Completing the Michigan 3421 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to sales transactions. Next, accurately report the total sales and the amount of sales tax collected during the reporting period. Ensure that all figures are correct to prevent discrepancies. After filling out the form, review it thoroughly for any errors before submission. Finally, submit the completed form by the designated deadline to avoid any late fees.

Legal Use of the Michigan 3421 Form

The Michigan 3421 form is legally binding when completed and submitted according to state regulations. It is essential for businesses to understand the legal implications of this form, as it serves as an official record of sales tax collected. Compliance with the filing requirements ensures that businesses meet their tax obligations and helps avoid legal issues with state tax authorities. Proper use of this form contributes to transparent financial practices and accountability.

Filing Deadlines for the Michigan 3421 Form

Filing deadlines for the Michigan 3421 form can vary based on the reporting period selected by the business. Generally, businesses are required to file this form on a monthly, quarterly, or annual basis. It is crucial to be aware of these deadlines to ensure timely submission. Missing a deadline can result in penalties or interest charges on unpaid taxes. Businesses should maintain a calendar of important tax dates to stay organized and compliant.

Required Documents for the Michigan 3421 Form

To complete the Michigan 3421 form accurately, certain documents are necessary. These typically include sales records, receipts, and any documentation that supports the total sales figures reported. Additionally, businesses should have their previous tax returns on hand for reference. Collecting these documents beforehand can streamline the process and ensure that all required information is readily available when filling out the form.

Penalties for Non-Compliance with the Michigan 3421 Form

Failure to comply with the filing requirements of the Michigan 3421 form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from state tax authorities. It is vital for businesses to understand the importance of timely and accurate submissions to avoid these consequences. Regular training and updates on tax compliance can help mitigate the risk of non-compliance.

Quick guide on how to complete schedulewpdf reset form schedule w michigan department

Complete ScheduleW pdf Reset Form Schedule W Michigan Department effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers a superb eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage ScheduleW pdf Reset Form Schedule W Michigan Department on any device with airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

How to modify and electronically sign ScheduleW pdf Reset Form Schedule W Michigan Department with ease

- Locate ScheduleW pdf Reset Form Schedule W Michigan Department and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign ScheduleW pdf Reset Form Schedule W Michigan Department to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Michigan 3421 and how does it relate to airSlate SignNow?

Michigan 3421 refers to a specific package of services offered by airSlate SignNow, designed to streamline document signing processes in Michigan. This solution enables users to manage, send, and eSign documents effortlessly, ensuring compliance and ease of use for businesses operating in the state.

-

What are the pricing options for airSlate SignNow Michigan 3421?

The pricing for airSlate SignNow Michigan 3421 is competitive and tailored to suit various business needs. Interested customers can visit our website to explore different plans, which include features relevant to document workflow and electronic signatures while aligning with the budget considerations typical in Michigan.

-

What features does Michigan 3421 offer for document management?

Michigan 3421 includes essential features such as customizable templates, secure eSigning, document tracking, and cloud storage. These functionalities are designed to enhance productivity for businesses in Michigan by offering an intuitive interface and reliable document management solutions.

-

How can airSlate SignNow Michigan 3421 benefit my business?

Utilizing Michigan 3421 can signNowly improve your business operations by minimizing paperwork and enhancing turnaround times for document approvals. With its cost-effective nature, this solution helps businesses in Michigan focus more on their core activities while ensuring compliance and secure document handling.

-

What integrations does Michigan 3421 support?

Michigan 3421 supports a variety of integrations with popular business applications including CRM systems and project management tools. These integrations facilitate seamless workflows and allow for better collaboration among team members, making airSlate SignNow a versatile choice for businesses in the region.

-

Is airSlate SignNow Michigan 3421 compliant with local regulations?

Yes, Michigan 3421 is designed with compliance in mind, adhering to local laws and regulations regarding electronic signatures. This ensures that documents signed using airSlate SignNow are legally binding and accepted across Michigan and beyond.

-

Can I try airSlate SignNow Michigan 3421 before committing?

Absolutely! We offer a free trial of airSlate SignNow Michigan 3421, allowing businesses to explore its features and benefits before making a financial commitment. This trial makes it easier for prospective customers in Michigan to assess how the solution meets their needs.

Get more for ScheduleW pdf Reset Form Schedule W Michigan Department

- 2021 form 6251 irs tax formsabout form 6251 alternative minimum tax individuals2021 form 6251 irs tax forms

- 2022 schedule k form 990 supplemental information on tax exempt bonds

- Cca division of taxation form

- 2022 schedule 1 form 1040 additional income and adjustments to income

- Louisiana form r 19026 installment request for individuallouisiana form r 19026 installment request for individualhome page

- Ksrevenuegovpdfst8bst 8b exemption for certain vehicles and aircraft sold to form

- Wwwtaxformfinderorgcaliforniaform 100 scalifornia shareholders share of income deductions credits

- 2022 form 2350 application for extension of time to file us income tax return

Find out other ScheduleW pdf Reset Form Schedule W Michigan Department

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template