Service Credit Union Direct Deposit Form

What is the Service Credit Union Direct Deposit Form

The Service Credit Union Direct Deposit Form is a document that allows members to authorize the direct deposit of their paychecks or other payments directly into their credit union accounts. This form streamlines the payment process, ensuring that funds are deposited securely and efficiently without the need for physical checks. By using this form, members can enjoy quicker access to their funds, typically on payday, enhancing financial management.

How to use the Service Credit Union Direct Deposit Form

Using the Service Credit Union Direct Deposit Form involves a few straightforward steps. First, members need to obtain the form, which can usually be found on the credit union's website or requested at a branch. Next, complete the form by providing necessary details, including personal information, account numbers, and the type of deposits to be made. After filling out the form, submit it to the employer or the relevant payment source to initiate the direct deposit process. It is essential to ensure all information is accurate to prevent any delays in payments.

Steps to complete the Service Credit Union Direct Deposit Form

Completing the Service Credit Union Direct Deposit Form requires careful attention to detail. Follow these steps:

- Obtain the form from the Service Credit Union website or branch.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide your credit union account number and routing number, which can be found on your checks or by contacting your credit union.

- Indicate the type of deposits you wish to receive, such as salary, government benefits, or other payments.

- Review the form for accuracy and completeness.

- Sign and date the form to authorize the direct deposit.

- Submit the completed form to your employer or the payment source.

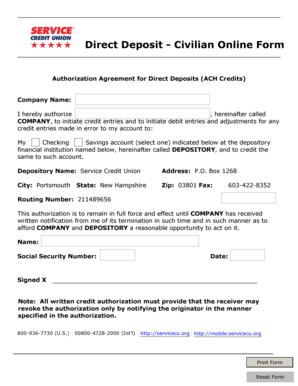

Key elements of the Service Credit Union Direct Deposit Form

The Service Credit Union Direct Deposit Form contains several key elements that ensure proper processing. These include:

- Personal Information: This section requires your full name, address, and Social Security number for identification.

- Account Information: You must provide your credit union account number and the corresponding routing number to direct funds accurately.

- Deposit Type: Specify whether the deposits will be recurring, such as payroll, or one-time payments.

- Signature: Your signature is necessary to authorize the direct deposit arrangement, confirming that you agree to the terms.

Legal use of the Service Credit Union Direct Deposit Form

The legal use of the Service Credit Union Direct Deposit Form is grounded in compliance with federal and state regulations governing electronic payments. By signing the form, members grant permission for their employers or payment sources to deposit funds directly into their accounts. This authorization must be clear and unambiguous to ensure that all parties understand the terms. Additionally, the form must be securely stored and managed to protect personal and financial information, adhering to privacy laws and regulations.

Form Submission Methods

Submitting the Service Credit Union Direct Deposit Form can be done through various methods, depending on the employer or payment source's requirements. Common submission methods include:

- Online Submission: Some employers allow electronic submission of the form through their payroll systems.

- Mail: You may send the completed form via postal mail to your employer's payroll department.

- In-Person: Delivering the form directly to your employer or the payment source can expedite processing.

Quick guide on how to complete service credit union direct deposit form

Complete Service Credit Union Direct Deposit Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and safely store it online. airSlate SignNow offers you all the tools needed to create, modify, and eSign your documents quickly and without delays. Manage Service Credit Union Direct Deposit Form on any device using airSlate SignNow's Android or iOS applications, and enhance any document-centric workflow today.

How to modify and eSign Service Credit Union Direct Deposit Form effortlessly

- Locate Service Credit Union Direct Deposit Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant portions of the documents or obscure sensitive details with tools specifically designed for that purpose, provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Service Credit Union Direct Deposit Form to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a service credit union direct deposit form?

A service credit union direct deposit form is a document that authorizes your employer to deposit your paycheck directly into your credit union account. This form simplifies the payment process, ensuring that funds are available in your account on payday. By using this form, you eliminate the need for paper checks, enhancing convenience and security.

-

How do I fill out the service credit union direct deposit form?

To fill out the service credit union direct deposit form, you'll need to provide your personal information, including your bank account number and routing number. Make sure to double-check all details for accuracy to ensure that your direct deposits are processed without any issues. Once completed, submit the form to your employer's payroll department.

-

Are there any fees associated with using the service credit union direct deposit form?

Typically, there are no fees associated with submitting a service credit union direct deposit form. This feature is often offered as a complimentary service by credit unions to facilitate easy access to your funds. It’s a cost-effective option that increases convenience for all members.

-

What are the benefits of using a service credit union direct deposit form?

Using a service credit union direct deposit form offers numerous benefits, including timely access to your funds, reduced risk of lost or stolen checks, and the ability to manage your finances more effectively. Additionally, it eliminates the need for frequent trips to the bank, making it easier to stay on top of your finances.

-

Can I change my banking information on the service credit union direct deposit form?

Yes, you can change your banking information on the service credit union direct deposit form. Simply fill out the form with your new banking details and submit it to your employer's payroll department. It's important to ensure that all information is correct to avoid any disruptions in your direct deposits.

-

Is the service credit union direct deposit form secure?

Yes, the service credit union direct deposit form is secure when submitted to your employer. Most employers and credit unions utilize encryption and secure channels to protect sensitive information. By opting for direct deposits, you enhance the security of your funds compared to traditional paper checks.

-

How long does it take for the service credit union direct deposit to become effective?

Once you submit the service credit union direct deposit form, it usually takes one to two pay cycles for your direct deposit to become effective. However, this can vary depending on your employer's payroll schedule. It’s advisable to follow up with your employer to confirm the timeline.

Get more for Service Credit Union Direct Deposit Form

Find out other Service Credit Union Direct Deposit Form

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online