Exempt Organization Business Income Tax Forms 2022

Understanding the Exempt Organization Business Income Tax Forms

The Exempt Organization Business Income Tax Forms are essential for organizations that operate under tax-exempt status but still generate income from business activities. These forms help ensure compliance with federal tax regulations while allowing organizations to report their unrelated business income. Understanding these forms is crucial for maintaining tax-exempt status and avoiding penalties.

Steps to Complete the Exempt Organization Business Income Tax Forms

Completing the Exempt Organization Business Income Tax Forms involves several key steps:

- Gather necessary financial records, including income statements and expense reports.

- Identify sources of unrelated business income, as this is the income subject to taxation.

- Fill out the appropriate form, typically Form 990-T, providing detailed information about income and expenses.

- Review the completed form for accuracy, ensuring all required information is included.

- Submit the form by the designated deadline to avoid penalties.

Legal Use of the Exempt Organization Business Income Tax Forms

These forms are legally binding documents that must be filled out accurately to reflect the organization’s financial activities. They serve to report unrelated business income to the IRS, ensuring that tax-exempt organizations comply with federal tax laws. Misrepresentation or failure to file can lead to significant penalties, including loss of tax-exempt status.

Filing Deadlines / Important Dates

Filing deadlines for the Exempt Organization Business Income Tax Forms can vary based on the organization’s fiscal year. Typically, the forms must be filed on or before the 15th day of the fifth month after the end of the organization’s tax year. It is important to mark these dates on your calendar to ensure timely submission and avoid penalties.

Required Documents

To complete the Exempt Organization Business Income Tax Forms, organizations need to prepare several documents, including:

- Financial statements detailing income and expenses.

- Records of any unrelated business income.

- Documentation of expenses related to generating that income.

- Prior year tax returns, if applicable, for reference.

Penalties for Non-Compliance

Failure to comply with the requirements for filing the Exempt Organization Business Income Tax Forms can result in severe penalties. These may include monetary fines, interest on unpaid taxes, and potential loss of tax-exempt status. It is crucial for organizations to understand their obligations and ensure timely and accurate filings to avoid these consequences.

Quick guide on how to complete exempt organization business income tax forms

Easily Prepare Exempt Organization Business Income Tax Forms on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Exempt Organization Business Income Tax Forms on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Effortlessly Modify and eSign Exempt Organization Business Income Tax Forms

- Obtain Exempt Organization Business Income Tax Forms and click on Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Highlight essential sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to secure your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or disorganized files, tedious form searches, or errors that require printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Exempt Organization Business Income Tax Forms to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct exempt organization business income tax forms

Create this form in 5 minutes!

How to create an eSignature for the exempt organization business income tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

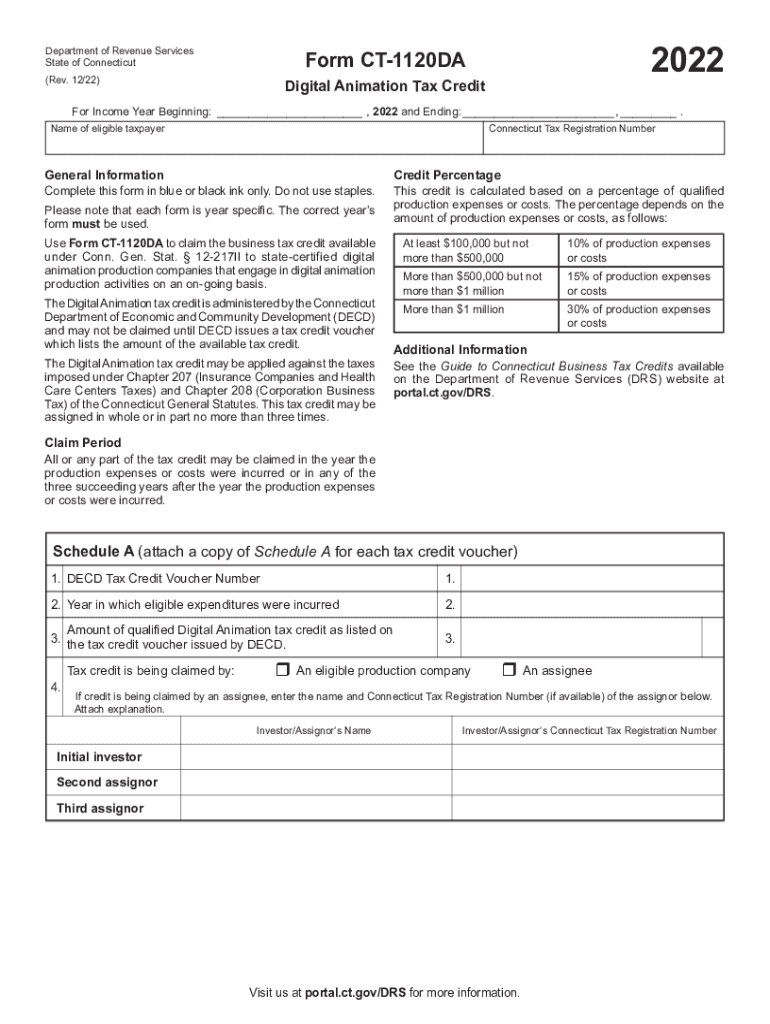

What is the 2012 ct1120da credit and how does it affect my taxes?

The 2012 ct1120da credit is a tax credit available for certain business expenses incurred by corporations in Connecticut. Understanding this credit is important as it can help reduce your overall tax liability, maximizing your savings. Be sure to check if you qualify for this credit when filing your CT tax returns.

-

How can airSlate SignNow help me with my 2012 ct1120da credit documentation?

AirSlate SignNow simplifies the process of signing and managing documents required for claiming your 2012 ct1120da credit. Our platform allows you to electronically sign and send essential documents quickly, ensuring you stay organized and compliant with tax regulations. This efficiency can save you time, making it easier to focus on your business.

-

Are there any costs associated with using airSlate SignNow for handling the 2012 ct1120da credit?

Yes, while airSlate SignNow offers cost-effective solutions, there may be subscription fees depending on the features you choose. However, using our eSignature service can potentially save you money by streamlining your document management, especially for tax-related processes like the 2012 ct1120da credit. We recommend reviewing our pricing plans to find the best fit for your needs.

-

What features of airSlate SignNow are beneficial for managing the 2012 ct1120da credit?

AirSlate SignNow boasts several features that are advantageous for managing your 2012 ct1120da credit, including customizable templates, secure cloud storage, and real-time collaboration. These tools help ensure that your documentation is efficient and compliant with state regulations. Additionally, our user-friendly interface makes it easy to track and manage your credit-related documents.

-

Can I integrate airSlate SignNow with other software for tax purposes related to the 2012 ct1120da credit?

Absolutely! AirSlate SignNow offers integrations with popular accounting and tax software, allowing for seamless management of your 2012 ct1120da credit documentation. This integration ensures that all your financial records are synchronized, making tax filing easier and more efficient. Check our list of integrations to see if your preferred software is supported.

-

What are the benefits of using airSlate SignNow for the 2012 ct1120da credit paperwork?

Using airSlate SignNow for your 2012 ct1120da credit paperwork enhances efficiency and accuracy. Our platform provides a secure and organized way to manage your important documents, reducing the risk of errors that could affect your credit claim. Moreover, our easy-to-navigate interface improves your overall experience during the tax season.

-

Is airSlate SignNow compliant with eSignature laws for claiming the 2012 ct1120da credit?

Yes, airSlate SignNow complies with eSignature laws, ensuring that your electronic signatures are legally valid for filings related to the 2012 ct1120da credit. Our platform adheres to the latest regulations, providing peace of mind that your tax documents are processed securely. Count on us for a reliable solution that meets legal standards.

Get more for Exempt Organization Business Income Tax Forms

- Essential documents for the organized traveler package tennessee form

- Tn documents with form

- Postnuptial agreements package tennessee form

- Tennessee letters form

- Tennessee construction or mechanics lien package individual tennessee form

- Tn corporation 497327081 form

- Storage business package tennessee form

- Child care services package tennessee form

Find out other Exempt Organization Business Income Tax Forms

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself