1040b Form

What is the 1040b Form

The 1040b form is a simplified version of the standard IRS Form 1040, designed for individual taxpayers in the United States. This form allows taxpayers to report their income, claim deductions, and calculate their tax liability. The 1040b form is particularly useful for those with straightforward tax situations, as it streamlines the filing process while ensuring compliance with IRS regulations. It is essential to understand the purpose and structure of the 1040b form to ensure accurate completion and timely submission.

How to use the 1040b Form

To effectively use the 1040b form, taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. The form is divided into sections that guide users through reporting income, claiming deductions, and calculating taxes owed or refunds due. It is crucial to follow the IRS instructions carefully to avoid errors that could lead to delays or penalties. Utilizing digital tools can simplify the process, making it easier to fill out and eSign the form securely.

Steps to complete the 1040b Form

Completing the 1040b form involves several key steps:

- Gather all necessary documents, including income statements and deduction records.

- Begin filling out the form by entering personal information, such as your name, address, and Social Security number.

- Report your total income from various sources, ensuring all figures are accurate and complete.

- Claim eligible deductions and credits to reduce your taxable income.

- Calculate your total tax liability and determine whether you owe taxes or are due a refund.

- Review the completed form for accuracy before signing and submitting it.

IRS Guidelines

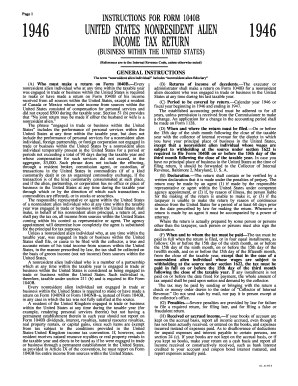

The IRS provides specific guidelines for completing the 1040b form, which include detailed instructions on income reporting, deductions, and credits. Taxpayers should familiarize themselves with these guidelines to ensure compliance. The IRS also updates these instructions annually, reflecting changes in tax laws and regulations. It is advisable to consult the latest IRS publications or seek professional assistance if there are uncertainties about any aspect of the form.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the 1040b form to avoid penalties. Typically, the deadline for submitting the form is April 15 of the following tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension, allowing them additional time to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

The 1040b form can be submitted through various methods, including online filing, mailing a paper form, or delivering it in person to a local IRS office. Online filing is often the most efficient option, allowing for quicker processing and confirmation of receipt. If mailing the form, taxpayers should ensure it is sent to the correct address based on their state of residence and include any required documentation. In-person submissions may be suitable for those needing immediate assistance or clarification from IRS representatives.

Quick guide on how to complete 1040b form

Complete 1040b Form effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Manage 1040b Form on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-driven process today.

How to modify and electronically sign 1040b Form easily

- Find 1040b Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or a shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow caters to your needs in document management with just a few clicks from any device you choose. Modify and electronically sign 1040b Form while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the irs instructions tax return essential for understanding the e-signature process?

The irs instructions tax return detail how electronic signatures are legally binding and accepted by the IRS. Understanding these instructions is crucial as they ensure compliance when filing tax documents electronically. airSlate SignNow simplifies this process, ensuring that your e-signed documents align with IRS requirements.

-

How does airSlate SignNow help with understanding irs instructions tax return?

airSlate SignNow provides templates and resources that help users navigate the irs instructions tax return. Our platform offers guidance on how to complete various tax forms, making it easier to ensure that all necessary steps are followed. This streamlining can reduce errors and improve efficiency during tax season.

-

Is airSlate SignNow compliant with irs instructions tax return requirements?

Yes, airSlate SignNow is fully compliant with irs instructions tax return requirements. Our eSigning solutions meet and exceed all necessary legal standards to ensure your documents are valid. This gives users peace of mind when it comes to filing their taxes electronically.

-

What pricing plans does airSlate SignNow offer for e-signing tax documents?

airSlate SignNow offers several cost-effective pricing plans that cater to businesses of all sizes. Each plan includes features tailored to enhance your e-signing experience, including compliance with irs instructions tax return. Choose a plan that fits your needs and budget, and start streamlining your tax document processes.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with various tax preparation software, allowing you to efficiently manage your documents. This integration helps ensure alignment with the irs instructions tax return while saving you time during the filing process. Our user-friendly platform simplifies document handling across different systems.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow offers several benefits, including increased efficiency and compliance with irs instructions tax return. Our platform allows for quick document sending and signing, reducing turnaround time signNowly. Additionally, you can track document statuses in real-time, enhancing overall workflow management.

-

How secure is airSlate SignNow when handling sensitive tax documents?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your sensitive tax documents, ensuring compliance with irs instructions tax return. You can confidently e-sign and send documents, knowing that your information is safeguarded throughout the process.

Get more for 1040b Form

- Pdf 741 kentucky department of revenue form

- Rc521 form

- Visitation child form

- Adult change of information form cheyenne and arapaho tribes c a tribes 35098575

- Form ri9465

- 2021 form 513 oklahoma resident fiduciary income tax return packet ampamp instructions

- 2021 nyc ext form

- 2020 banking corporation tax forms nycgov

Find out other 1040b Form

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure