Us Financial Life Insurance Forms

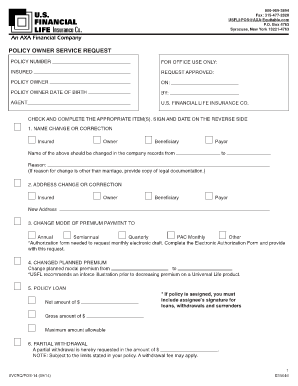

What is the U.S. Financial Life Insurance Forms?

The U.S. Financial Life Insurance Forms are essential documents used by policyholders to manage their insurance policies effectively. These forms include applications for new policies, beneficiary changes, and claims submissions. Understanding these forms is crucial for ensuring that all necessary information is accurately provided, which helps in the smooth processing of requests related to life insurance coverage.

How to Use the U.S. Financial Life Insurance Forms

Using the U.S. Financial Life Insurance Forms involves several steps to ensure compliance and accuracy. First, identify the specific form required for your needs, such as a beneficiary change form or a claim submission form. Next, gather all necessary information, including policy numbers and personal identification details. Once you have the correct form and information, fill it out carefully, ensuring that all sections are completed. After filling out the form, review it for any errors before submission.

Steps to Complete the U.S. Financial Life Insurance Forms

Completing the U.S. Financial Life Insurance Forms can be straightforward if you follow these steps:

- Determine the specific form you need based on your request.

- Collect required documents, such as identification and policy details.

- Fill out the form accurately, providing all necessary information.

- Double-check for any mistakes or missing information.

- Submit the form through the appropriate channel, whether online or by mail.

Legal Use of the U.S. Financial Life Insurance Forms

The legal use of the U.S. Financial Life Insurance Forms is governed by regulations that ensure the validity of electronic signatures and document submissions. To be legally binding, the forms must comply with the ESIGN Act and UETA, which establish the legality of electronic signatures in the United States. This means that when using digital platforms to fill out and submit these forms, it is essential to use a compliant eSignature solution to ensure that the documents hold up in legal contexts.

Required Documents for U.S. Financial Life Insurance Forms

When completing the U.S. Financial Life Insurance Forms, certain documents may be required to support your application or request. Commonly needed documents include:

- Government-issued identification (e.g., driver's license, passport)

- Current life insurance policy documents

- Proof of relationship for beneficiary changes (if applicable)

- Medical records or statements for claims submissions

Form Submission Methods

Submitting the U.S. Financial Life Insurance Forms can be done through various methods, depending on the specific requirements of the insurance provider. Common submission methods include:

- Online submission through the insurance company’s secure portal

- Mailing the completed forms to the designated address

- In-person submission at a local insurance office

Eligibility Criteria for U.S. Financial Life Insurance Forms

Eligibility criteria for using the U.S. Financial Life Insurance Forms vary based on the type of request being made. Generally, policyholders must be of legal age and have an active policy with the insurance company. For specific forms, additional criteria may apply, such as providing documentation for beneficiaries or meeting health requirements for claims. It is important to review the eligibility requirements outlined by the insurance provider before submitting any forms.

Quick guide on how to complete us financial life insurance forms

Effortlessly Prepare Us Financial Life Insurance Forms on Any Device

Digital document management has become increasingly favored by both organizations and individuals. It offers an excellent eco-conscious substitute for conventional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly and without hold-ups. Manage Us Financial Life Insurance Forms on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and electronically sign Us Financial Life Insurance Forms with ease

- Locate Us Financial Life Insurance Forms and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important parts of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form via email, SMS, an invitation link, or download it to your computer.

Leave behind concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Us Financial Life Insurance Forms and guarantee seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is New York life insurance and how does it work?

New York life insurance provides financial protection to beneficiaries upon the policyholder's death. It can come in various forms, such as term or whole life policies, each with unique benefits. Understanding how new york life insurance works is essential to choosing the right plan for your needs.

-

What are the benefits of purchasing new york life insurance?

New York life insurance offers peace of mind by ensuring your loved ones are financially secure after your passing. Benefits can include cash value accumulation, flexible premium payment options, and the ability to borrow against the policy. These features make new york life insurance a valuable investment for long-term financial stability.

-

How much does new york life insurance typically cost?

The cost of new york life insurance depends on factors such as age, health, coverage amount, and type of policy. On average, term life insurance tends to be more affordable compared to whole life policies. It's best to get personalized quotes to understand the pricing for your specific situation.

-

Can I adjust my new york life insurance policy as my needs change?

Yes, many new york life insurance policies offer flexibility to adjust coverage amounts or convert term policies to whole life. This feature allows you to adapt your insurance to fit evolving life circumstances, such as marriage, children, or career changes. Consult your provider to explore your options.

-

What factors should I consider when choosing new york life insurance?

When choosing new york life insurance, consider your financial goals, the coverage amount needed, and the type of policy that best suits your lifestyle. Factors like premium costs, policy terms, and company reputation are also important. Taking the time to compare these elements can help ensure you make an informed decision.

-

How does new york life insurance integrate with estate planning?

New york life insurance plays a vital role in estate planning by providing liquidity to cover estate taxes and ensuring your assets are passed on smoothly to heirs. It can help prevent the forced sale of assets during a difficult time. Consulting with an estate planner can help you effectively incorporate new york life insurance into your overall strategy.

-

Are there any exclusions or limitations with new york life insurance?

Like any insurance policy, new york life insurance may have exclusions, such as suicide within the first two years or death resulting from criminal activities. It’s essential to read your policy to understand any limitations. Being aware of these details can help prevent surprises when it comes time to file a claim.

Get more for Us Financial Life Insurance Forms

Find out other Us Financial Life Insurance Forms

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free