Nevada Taxation Sales Use Forms to Print 2009

What is the Nevada Taxation Sales Use Forms To Print

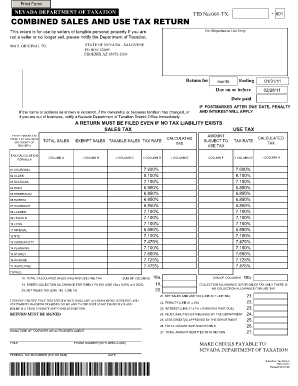

The Nevada Taxation Sales Use Forms To Print are official documents required for reporting and remitting sales and use taxes in the state of Nevada. These forms are essential for businesses and individuals who engage in taxable sales or utilize taxable goods and services. The forms help ensure compliance with state tax regulations, enabling proper calculation and payment of taxes owed. Understanding the purpose and requirements of these forms is crucial for accurate tax reporting.

How to Use the Nevada Taxation Sales Use Forms To Print

Using the Nevada Taxation Sales Use Forms To Print involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding sales transactions, including dates, amounts, and types of goods or services sold. Next, access the appropriate forms from the Nevada Department of Taxation website or other authorized sources. Fill out the forms carefully, ensuring that all required fields are completed accurately. After completing the forms, review them for any errors before submission.

Steps to Complete the Nevada Taxation Sales Use Forms To Print

Completing the Nevada Taxation Sales Use Forms To Print requires a systematic approach. Follow these steps:

- Gather all relevant sales records and documentation.

- Obtain the correct form from the Nevada Department of Taxation.

- Fill in your business information, including name, address, and tax identification number.

- Detail your sales transactions, including the type of goods sold and total sales amount.

- Calculate the total tax owed based on the applicable tax rate.

- Review the form for accuracy and completeness.

- Submit the form by the specified deadline, either electronically or by mail.

Legal Use of the Nevada Taxation Sales Use Forms To Print

The Nevada Taxation Sales Use Forms To Print are legally binding documents once completed and submitted according to state regulations. Proper execution of these forms ensures that taxpayers fulfill their obligations under Nevada tax law. It is essential to follow the guidelines provided by the Nevada Department of Taxation to avoid potential legal issues, including audits or penalties for non-compliance.

State-Specific Rules for the Nevada Taxation Sales Use Forms To Print

Each state has unique regulations governing taxation, and Nevada is no exception. Specific rules related to the Nevada Taxation Sales Use Forms To Print include the requirement to report all taxable sales, adherence to local tax rates, and submission deadlines. Businesses must stay informed about any changes in tax laws or forms to ensure compliance. Regularly checking the Nevada Department of Taxation's website can provide updates on state-specific requirements.

Form Submission Methods (Online / Mail / In-Person)

There are multiple methods for submitting the Nevada Taxation Sales Use Forms To Print. Taxpayers can choose to submit forms online through the Nevada Department of Taxation's e-filing system, which offers convenience and immediate confirmation of receipt. Alternatively, forms can be mailed to the appropriate tax office, ensuring they are postmarked by the submission deadline. In-person submissions may also be possible at designated tax offices, allowing for direct interaction with tax officials.

Quick guide on how to complete nevada taxation sales use forms to print

Accomplish Nevada Taxation Sales Use Forms To Print effortlessly on any apparatus

Digital document management has gained immense popularity among enterprises and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and eSign your documents swiftly without complications. Handle Nevada Taxation Sales Use Forms To Print on any platform using airSlate SignNow's Android or iOS applications and ease any document-related task today.

How to alter and eSign Nevada Taxation Sales Use Forms To Print effortlessly

- Find Nevada Taxation Sales Use Forms To Print and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Nevada Taxation Sales Use Forms To Print and ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nevada taxation sales use forms to print

Create this form in 5 minutes!

How to create an eSignature for the nevada taxation sales use forms to print

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Nevada taxation sales use forms to print?

Nevada taxation sales use forms to print are official documents required for businesses to report and remit sales and use taxes in the state of Nevada. These forms ensure compliance with state tax regulations, making it essential for businesses operating in Nevada to manage their tax obligations accurately.

-

How can airSlate SignNow help with Nevada taxation sales use forms?

airSlate SignNow simplifies the process of handling Nevada taxation sales use forms to print by allowing users to electronically sign and send documents. This eliminates paper clutter and enhances efficiency, ensuring that your business can handle tax submissions smoothly and on time.

-

Are there any fees associated with using airSlate SignNow for Nevada taxation forms?

airSlate SignNow offers a cost-effective solution for managing Nevada taxation sales use forms to print, with various pricing plans to fit different business needs. Users can choose from monthly or annual subscriptions, providing flexibility and value for businesses of all sizes.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow offers integrations with various accounting and business management software that can assist in managing Nevada taxation sales use forms to print. This capability streamlines workflows and allows for seamless data transfer, enhancing overall efficiency.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow provides features such as customizable templates, secure eSignature capabilities, and workflow automation, specifically designed to handle Nevada taxation sales use forms to print. These features allow businesses to streamline their document processes and ensure compliance effortlessly.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes security by employing advanced encryption protocols and secure storage solutions for all documents, including Nevada taxation sales use forms to print. This ensures that sensitive tax information remains protected and compliant with regulations, giving you peace of mind.

-

Is training available for using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers comprehensive training resources and customer support to help users effectively navigate the platform, especially for managing Nevada taxation sales use forms to print. These resources include tutorials, webinars, and dedicated support teams to assist with any inquiries.

Get more for Nevada Taxation Sales Use Forms To Print

- Adsef formulario 106

- Health plan selection form utah department of health utah gov health utah

- Louisiana workforce commission benefit analysis team phone number form

- Old mutual medical examination request form

- Hodges university transcript request form

- Intention to employa1 in gov form

- City of cocoa beach permit application form

- Tr 155 lien release form

Find out other Nevada Taxation Sales Use Forms To Print

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors