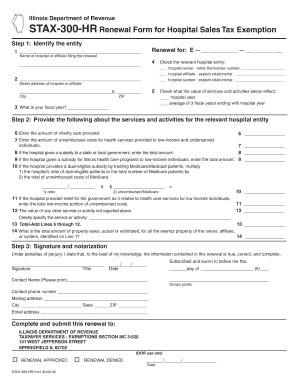

Illinois Revenue Sales Tax Form

What is the Illinois Revenue Sales Tax

The Illinois Revenue Sales Tax is a tax imposed on the sale of tangible personal property and certain services within the state of Illinois. This tax is collected by retailers from consumers at the point of sale and is remitted to the Illinois Department of Revenue (IDOR). The standard sales tax rate in Illinois is six and a quarter percent, but local jurisdictions may impose additional taxes, resulting in varying rates across different areas. Understanding this tax is essential for both consumers and businesses to ensure compliance and proper financial planning.

How to complete the Illinois Revenue Sales Tax form

Completing the Illinois Revenue Sales Tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including sales records and exemption certificates. Next, accurately fill out the form, ensuring that all required fields are completed. Pay special attention to the details, such as the tax rate applicable to your sales and any exemptions that may apply. Once the form is filled out, review it for any errors before submission. It is advisable to keep a copy for your records.

Key elements of the Illinois Revenue Sales Tax

Key elements of the Illinois Revenue Sales Tax include the applicable tax rates, exemptions, and compliance requirements. The standard tax rate is six and a quarter percent, but this can vary based on local taxes. Certain items, such as food and prescription drugs, may be exempt from sales tax. Additionally, businesses must maintain accurate records of sales and tax collected to ensure compliance with IDOR regulations. Understanding these elements is crucial for both consumers and businesses to navigate the tax landscape effectively.

Required Documents for Illinois Revenue Sales Tax

When filing for the Illinois Revenue Sales Tax, several documents are required to support your submission. These typically include sales records, exemption certificates, and any relevant invoices. For businesses, maintaining accurate financial records is critical, as these documents provide evidence of sales transactions and tax collected. Having these documents organized and readily available can streamline the filing process and ensure compliance with state regulations.

Penalties for Non-Compliance

Failure to comply with Illinois Revenue Sales Tax regulations can result in significant penalties. Businesses that do not collect the appropriate sales tax may face fines and interest on unpaid taxes. Additionally, the Illinois Department of Revenue may impose penalties for late filings or inaccuracies in submitted forms. It is essential for businesses to stay informed about their tax obligations to avoid these potential penalties and maintain good standing with the state.

Eligibility Criteria for Sales Tax Exemption

Eligibility for sales tax exemption in Illinois typically depends on the nature of the purchase and the buyer's status. Certain organizations, such as non-profits and government entities, may qualify for exemptions. Additionally, specific types of purchases, like manufacturing equipment or items for resale, may also be exempt from sales tax. To claim an exemption, buyers must provide the appropriate exemption certificate, ensuring that they meet all eligibility criteria established by the Illinois Department of Revenue.

Form Submission Methods for Illinois Revenue Sales Tax

Submitting the Illinois Revenue Sales Tax form can be done through various methods, including online, by mail, or in person. The online submission process is often the most efficient, allowing for quicker processing times. Alternatively, forms can be printed and mailed to the Illinois Department of Revenue, or submitted in person at designated offices. Each method has its own requirements and timelines, so it is important to choose the one that best fits your needs and ensures timely compliance.

Quick guide on how to complete illinois revenue sales tax

Prepare Illinois Revenue Sales Tax seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Illinois Revenue Sales Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to adjust and eSign Illinois Revenue Sales Tax effortlessly

- Find Illinois Revenue Sales Tax and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow provides explicitly for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to preserve your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Adjust and eSign Illinois Revenue Sales Tax to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Illinois revenue sales tax rate?

The Illinois revenue sales tax rate varies depending on the location of the transaction, but it generally stands around 6.25%. Some municipalities may impose additional local taxes, which can increase the total sales tax rate. Understanding the Illinois revenue sales tax is crucial for businesses to ensure compliance.

-

How does airSlate SignNow help with sales tax compliance?

airSlate SignNow offers features that streamline the signing process of important documents related to sales tax compliance. By enabling secure eSignatures, businesses can quickly finalize sales tax returns and regulations documents. This efficiency aids in adhering to the Illinois revenue sales tax requirements.

-

Is airSlate SignNow cost-effective for managing sales tax documents?

Yes, airSlate SignNow provides a cost-effective solution for managing documents related to the Illinois revenue sales tax. Our pricing plans are designed to suit businesses of all sizes, allowing you to save both time and money on document management. This affordability is complemented by robust features.

-

What features of airSlate SignNow support sales tax documentation?

airSlate SignNow includes various features that cater to sales tax documentation, such as templates for various tax forms and efficient eSignature capabilities. These features enhance accuracy and speed up the signing process of documents related to the Illinois revenue sales tax. Additionally, you can track document status in real-time.

-

Are there integrations available for airSlate SignNow to assist with sales tax?

Yes, airSlate SignNow integrates seamlessly with various accounting and finance tools that help in managing Illinois revenue sales tax compliance. These integrations streamline workflows and ensure that your financial records align with state sales tax requirements. This ensures a smoother tax preparation process.

-

Can airSlate SignNow help with audit trails for sales tax documents?

Absolutely! airSlate SignNow provides comprehensive audit trails for all documents signed, which is crucial for Illinois revenue sales tax compliance. These records can be invaluable during audits or when discrepancies arise, ensuring that your business maintains transparency and accuracy.

-

How does using airSlate SignNow improve efficiency in handling sales tax forms?

By utilizing airSlate SignNow, businesses can signNowly improve their efficiency in handling sales tax forms related to the Illinois revenue sales tax. The platform allows for quick document sharing and signing, reducing the time spent on manual processes. This efficiency can lead to faster tax submissions and improved compliance.

Get more for Illinois Revenue Sales Tax

Find out other Illinois Revenue Sales Tax

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word