Ohio it 3 Transmittal of Wage and Tax Statements Ohio Department 2014

What is the Ohio IT 3 Transmittal Of Wage And Tax Statements Ohio Department

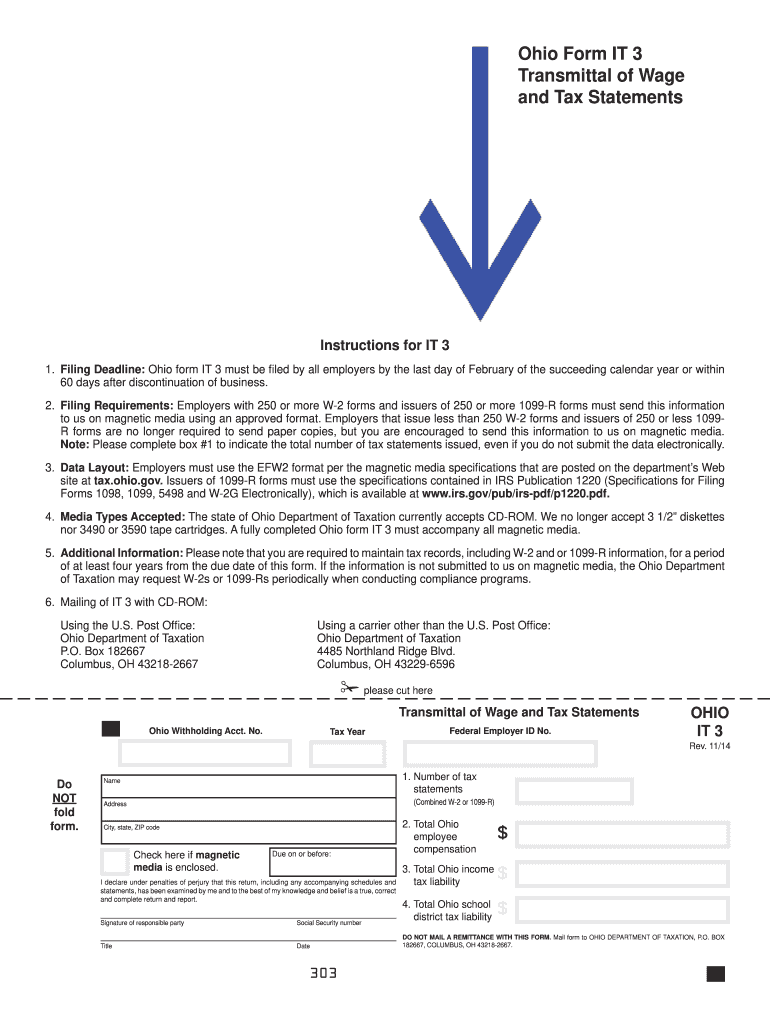

The Ohio IT 3 Transmittal Of Wage And Tax Statements is a crucial document used by employers in Ohio to report wage and tax information to the Ohio Department of Taxation. This form serves as a cover sheet for submitting W-2 forms and other related wage statements. It consolidates the information from multiple employees into a single submission, making it easier for the state to process and track tax obligations. Employers must complete this form accurately to ensure compliance with state tax laws.

Steps to complete the Ohio IT 3 Transmittal Of Wage And Tax Statements Ohio Department

Completing the Ohio IT 3 involves several important steps:

- Gather necessary information, including employer details, total wages paid, and tax withheld for each employee.

- Fill out the Ohio IT 3 form, ensuring all fields are completed accurately.

- Attach copies of the W-2 forms for each employee to the transmittal.

- Review the completed form for accuracy to avoid potential penalties.

- Submit the Ohio IT 3 along with the attached W-2 forms to the Ohio Department of Taxation by the designated deadline.

How to use the Ohio IT 3 Transmittal Of Wage And Tax Statements Ohio Department

The Ohio IT 3 is utilized primarily by employers for reporting purposes. To use this form effectively, employers should:

- Ensure they have the latest version of the form, available from the Ohio Department of Taxation.

- Accurately compile wage and tax information for all employees, including any adjustments or corrections from previous filings.

- Submit the completed form electronically or via mail, depending on the preferred submission method.

Filing Deadlines / Important Dates

Timely submission of the Ohio IT 3 is essential to avoid penalties. The standard deadline for filing this form coincides with the federal W-2 deadline, typically January thirty-first of each year. Employers should be aware of any changes to these deadlines, especially during tax season, to ensure compliance.

Required Documents

When submitting the Ohio IT 3, employers must include the following documents:

- The completed Ohio IT 3 form.

- Copies of W-2 forms for each employee.

- Any additional documentation that supports wage and tax reporting, such as amended returns if applicable.

Penalties for Non-Compliance

Failure to file the Ohio IT 3 on time or inaccuracies in reporting can result in penalties. Employers may face fines for late submissions, and incorrect information can lead to further complications with tax assessments. It is crucial to ensure that all details are accurate and submitted within the required timeframe to avoid these consequences.

Quick guide on how to complete ohio form it 3 2014

Your assistance manual on how to prepare your Ohio IT 3 Transmittal Of Wage And Tax Statements Ohio Department

If you're curious about how to finalize and submit your Ohio IT 3 Transmittal Of Wage And Tax Statements Ohio Department, here are a few brief pointers on how to simplify the tax submission process.

To get started, all you need is to create your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally intuitive and robust document solution that allows you to modify, draft, and complete your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures, and revisit any information for adjustments. Enhance your tax management with sophisticated PDF editing, eSigning, and convenient sharing options.

Follow the steps below to complete your Ohio IT 3 Transmittal Of Wage And Tax Statements Ohio Department in moments:

- Create your account and start working on PDFs within moments.

- Utilize our catalog to locate any IRS tax form; browse through different versions and schedules.

- Click Get form to access your Ohio IT 3 Transmittal Of Wage And Tax Statements Ohio Department in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Use the Sign Tool to add your legally binding electronic signature (if required).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper may lead to return errors and slow down reimbursements. Additionally, before e-filing your taxes, verify the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct ohio form it 3 2014

FAQs

-

How much would it cost to fill a 30-lb tank of propane in Ohio?

lets see, a 30 lb tank holds 7 gals at around $3.98 a gallon (average price right now) would come to $27.86

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

Create this form in 5 minutes!

How to create an eSignature for the ohio form it 3 2014

How to create an eSignature for your Ohio Form It 3 2014 online

How to generate an electronic signature for the Ohio Form It 3 2014 in Google Chrome

How to create an eSignature for putting it on the Ohio Form It 3 2014 in Gmail

How to make an electronic signature for the Ohio Form It 3 2014 from your mobile device

How to make an eSignature for the Ohio Form It 3 2014 on iOS

How to make an electronic signature for the Ohio Form It 3 2014 on Android OS

People also ask

-

What is the Ohio IT 3 Transmittal Of Wage And Tax Statements?

The Ohio IT 3 Transmittal Of Wage And Tax Statements is a form used by employers to report employee wages and taxes withheld to the Ohio Department. This document is essential for ensuring compliance with state tax regulations and helps streamline the tax filing process for businesses in Ohio.

-

How can airSlate SignNow assist with the Ohio IT 3 Transmittal Of Wage And Tax Statements?

airSlate SignNow provides an easy-to-use platform to electronically sign and send the Ohio IT 3 Transmittal Of Wage And Tax Statements. With its user-friendly interface, you can efficiently prepare, eSign, and submit your wage and tax statements, ensuring a smooth and compliant process.

-

Is airSlate SignNow a cost-effective solution for submitting the Ohio IT 3 Transmittal Of Wage And Tax Statements?

Yes, airSlate SignNow offers a cost-effective solution for handling the Ohio IT 3 Transmittal Of Wage And Tax Statements. By reducing paperwork and streamlining the signing process, businesses can save both time and money, making it a smart choice for managing tax documentation.

-

What features does airSlate SignNow offer for managing tax documents like the Ohio IT 3?

airSlate SignNow includes features like document templates, customizable workflows, and secure electronic signatures, all of which are beneficial for managing the Ohio IT 3 Transmittal Of Wage And Tax Statements. These tools help ensure accuracy and compliance while simplifying the document management process.

-

Can I integrate airSlate SignNow with other software for the Ohio IT 3 Transmittal Of Wage And Tax Statements?

Absolutely! airSlate SignNow offers integrations with various software solutions, enhancing your workflow for the Ohio IT 3 Transmittal Of Wage And Tax Statements. Whether you're using accounting software or HR systems, you can streamline document handling and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the Ohio IT 3 Transmittal Of Wage And Tax Statements?

Using airSlate SignNow for the Ohio IT 3 Transmittal Of Wage And Tax Statements allows for faster processing times, improved compliance, and easier tracking of document status. Additionally, the platform enhances collaboration among team members, ensuring everyone is on the same page throughout the tax filing process.

-

Is airSlate SignNow secure for handling sensitive documents like the Ohio IT 3?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents, including the Ohio IT 3 Transmittal Of Wage And Tax Statements, are protected. With advanced encryption and secure storage, you can trust that your data remains confidential and safe from unauthorized access.

Get more for Ohio IT 3 Transmittal Of Wage And Tax Statements Ohio Department

- The refresher course is an individually planned and self directed course of form

- Cns ref course app 11182019 form

- Application for a copy of a north carolina birth certificate application form

- Nc division of vital records raleigh wake county north form

- Nc kindergarten health assessment report rev 111 form

- Nc birth certificate form

- Nc dhhs telework form

- Dss 8116 i form

Find out other Ohio IT 3 Transmittal Of Wage And Tax Statements Ohio Department

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple