Transmittal of W 2 and 1099 R Statements 2020-2026

What is the Transmittal of W-2 and 1099-R Statements?

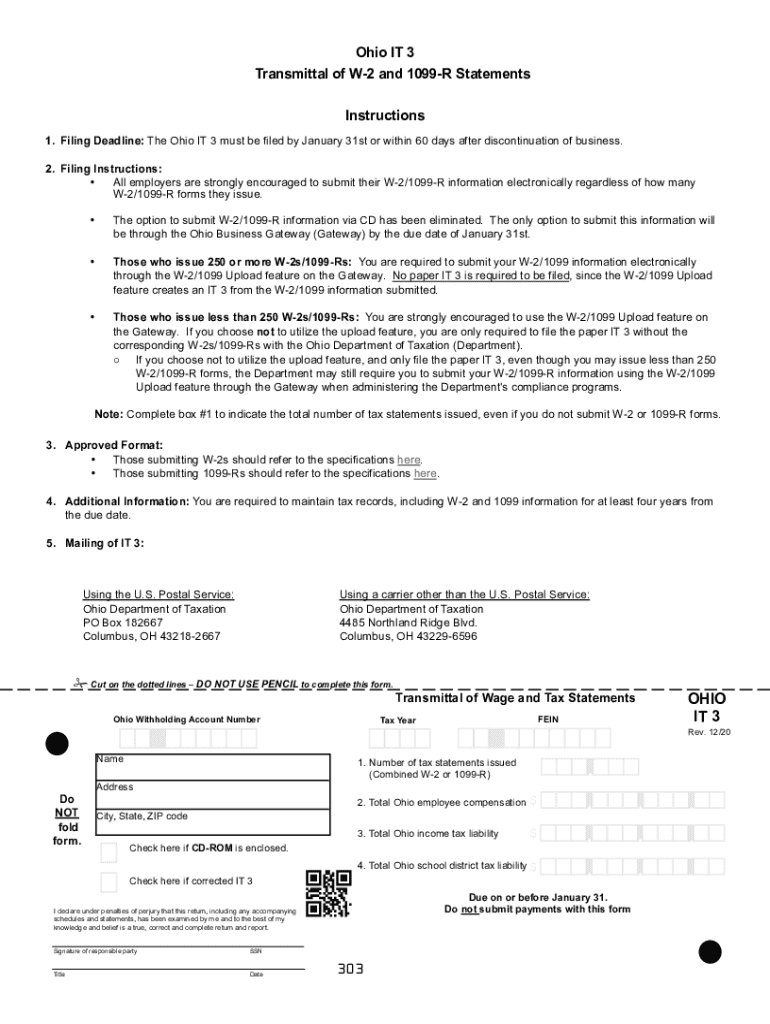

The Transmittal of W-2 and 1099-R Statements is a crucial document used by employers and financial institutions to report wage and tax information to the IRS. This form serves as a cover sheet for the accompanying W-2 and 1099-R forms, summarizing the total amounts reported. It ensures that the IRS can match the information provided by employers with the income reported by employees and recipients. Understanding this form is vital for accurate tax reporting and compliance.

How to Use the Transmittal of W-2 and 1099-R Statements

Using the Transmittal of W-2 and 1099-R Statements involves several steps. First, gather all W-2 and 1099-R forms that need to be submitted. Next, complete the transmittal form by entering the total number of forms being submitted, along with the total amounts reported. Ensure that all information is accurate to avoid delays or penalties. Finally, submit the transmittal along with the W-2 and 1099-R forms to the IRS, either electronically or by mail, depending on your preference and the volume of forms.

Steps to Complete the Transmittal of W-2 and 1099-R Statements

Completing the Transmittal of W-2 and 1099-R Statements requires careful attention to detail. Follow these steps:

- Obtain the correct form from the IRS website or your tax software.

- Fill in your employer identification number (EIN) and the tax year.

- Indicate the total number of W-2 and 1099-R forms being submitted.

- Calculate and enter the total wages, tips, and other compensation, as well as the total federal income tax withheld.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Transmittal of W-2 and 1099-R Statements are crucial for compliance. Typically, the forms must be submitted to the IRS by January 31 of the year following the tax year. If you are filing electronically, the deadline may extend slightly, but it is essential to check the IRS guidelines for specific dates each year. Late submissions can result in penalties, so timely filing is important.

Penalties for Non-Compliance

Failing to comply with the filing requirements for the Transmittal of W-2 and 1099-R Statements can lead to significant penalties. The IRS imposes fines based on how late the forms are filed, with higher penalties for longer delays. Additionally, incorrect information on the forms can lead to further fines and complications with tax reporting. It is advisable to ensure accuracy and timeliness to avoid these penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Transmittal of W-2 and 1099-R Statements. These guidelines include instructions on the required information, formatting, and submission methods. It is essential to refer to the latest IRS publications to ensure compliance with current regulations. Following these guidelines helps maintain accurate records and ensures that all tax obligations are met.

Quick guide on how to complete transmittal of w 2 and 1099 r statements

Complete Transmittal Of W 2 And 1099 R Statements effortlessly on any device

Web-based document management has gained signNow traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage Transmittal Of W 2 And 1099 R Statements on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Transmittal Of W 2 And 1099 R Statements with ease

- Obtain Transmittal Of W 2 And 1099 R Statements and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you would like to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or displaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Transmittal Of W 2 And 1099 R Statements and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct transmittal of w 2 and 1099 r statements

Create this form in 5 minutes!

How to create an eSignature for the transmittal of w 2 and 1099 r statements

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it work for businesses in 2019 oh it?

airSlate SignNow is a powerful eSignature platform designed to help businesses streamline their document management processes. In 2019 oh it, this solution allows users to easily send, sign, and manage documents online, enabling faster transactions and improved workflows.

-

What are the pricing plans available for airSlate SignNow in 2019 oh it?

airSlate SignNow offers several pricing plans tailored to fit different business needs in 2019 oh it. The plans include a free trial, as well as affordable monthly subscriptions that vary based on features and number of users, ensuring flexibility for businesses of all sizes.

-

What key features does airSlate SignNow offer in 2019 oh it?

In 2019 oh it, airSlate SignNow provides a range of features including secure eSignatures, document templates, team collaboration tools, and API integrations. These features are designed to enhance productivity and make document management more efficient for businesses.

-

How can airSlate SignNow benefit my business in 2019 oh it?

Using airSlate SignNow in 2019 oh it can signNowly benefit your business by reducing paper usage, speeding up document turnaround times, and enhancing overall efficiency. The platform also improves accuracy in document handling, which helps minimize costly errors.

-

Can airSlate SignNow integrate with other tools and platforms in 2019 oh it?

Yes, airSlate SignNow supports a wide range of integrations with other software platforms in 2019 oh it, including popular CRMs, cloud storage services, and productivity tools. These integrations help streamline workflows and enhance collaboration across your organization.

-

Is airSlate SignNow secure for eSigning documents in 2019 oh it?

Absolutely! airSlate SignNow employs advanced security measures in 2019 oh it, including encryption and multi-factor authentication, to ensure that your document signatures and data remain confidential and protected. Compliance with eSignature laws further guarantees the legal validity of your signed documents.

-

How quickly can I get started with airSlate SignNow in 2019 oh it?

Getting started with airSlate SignNow in 2019 oh it is quick and easy. You can sign up for a free trial, explore the platform's features, and start sending documents for signing within minutes, making it a user-friendly solution for businesses looking to enhance their workflows.

Get more for Transmittal Of W 2 And 1099 R Statements

Find out other Transmittal Of W 2 And 1099 R Statements

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge