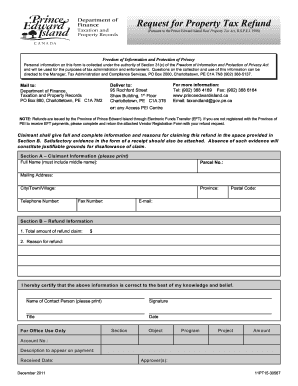

Prince Edward Island Property Form

What is the Prince Edward Island Property Tax?

The Prince Edward Island property tax is a tax levied on real estate properties located within the province of Prince Edward Island, Canada. This tax is typically assessed based on the value of the property, which is determined by local authorities. Property taxes are essential for funding local services, including education, public safety, and infrastructure maintenance. The tax rate can vary depending on the municipality and the type of property, whether residential, commercial, or agricultural.

How to Obtain Information on Prince Edward Island Property Tax

To obtain information regarding property tax in Prince Edward Island, property owners can access resources provided by local municipalities. Each municipality typically maintains a website that offers details on tax rates, assessment processes, and payment options. Additionally, property owners can contact their local tax office directly for specific inquiries or assistance. It is important to stay informed about any changes in tax rates or regulations that may affect property ownership.

Steps to Complete the Prince Edward Island Property Tax Form

Completing the Prince Edward Island property tax form involves several key steps:

- Gather necessary documentation, including property assessment notices and prior tax statements.

- Fill out the property tax form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate municipal office by the specified deadline.

- Keep a copy of the submitted form and any correspondence for your records.

Required Documents for Prince Edward Island Property Tax

When filing for property tax in Prince Edward Island, several documents may be required to ensure accurate assessment and compliance. These documents typically include:

- Property assessment notice from the local municipality.

- Proof of ownership, such as a deed or title.

- Previous property tax statements for reference.

- Any additional documentation requested by the local tax authority.

Penalties for Non-Compliance with Prince Edward Island Property Tax Regulations

Failure to comply with Prince Edward Island property tax regulations can result in various penalties. Common consequences include:

- Late fees added to outstanding tax balances.

- Interest charges accruing on overdue amounts.

- Potential legal action to recover unpaid taxes.

- Liens placed on the property until the tax obligation is fulfilled.

Eligibility Criteria for Prince Edward Island Property Tax Relief

Property owners in Prince Edward Island may qualify for tax relief under certain conditions. Eligibility criteria can include:

- Age or disability status of the property owner.

- Income level, which may affect the ability to pay property taxes.

- Type of property, such as primary residences versus investment properties.

Quick guide on how to complete prince edward island property

Easily Prepare Prince Edward Island Property on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Prince Edward Island Property on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Prince Edward Island Property Effortlessly

- Find Prince Edward Island Property and click Get Form to begin.

- Use the tools we provide to complete your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Prince Edward Island Property and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the average prince edward island property tax rate?

The average property tax rate in Prince Edward Island varies by municipality, but it typically ranges from 0.5% to 1.5% of the assessed property value. Homeowners should check with their local municipality to find the exact rates applicable to their properties. Understanding this helps in budgeting for annual expenses related to prince edward island property tax.

-

How often do I need to pay my prince edward island property tax?

Property taxes in Prince Edward Island are generally billed annually, with payment due on specific dates dictated by local municipalities. Some areas may offer installment options that allow for semi-annual or quarterly payments. Ensuring timely payment is crucial to avoid penalties on your prince edward island property tax.

-

What factors influence my prince edward island property tax amount?

Several factors influence the amount of prince edward island property tax you pay, including the assessed value of your property, local tax rates, and any applicable exemptions or credits. Changes in property value due to renovations or market fluctuations can also affect your tax obligations. It's important to stay informed about these variables to manage your property expenses effectively.

-

Are there any tax exemptions available for prince edward island property tax?

Yes, Prince Edward Island offers various property tax exemptions and credits, especially for seniors, low-income families, and certain types of properties. Homeowners can apply for these exemptions to reduce their overall prince edward island property tax burden. Checking with your local assessment office can provide you with details on eligibility and application processes.

-

How can I appeal my prince edward island property tax assessment?

If you believe your property assessment for prince edward island property tax is incorrect, you have the option to file an appeal. The process typically involves submitting a formal application to your local assessment review board within a specific timeframe. Providing evidence to support your claim can be essential for a successful appeal.

-

How do property taxes in Prince Edward Island compare to other provinces?

Compared to other Canadian provinces, Prince Edward Island's property tax rates are relatively moderate. Some provinces have higher rates due to more extensive municipal services. However, the overall cost of living and property values in Prince Edward Island also play an essential role in understanding your prince edward island property tax expenses.

-

What payment methods are available for prince edward island property tax?

Most municipalities in Prince Edward Island allow various payment methods for property tax, including online payments, bank transfers, and in-person payments at designated offices. This flexibility helps ensure homeowners can pay their prince edward island property tax conveniently and on time. Always check with your local municipality for specific options available.

Get more for Prince Edward Island Property

Find out other Prince Edward Island Property

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy