Council Tax Discount Application Form

What is the Council Tax Discount Application

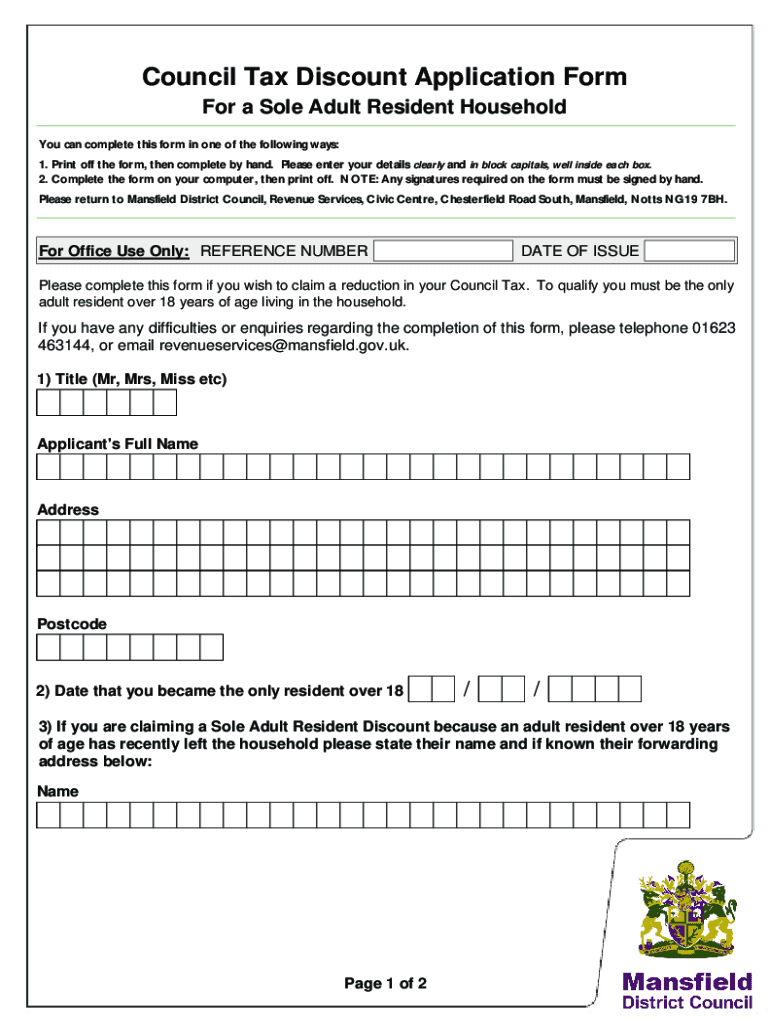

The Council Tax Discount Application is a formal request submitted by residents in the United Kingdom to receive a reduction in their council tax liability. This application is particularly relevant for individuals who may qualify for discounts based on specific criteria, such as living alone, being a student, or having a disability. The application process ensures that eligible individuals can benefit from financial relief, making it an important aspect of managing household expenses.

Steps to complete the Council Tax Discount Application

Completing the Council Tax Discount Application involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal details, property information, and any supporting documents that demonstrate eligibility. Next, fill out the application form carefully, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions before submitting it to the appropriate local council authority. It is advisable to keep a copy of the submitted application for your records.

Eligibility Criteria

To qualify for a council tax discount, applicants must meet specific eligibility criteria set by local councils. Common factors include living alone, being a full-time student, or being a person with a disability. Additionally, certain exemptions may apply for individuals receiving specific benefits or allowances. It is essential to review the local council's guidelines to determine if you meet the necessary conditions for a discount before applying.

Required Documents

When submitting the Council Tax Discount Application, certain documents may be required to support your request. These documents can include proof of identity, such as a driver's license or passport, evidence of residency, and any relevant documentation that verifies your eligibility for a discount, such as student enrollment letters or disability certificates. Ensuring that all required documents are included can expedite the processing of your application.

Form Submission Methods

The Council Tax Discount Application can typically be submitted through various methods, including online, by mail, or in person at local council offices. Online submissions are often the most efficient, allowing for quicker processing times. When submitting by mail, ensure that the application is sent to the correct address and consider using a trackable mailing option. In-person submissions may provide immediate confirmation of receipt, which can be beneficial if there are time-sensitive considerations.

Legal use of the Council Tax Discount Application

The legal use of the Council Tax Discount Application is governed by regulations that ensure the integrity of the application process. It is crucial to provide accurate information, as submitting false or misleading information can result in penalties or denial of the discount. Additionally, electronic submissions must comply with relevant eSignature laws to be considered legally binding. This compliance guarantees that the application is recognized by local authorities and adheres to established legal standards.

Quick guide on how to complete council tax discount application

Effortlessly Prepare Council Tax Discount Application on Any Device

Web-based document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your paperwork swiftly and without complications. Manage Council Tax Discount Application on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to edit and electronically sign Council Tax Discount Application with ease

- Find Council Tax Discount Application and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or mislaid files, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Council Tax Discount Application and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a council tax discount application?

A council tax discount application is a formal request submitted to your local council to reduce your council tax bill based on specific eligibility criteria. By providing necessary documentation and fulfilling the outlined requirements, you can potentially lower your tax obligation. Using airSlate SignNow can simplify this process with its easy eSigning capabilities.

-

How does airSlate SignNow streamline the council tax discount application process?

airSlate SignNow streamlines the council tax discount application process by allowing users to digitally fill out and sign necessary documents online. This eliminates the need for printing, scanning, or mailing documents, saving valuable time for applicants. With our user-friendly platform, you can ensure your application is submitted quickly and securely.

-

Is there a fee associated with using airSlate SignNow for council tax discount applications?

Using airSlate SignNow for your council tax discount application comes at a competitive subscription rate designed to meet varying business needs. We offer flexible pricing plans, so you can choose one that fits your budget while still accessing powerful eSigning and document management features. Review our pricing page for more details.

-

What documents do I need for a council tax discount application?

For a council tax discount application, you typically need to provide proof of identity, residency, and any circumstances that support your eligibility for a discount. This may include documents such as identification cards, tenancy agreements, or evidence of disability. airSlate SignNow enables you to gather and manage these documents efficiently.

-

Can I track the status of my council tax discount application with airSlate SignNow?

Yes, airSlate SignNow offers features that allow you to track the status of your council tax discount application once it has been submitted. You'll receive notifications when your application is viewed or signed, giving you peace of mind during the waiting period. This helps you stay informed every step of the way.

-

What are the benefits of using airSlate SignNow for my council tax discount application?

The benefits of using airSlate SignNow for your council tax discount application include saving time with easy digital signatures, reducing paperwork, and improving the overall efficiency of the submission process. Our platform is designed to be user-friendly, ensuring applicants can complete their applications seamlessly from any device. Plus, you'll benefit from enhanced security features to protect your sensitive information.

-

Is airSlate SignNow compatible with other applications I am using for my council tax discount application?

Yes, airSlate SignNow integrates smoothly with numerous applications to facilitate your council tax discount application process. Whether you are using document storage solutions or payment systems, our platform ensures compatibility, allowing for a cohesive workflow. Explore our integration options to find tools that suit your needs.

Get more for Council Tax Discount Application

- See rule 54 3a of upvat rules form

- Tietz fundamentals of clinical chemistry 8th edition pdf download form

- Cuisinart soup maker recipes pdf form

- Carol wright mail order catalog form

- Cctv consent form template

- Answer key rule of 72 worksheet answers form

- Luminaria order form luminaria order form relay for life relay acsevents

- Letter for ymca scholarship form

Find out other Council Tax Discount Application

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online