Nyc 210 Claim Form

What is the NYC 210 Claim Form

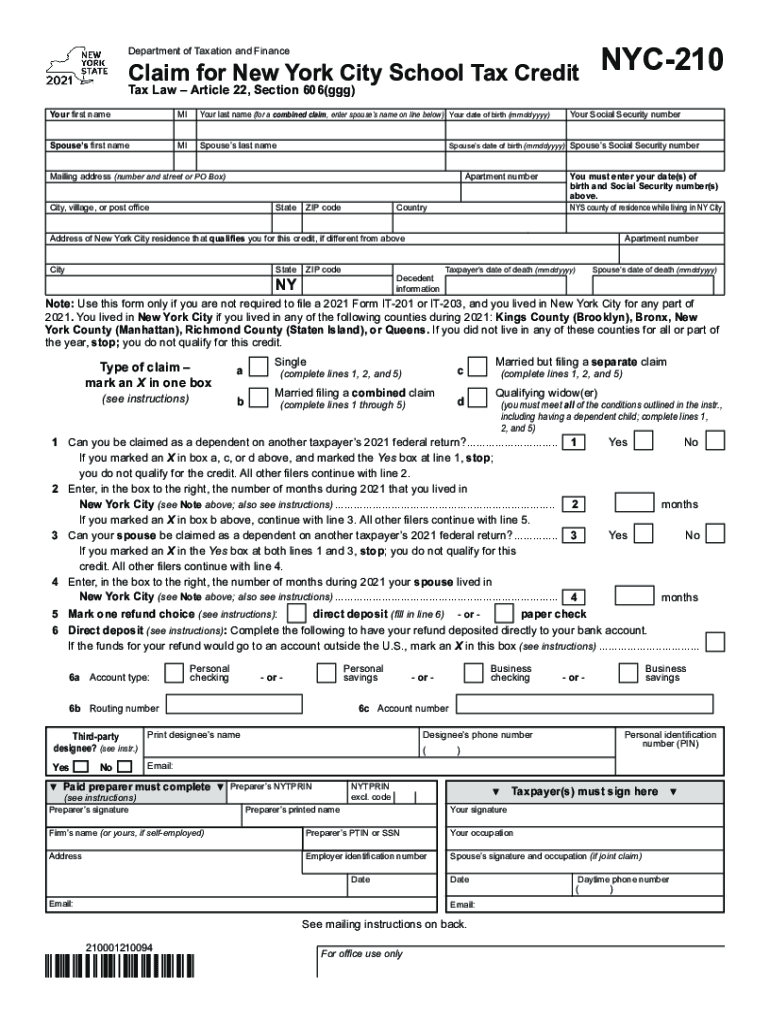

The NYC 210 Claim Form, officially known as the NYS Department of Taxation and Finance Form 210, is a document used by taxpayers in New York City to claim certain tax credits and benefits. This form is particularly relevant for individuals seeking to receive a refund for overpaid school taxes or to apply for specific tax relief programs. Understanding the purpose and function of this form is essential for ensuring that taxpayers can maximize their eligible credits and comply with local tax regulations.

Steps to Complete the NYC 210 Claim Form

Completing the NYC 210 Claim Form involves several key steps to ensure accuracy and compliance. Here’s a streamlined process:

- Gather Required Information: Collect all necessary documentation, including proof of residency, income statements, and any relevant tax documents.

- Fill Out Personal Information: Enter your name, address, and Social Security number accurately to avoid processing delays.

- Detail Tax Credits: Specify the tax credits you are claiming, ensuring you meet the eligibility criteria for each.

- Review and Verify: Double-check all entries for accuracy and completeness, as errors can lead to rejection or delays.

- Sign and Date: Ensure the form is signed and dated to validate your submission.

Legal Use of the NYC 210 Claim Form

The legal use of the NYC 210 Claim Form is governed by specific regulations that dictate how and when it can be submitted. To be considered valid, the form must be completed in accordance with the guidelines set forth by the New York State Department of Taxation and Finance. This includes using the most current version of the form, adhering to filing deadlines, and providing accurate information. Failure to comply with these legal requirements may result in penalties or denial of claims.

How to Obtain the NYC 210 Claim Form

The NYC 210 Claim Form can be obtained through several channels. Taxpayers can download a printable version directly from the New York State Department of Taxation and Finance website. Additionally, physical copies may be available at local tax offices or public libraries. It is recommended to ensure that you are using the most recent version of the form to avoid any issues during the submission process.

Required Documents for the NYC 210 Claim Form

To successfully complete the NYC 210 Claim Form, certain documents are required to support your claim. These may include:

- Proof of residency, such as a utility bill or lease agreement.

- Income documentation, including W-2 forms or 1099 statements.

- Any prior tax returns that may be relevant to your claim.

- Additional forms that may apply to specific tax credits being claimed.

Form Submission Methods

The NYC 210 Claim Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically through the New York State Department of Taxation and Finance's online portal, which offers a streamlined process.

- Mail: Completed forms can be mailed to the designated address provided on the form. Ensure to send it via certified mail for tracking purposes.

- In-Person: Taxpayers may also submit the form in person at local tax offices, which can provide immediate confirmation of receipt.

Quick guide on how to complete nyc 210 claim form

Effortlessly prepare Nyc 210 Claim Form on any device

Online document organization has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Nyc 210 Claim Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to edit and eSign Nyc 210 Claim Form with ease

- Obtain Nyc 210 Claim Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Nyc 210 Claim Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the nyc210 school program offered by airSlate SignNow?

The nyc210 school program is designed to enhance document management and e-signature solutions specifically tailored for educational institutions. With airSlate SignNow, schools can streamline their administrative processes by easily sending and signing important documents online, ensuring efficiency and compliance.

-

How does pricing work for the nyc210 school services?

Pricing for the nyc210 school services varies based on the number of users and specific features needed. airSlate SignNow offers competitive pricing plans that cater to budget-conscious schools seeking efficient e-signature solutions without compromising on quality.

-

What features does airSlate SignNow provide for the nyc210 school?

airSlate SignNow provides a range of features for the nyc210 school, including document templates, real-time tracking, and secure storage. These tools help educators manage forms, consent slips, and other essential paperwork seamlessly, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for nyc210 school?

Using airSlate SignNow for the nyc210 school brings numerous benefits, such as reducing paperwork, lowering operational costs, and improving collaboration among staff. The platform's user-friendly interface ensures that both educators and students can easily navigate e-signature processes without technical difficulties.

-

Can airSlate SignNow integrate with existing systems at nyc210 school?

Yes, airSlate SignNow can integrate with various existing systems and software commonly used in educational environments. This compatibility ensures that the nyc210 school can incorporate e-signature functionalities seamlessly into their current workflows, enhancing data management and communication.

-

Is training available for staff at nyc210 school to use airSlate SignNow?

Absolutely! airSlate SignNow offers comprehensive training resources and support for staff at the nyc210 school. This ensures that all users, regardless of their technical expertise, can effectively utilize the platform to streamline their document processes.

-

How secure is airSlate SignNow for documents at nyc210 school?

Security is a top priority at airSlate SignNow, especially for sensitive documents handled by the nyc210 school. The platform employs advanced encryption technologies and compliance with data protection regulations to safeguard all documents, ensuring peace of mind for users.

Get more for Nyc 210 Claim Form

- Pmss renewal annexure 1 form

- Medication administration permission form 59208253

- 15317789 zip form

- Aap international license makati form

- Worksite description eta 9143 form

- Form b250a

- Lions mollymook beach market ulladulla milton lions club ulladullamilton nsw lions org form

- 8152certificated resignation form03 unprotected doc

Find out other Nyc 210 Claim Form

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF