3800n Form

What is the 3800n

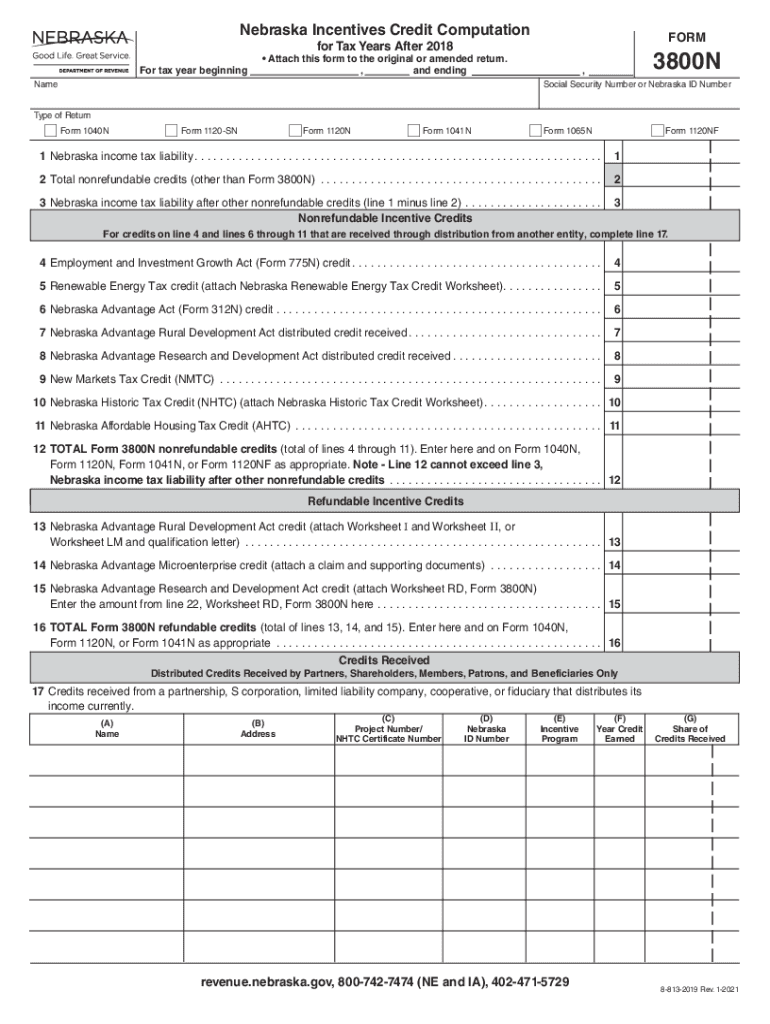

The 3800n form is a specific document used primarily in Nebraska for tax purposes. It serves as a means for taxpayers to report certain information related to their financial activities. Understanding the purpose of the 3800n is essential for ensuring compliance with state tax regulations. This form is particularly relevant for individuals and businesses that need to provide detailed financial data to the Nebraska Department of Revenue.

How to use the 3800n

Using the 3800n form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submission. Utilizing digital tools can streamline this process, allowing for easier editing and secure submission.

Steps to complete the 3800n

Completing the 3800n form requires a systematic approach. Begin by downloading the form from the Nebraska Department of Revenue website or accessing it through a digital platform. Follow these steps:

- Enter your personal information, including your name, address, and taxpayer identification number.

- Provide details about your income and any deductions you wish to claim.

- Review all entries for accuracy, ensuring that figures match your supporting documents.

- Sign and date the form, indicating your agreement with the information provided.

Once completed, submit the form according to the specified guidelines.

Legal use of the 3800n

The legal validity of the 3800n form hinges on compliance with state tax laws. To ensure that the form is legally recognized, it must be filled out correctly and submitted by the appropriate deadlines. Utilizing a reliable eSignature solution can enhance the legal standing of the form, as it provides a digital certificate that verifies the identity of the signer. Compliance with relevant regulations, such as the ESIGN Act, is crucial for maintaining the document's legal integrity.

State-specific rules for the 3800n

Each state may have unique rules governing the use of tax forms, including the 3800n. In Nebraska, it is essential to be aware of specific filing requirements, deadlines, and any updates to tax laws that may affect the form. Taxpayers should consult the Nebraska Department of Revenue for the most current information regarding the 3800n, ensuring they adhere to all state-specific regulations.

Examples of using the 3800n

There are various scenarios in which the 3800n form may be utilized. For instance, an individual who has received income from freelance work may need to report this income using the 3800n. Similarly, a small business owner may use the form to declare business earnings and claim deductions for expenses incurred during the tax year. Understanding these examples can help taxpayers recognize when the 3800n is applicable to their financial situations.

Quick guide on how to complete 3800n

Prepare 3800n seamlessly on any device

Online document organization has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without issues. Manage 3800n on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to edit and electronically sign 3800n without hassle

- Locate 3800n and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages your document organization needs in just a few clicks from any device you prefer. Modify and electronically sign 3800n and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 3800n, and how does it benefit my business?

The 3800n is an advanced electronic signature solution from airSlate SignNow designed to streamline document signing processes. It enhances efficiency by allowing users to send, sign, and manage documents in a secure and cost-effective manner. This solution is ideal for businesses looking to reduce turnaround time and improve workflow.

-

How much does the 3800n cost?

Pricing for the 3800n varies based on the specific plan you choose. airSlate SignNow offers flexible pricing structures to accommodate businesses of all sizes, ensuring affordability and value. For a detailed quote tailored to your needs, you can visit our pricing page or contact our sales team.

-

What features are included with the 3800n?

The 3800n comes packed with features such as customizable templates, in-person signing, advanced authentication options, and real-time tracking of document status. These features are designed to facilitate a seamless signing experience, ensuring that businesses can operate efficiently and securely. Overall, the 3800n enhances user experience and operational efficiency.

-

Can the 3800n integrate with other software solutions?

Yes, the 3800n integrates effortlessly with a variety of third-party applications, including CRM and project management tools. This integration allows businesses to combine workflows and eliminate data silos, leading to better collaboration and productivity. Users can easily set up integrations to suit their specific operational needs.

-

Is the 3800n compliant with legal standards?

Absolutely! The 3800n is designed to comply with eSignature laws such as the ESIGN Act and UETA, ensuring that all signed documents are legally binding. airSlate SignNow prioritizes security and compliance, giving users confidence in their document signing processes. Your legal integrity is maintained with every eSigned document.

-

What benefits does using the 3800n provide?

Using the 3800n presents numerous benefits including increased efficiency, reduced paperwork, and improved turnaround times for contract signing. Businesses can automate routine tasks, saving valuable time and resources. Ultimately, the 3800n empowers businesses to focus on core activities while leaving document management to the experts.

-

Is support available for 3800n users?

Yes, airSlate SignNow provides comprehensive support for all 3800n users, including tutorials, FAQs, and direct customer service assistance. Our support team is available to help resolve any issues and answer questions to ensure a smooth user experience. We are committed to your success in using the 3800n solution.

Get more for 3800n

Find out other 3800n

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors