Irs Gov Tax Forms

What is the IRS Tax Forms?

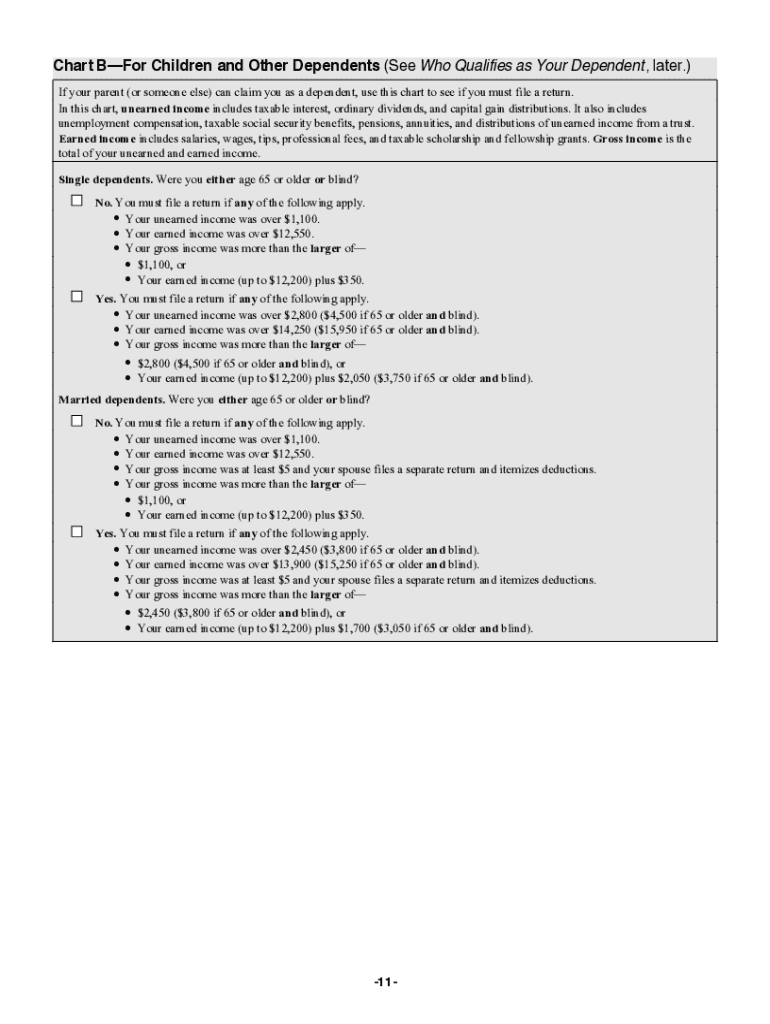

The IRS tax forms are official documents used by taxpayers to report their income, calculate taxes owed, and claim deductions or credits. These forms are essential for individuals and businesses to fulfill their tax obligations under U.S. law. Common forms include the 1040 for individual income tax returns and the W-2 for wage and tax statements. Each form serves a specific purpose and must be completed accurately to ensure compliance with IRS regulations.

How to Use the IRS Tax Forms

Using IRS tax forms involves several steps. First, identify the correct form for your tax situation, such as the 1040, W-2, or 1099. Next, gather all necessary documentation, including income statements and receipts for deductions. Carefully fill out the form, ensuring all information is accurate and complete. Finally, submit the form either electronically or by mail, depending on your preference and the form's requirements. It's important to keep copies of submitted forms for your records.

Steps to Complete the IRS Tax Forms

Completing IRS tax forms requires attention to detail. Start by selecting the appropriate form based on your filing status and income type. Follow these steps:

- Gather all financial documents, including income statements and previous tax returns.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your income accurately, including wages, dividends, and any other sources.

- Claim deductions and credits for which you qualify, ensuring you have supporting documentation.

- Review the form for errors before submission.

Legal Use of the IRS Tax Forms

IRS tax forms must be used according to federal tax laws. They serve as legal documents that report income and tax liability. Accurate completion and timely submission are crucial to avoid penalties. The IRS requires that all taxpayers use the correct forms and adhere to filing deadlines. Non-compliance can result in fines, interest on unpaid taxes, and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for IRS tax forms are typically set for April 15 of each year, although this date may vary slightly depending on weekends or holidays. Taxpayers should be aware of key dates, such as the deadline for submitting extension requests and the due date for any taxes owed. Staying informed about these deadlines helps ensure compliance and avoids late fees.

Form Submission Methods

IRS tax forms can be submitted through several methods. Taxpayers may choose to file electronically using tax preparation software or the IRS e-file system, which is often faster and more secure. Alternatively, forms can be printed and mailed to the appropriate IRS address. In-person submission is also an option at designated IRS offices. Each method has specific guidelines and processing times, so it's essential to choose the one that best suits your needs.

Quick guide on how to complete irs gov tax forms 578958436

Effortlessly Prepare Irs Gov Tax Forms on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed forms, allowing you to access the appropriate template and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Handle Irs Gov Tax Forms on any device using the airSlate SignNow apps for Android or iOS, and streamline your document-related tasks today.

The Easiest Way to Modify and Electronically Sign Irs Gov Tax Forms

- Obtain Irs Gov Tax Forms and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to share your form, whether through email, text message (SMS), invite link, or downloading it to your computer.

No more worries about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Irs Gov Tax Forms to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are IRS 2021 forms and why are they important?

IRS 2021 forms are necessary documents required for tax filing by individuals and businesses. They ensure compliance with federal tax regulations and help avoid penalties. Understanding these forms is crucial to accurately report income and expenses for the 2021 tax year.

-

How can airSlate SignNow help in managing IRS 2021 forms?

airSlate SignNow offers a streamlined platform for sending and signing IRS 2021 forms, enhancing efficiency and accuracy. The solution provides an easy-to-use interface, allowing users to fill out and eSign these forms quickly. This ensures timely submission and compliance with IRS requirements.

-

What features does airSlate SignNow offer for handling IRS 2021 forms?

AirSlate SignNow provides features such as customizable templates, secure eSignature capabilities, and team collaboration tools for managing IRS 2021 forms. Users can easily track the status of their documents and receive notifications when forms are signed. These functionalities make the process efficient and hassle-free.

-

Is airSlate SignNow cost-effective for handling IRS 2021 forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs for managing IRS 2021 forms. The platform is designed to be a cost-effective solution that simplifies document management without sacrificing quality. This allows businesses to save time and resources effectively.

-

Can airSlate SignNow integrate with other software for IRS 2021 forms?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and financial software, making it easy to manage IRS 2021 forms alongside your other business tools. These integrations streamline workflows and provide users with a unified experience for managing their tax-related documents.

-

What are the benefits of eSigning IRS 2021 forms with airSlate SignNow?

eSigning IRS 2021 forms with airSlate SignNow ensures security, convenience, and compliance. The eSignature process is legally binding and helps eliminate the need for physical paperwork. Additionally, it speeds up the process of filing forms, ensuring you meet deadlines without hassle.

-

How does airSlate SignNow ensure the security of IRS 2021 forms?

airSlate SignNow prioritizes the security of your IRS 2021 forms with encryption, secure access controls, and compliance with industry standards. These measures protect sensitive information during the signing process and ensure that your documents are safe from unauthorized access. You can trust airSlate SignNow to keep your data secure.

Get more for Irs Gov Tax Forms

- Contoh surat penutupan akaun tnb form

- Texas bill of sale vehicle form

- Massage and bodywork intake form studio g salon amp spa

- Lodgify rental agreement form

- Strawberry order form

- Civil rights complaint sample form

- Snipef certificate fill online printable fillable blank form

- Epionce skin peel consent form

Find out other Irs Gov Tax Forms

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy