Form 3903 Moving Expenses 2024-2026

What is the Form 3903 Moving Expenses

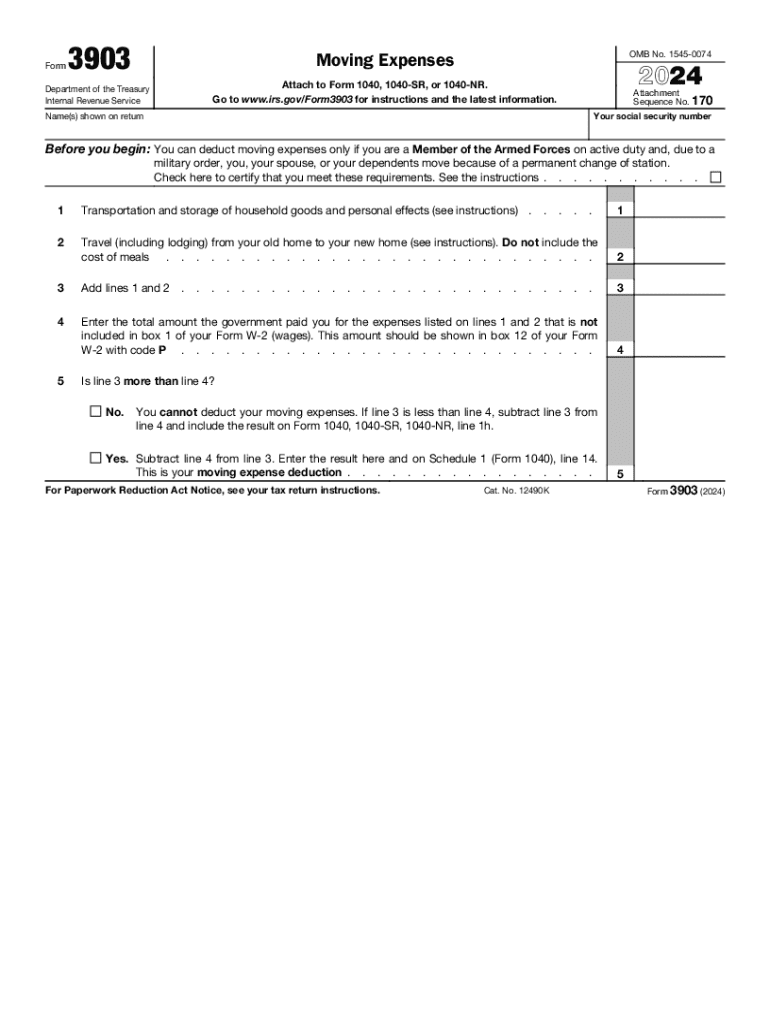

The Form 3903 is a tax form used by individuals to claim moving expenses that are deductible under certain conditions. This form is particularly relevant for taxpayers who have relocated for work-related reasons. The IRS allows for specific expenses to be deducted, which can significantly reduce taxable income. Understanding how to properly utilize this form is essential for maximizing potential tax benefits.

How to use the Form 3903 Moving Expenses

To use Form 3903, taxpayers must first determine their eligibility based on IRS guidelines. The form requires detailed information about the move, including the distance traveled and the expenses incurred. Taxpayers must fill out the form accurately, ensuring that all necessary documentation is attached to support their claims. Once completed, the form should be submitted with the taxpayer's annual tax return.

Steps to complete the Form 3903 Moving Expenses

Completing Form 3903 involves several key steps:

- Gather all relevant documentation, including receipts for moving expenses.

- Fill out personal information, such as name and Social Security number.

- Detail the moving expenses, including transportation and storage costs.

- Calculate the total deductible amount based on IRS guidelines.

- Review the form for accuracy before submission.

IRS Guidelines

The IRS has specific guidelines regarding what qualifies as deductible moving expenses. Generally, expenses related to transportation, lodging, and storage during the move are eligible. However, personal expenses, such as meals and temporary housing, are not deductible. Taxpayers should refer to the latest IRS publications for detailed information on qualifying expenses and the necessary documentation required.

Eligibility Criteria

To qualify for moving expenses deduction, taxpayers must meet certain criteria set forth by the IRS. These include being an active member of the military, moving due to a job change, and meeting the distance and time tests. The distance test requires that the new job location be at least fifty miles farther from the old home than the old job was. Additionally, the move must occur within one year of starting the new job.

Required Documents

When filing Form 3903, taxpayers must provide supporting documents to substantiate their claims. Required documents typically include:

- Receipts for moving services and transportation costs.

- Proof of employment at the new location.

- Documentation showing the distance between the old and new homes.

Having these documents ready can help ensure a smooth filing process and support the claims made on the form.

Create this form in 5 minutes or less

Find and fill out the correct form 3903 moving expenses

Create this form in 5 minutes!

How to create an eSignature for the form 3903 moving expenses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are moving expenses deductible for tax purposes?

Moving expenses deductible typically include costs related to relocating for a job, such as transportation, storage, and travel expenses. However, it's important to note that the eligibility for these deductions can vary based on specific circumstances and tax laws. Always consult a tax professional to understand what qualifies as deductible.

-

How can airSlate SignNow help with managing moving expenses deductible?

airSlate SignNow provides a streamlined solution for managing documents related to moving expenses deductible. You can easily create, send, and eSign forms that track your moving costs, ensuring you have all necessary documentation for tax purposes. This simplifies the process and helps you stay organized.

-

Are there any fees associated with using airSlate SignNow for moving expenses deductible documentation?

airSlate SignNow offers a cost-effective solution with various pricing plans to fit your needs. While there may be subscription fees, the platform's efficiency in managing moving expenses deductible can save you time and potential tax-related costs. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for tracking moving expenses deductible?

airSlate SignNow includes features such as customizable templates, document tracking, and secure eSigning, all of which are beneficial for managing moving expenses deductible. These tools help ensure that you have accurate records and can easily access them when needed for tax filing.

-

Can I integrate airSlate SignNow with other financial tools for moving expenses deductible?

Yes, airSlate SignNow offers integrations with various financial and accounting software, making it easier to manage your moving expenses deductible. This allows you to sync your documents and data seamlessly, enhancing your overall workflow and ensuring accurate record-keeping.

-

Is airSlate SignNow user-friendly for tracking moving expenses deductible?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and manage their moving expenses deductible. The intuitive interface allows you to quickly create and send documents without any technical expertise.

-

What benefits does airSlate SignNow provide for businesses handling moving expenses deductible?

For businesses, airSlate SignNow streamlines the process of managing moving expenses deductible, reducing administrative burdens and improving efficiency. By automating document workflows, businesses can ensure compliance and accuracy in their financial records, ultimately saving time and resources.

Get more for Form 3903 Moving Expenses

- Employee service record format in excel

- S corp shareholder basis worksheet excel form

- Employee benefits template word form

- Drug information handbook 27th edition pdf download

- Trespass notice form southlakepd com

- Irpifta minnesota presence affidavidit form

- Form div407 findings of fact conclusions of law order

- Garnishment exemption notice and notice of intent to hennepinsheriff form

Find out other Form 3903 Moving Expenses

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe