Ir526 Form

What is the IR526 Form

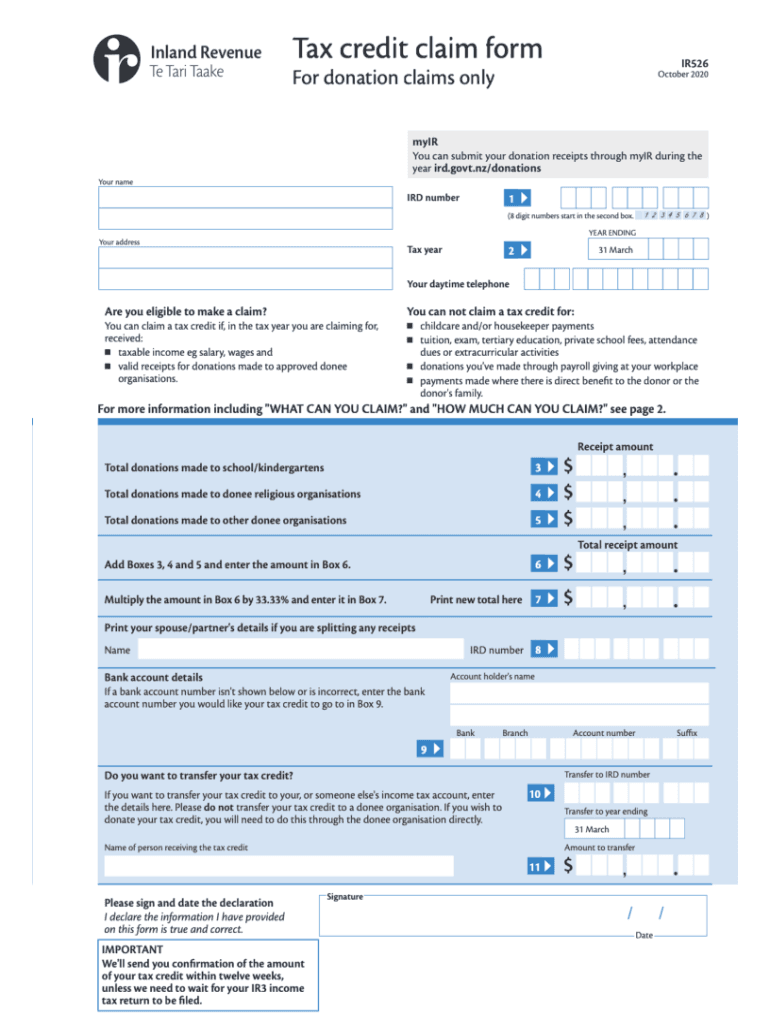

The IR526 form, also known as the tax credit claim form IR526, is a document used primarily for claiming tax credits related to donations made to eligible organizations. This form is essential for taxpayers who wish to receive tax benefits for their charitable contributions. It is designed to ensure that the claims made are valid and comply with the regulations set forth by the IRS. Understanding the purpose and requirements of the IR526 form is crucial for effective tax planning and compliance.

How to Obtain the IR526 Form

To obtain the IR526 form, individuals can visit the official IRS website where they can download the form directly. It is available in a printable format, making it easy for users to fill it out by hand or electronically. Additionally, tax preparation software often includes the IR526 form, allowing users to complete it as part of their overall tax filing process. Ensuring that you have the most current version of the form is important, as tax regulations may change annually.

Steps to Complete the IR526 Form

Completing the IR526 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your charitable donations, including receipts and acknowledgment letters from the organizations. Next, accurately fill out your personal information at the top of the form, followed by details of the donations made. It is important to provide precise amounts and dates of the contributions. After completing the form, review it thoroughly for any errors before submission to avoid delays in processing.

Legal Use of the IR526 Form

The IR526 form holds legal significance as it is used to substantiate claims for tax credits. For the form to be considered valid, it must be filled out correctly and submitted in accordance with IRS guidelines. This includes adhering to deadlines and ensuring that all required documentation is attached. Failure to comply with these legal requirements may result in the denial of the tax credit claim or potential penalties. Therefore, understanding the legal implications of using the IR526 form is essential for taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the IR526 form are typically aligned with the annual tax return deadlines. Taxpayers should be aware of the specific dates for submission to ensure that they do not miss out on potential tax credits. Generally, the deadline for filing individual tax returns is April 15, unless it falls on a weekend or holiday, in which case it may be extended. It is advisable to check the IRS website for any updates or changes to these important dates each tax year.

Required Documents

When completing the IR526 form, certain documents are required to support your claims. These typically include receipts for donations, bank statements, and any correspondence from the charitable organizations confirming the contributions. It is crucial to keep these documents organized and accessible, as they may be needed for verification by the IRS. Having all necessary documentation ready can streamline the process and help ensure that your claims are processed without issues.

Eligibility Criteria

To successfully use the IR526 form, taxpayers must meet specific eligibility criteria. Generally, individuals must have made donations to qualifying organizations recognized by the IRS. These organizations typically include registered charities, educational institutions, and certain non-profit entities. Additionally, the donations must meet minimum thresholds set by the IRS to qualify for tax credits. Understanding these eligibility requirements is vital for taxpayers looking to maximize their tax benefits.

Quick guide on how to complete ir526 form

Effortlessly Prepare Ir526 Form on Any Device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, edit, and electronically sign your documents quickly and without holdups. Manage Ir526 Form on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Modify and eSign Ir526 Form with Ease

- Obtain Ir526 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive details using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you would like to deliver your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and eSign Ir526 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ir526 form and why is it important?

The ir526 form is a crucial document used for specific legal procedures, such as the submission of certain requests to government agencies. Understanding how to correctly fill out and submit the ir526 form can help streamline processes and ensure compliance with regulations.

-

How can airSlate SignNow assist with filling out the ir526 form?

airSlate SignNow provides an easy-to-use platform for generating, editing, and signing the ir526 form digitally. With our intuitive document management tools, users can ensure their forms are filled out accurately and signed promptly.

-

Is there a cost associated with using airSlate SignNow for the ir526 form?

Yes, while airSlate SignNow offers a free trial, ongoing use of our platform for the ir526 form comes with affordable pricing plans. These plans are designed to be cost-effective for businesses of all sizes, ensuring you get value while managing your documents.

-

What features does airSlate SignNow offer for the ir526 form?

airSlate SignNow offers various features for the ir526 form, including document templates, eSignature capabilities, and secure storage. Additionally, users can track the status of their forms and collaborate with team members in real time.

-

Can the ir526 form be signed electronically using airSlate SignNow?

Absolutely! airSlate SignNow allows users to electronically sign the ir526 form easily and securely. This digital signature option not only speeds up the process but also ensures compliance with legal standards for electronic agreements.

-

What integrations does airSlate SignNow support for the ir526 form?

airSlate SignNow integrates seamlessly with various third-party applications, making it easy to manage your ir526 form alongside other tools. These integrations help streamline your workflow and ensure your documents are accessible wherever you need them.

-

How does airSlate SignNow enhance the security of the ir526 form?

airSlate SignNow prioritizes security with advanced encryption and multi-level authentication methods, ensuring that the ir526 form and all associated data remain protected. Our commitment to security helps you manage sensitive information with peace of mind.

Get more for Ir526 Form

Find out other Ir526 Form

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement