Form 2106 Employee Business Expenses 2024-2026

What is the Form 2106 Employee Business Expenses

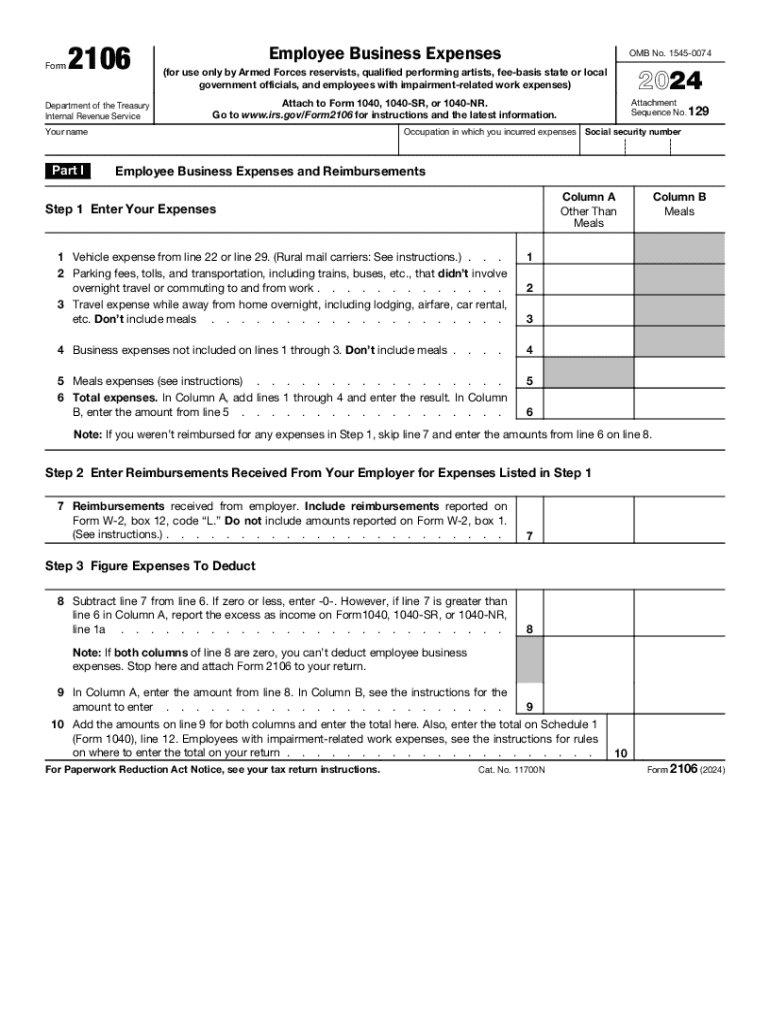

The Form 2106, also known as the Employee Business Expenses form, is used by employees to report expenses incurred while performing job-related duties. This form allows employees to claim deductions for costs that are not reimbursed by their employer, such as travel, meals, and other necessary expenses related to their work. Understanding this form is essential for employees who want to maximize their tax deductions and ensure compliance with IRS regulations.

How to use the Form 2106 Employee Business Expenses

Using the Form 2106 involves several steps. First, gather all relevant documentation, including receipts and records of expenses. Next, fill out the form by detailing the nature of each expense, the amount spent, and the purpose of the expense related to your job. Once completed, the form is submitted with your tax return to the IRS. It is important to ensure that all information is accurate and that you have supporting documents in case of an audit.

Steps to complete the Form 2106 Employee Business Expenses

Completing the Form 2106 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name and Social Security number.

- List your business expenses in the appropriate sections, categorizing them as travel, meals, or other expenses.

- Provide the total amount for each category and ensure that your totals are accurate.

- Attach any necessary documentation, such as receipts, to support your claims.

- Review the form for accuracy before submitting it with your tax return.

IRS Guidelines

The IRS provides specific guidelines for using the Form 2106. Employees must adhere to these guidelines to ensure their deductions are valid. According to IRS regulations, only ordinary and necessary expenses incurred while performing job duties can be claimed. Additionally, the IRS requires that expenses be substantiated with adequate records, such as receipts or invoices. Familiarizing yourself with these guidelines can help avoid potential issues during tax filing.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2106 align with the general tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If you require an extension, you may file for an extension, which typically provides an additional six months to submit your return. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To accurately complete the Form 2106, you will need several documents, including:

- Receipts for all business-related expenses.

- A record of your mileage if you are claiming travel expenses.

- Any relevant documentation from your employer regarding reimbursements.

- Previous tax returns, if applicable, for reference.

Eligibility Criteria

To be eligible to use the Form 2106, you must be an employee who incurs expenses related to your job that are not reimbursed by your employer. Additionally, your employer must not provide you with a per diem allowance for travel expenses. Understanding these criteria is crucial for ensuring that you can legitimately claim deductions on your tax return.

Create this form in 5 minutes or less

Find and fill out the correct form 2106 employee business expenses

Create this form in 5 minutes!

How to create an eSignature for the form 2106 employee business expenses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are IRS business expenses?

IRS business expenses are the costs incurred in the ordinary course of running a business that can be deducted from your taxable income. Understanding these expenses is crucial for maximizing your tax deductions and ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with managing IRS business expenses?

airSlate SignNow streamlines the process of sending and signing documents related to IRS business expenses. By digitizing your expense reports and receipts, you can easily track and manage your expenses, making tax season less stressful.

-

What features does airSlate SignNow offer for expense management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document storage that can help you manage IRS business expenses efficiently. These tools ensure that all your expense-related documents are organized and easily accessible.

-

Is airSlate SignNow cost-effective for small businesses managing IRS business expenses?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With affordable pricing plans, it allows you to manage your IRS business expenses without breaking the bank, ensuring you get the most value for your investment.

-

Can I integrate airSlate SignNow with my accounting software for IRS business expenses?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to sync your IRS business expenses directly. This integration simplifies your financial management and ensures accurate record-keeping.

-

What are the benefits of using airSlate SignNow for IRS business expenses?

Using airSlate SignNow for IRS business expenses provides numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. By digitizing your expense management, you can save time and focus on growing your business.

-

How does airSlate SignNow ensure the security of my IRS business expenses documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your IRS business expenses documents. You can rest assured that your sensitive information is safe and compliant with industry standards.

Get more for Form 2106 Employee Business Expenses

- Cpr record sheet form

- Steagald warrant form

- Clear grammar pdf form

- Sba environmental questionnaire pdf form

- Labcorp add on test form pdf

- Ceremonial support request defence form

- Minnesota standard consent form to release health information 779012614

- Elder or dependent adult abuse restraining order a form

Find out other Form 2106 Employee Business Expenses

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF