MN Self Employment Income Cash Accounting 2019-2026

Understanding the self employment income worksheet

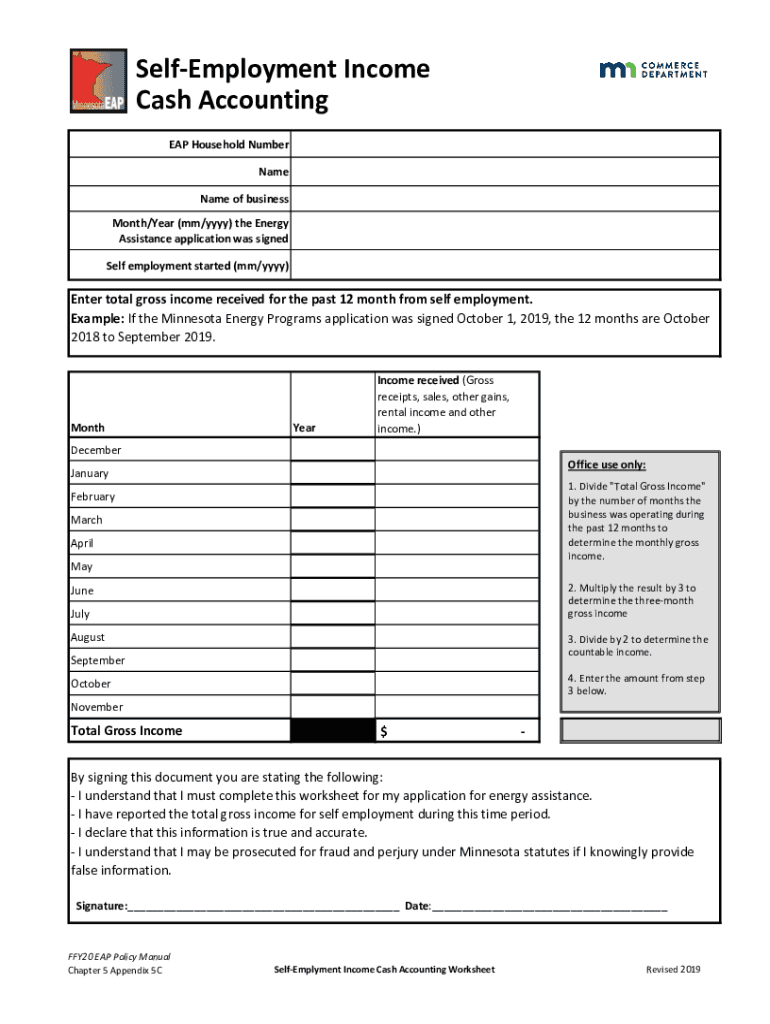

The self employment income worksheet is a crucial document for individuals engaged in self-employment. It helps track income and expenses, ensuring accurate reporting for tax purposes. This worksheet typically includes sections for detailing various income sources, allowable business expenses, and net profit calculations. Properly filling out this form can aid in understanding your financial position and preparing for tax obligations.

Steps to complete the self employment income worksheet

Completing the self employment income worksheet involves several key steps:

- Gather documentation: Collect all relevant financial documents, including invoices, receipts, and bank statements.

- List income sources: Detail all income received from self-employment activities, ensuring to include any miscellaneous income.

- Document expenses: Record all business-related expenses, such as supplies, travel, and home office costs.

- Calculate net profit: Subtract total expenses from total income to determine net profit, which is essential for tax calculations.

Legal use of the self employment income worksheet

The self employment income worksheet is legally recognized as a valid tool for reporting income to the IRS. It assists in ensuring compliance with tax regulations. Accurate completion of this form can help avoid penalties associated with underreporting income. It is important to retain copies of the worksheet and supporting documents for your records, as they may be required in case of an audit.

IRS guidelines for self employment income reporting

The IRS provides specific guidelines for reporting self-employment income. According to IRS regulations, individuals must report all income earned from self-employment activities, regardless of the amount. This includes cash payments, bartering, and any other forms of income. The IRS also outlines allowable deductions that can be claimed against self-employment income, which can help reduce taxable income.

Filing deadlines for self employment income

Filing deadlines for self employment income typically align with the annual tax return due date. For most individuals, this is April fifteenth of each year. However, if you are self-employed and expect to owe more than one thousand dollars in taxes, you may need to make estimated tax payments quarterly. These payments are generally due on April fifteenth, June fifteenth, September fifteenth, and January fifteenth of the following year.

Required documents for the self employment income worksheet

To accurately complete the self employment income worksheet, certain documents are essential:

- Invoices and receipts for income received

- Bank statements showing deposits

- Records of business expenses, including receipts

- Previous year’s tax return for reference

Common taxpayer scenarios for self employment income

Various taxpayer scenarios can affect how the self employment income worksheet is completed:

- Freelancers: Individuals providing services on a contract basis must report all income and expenses related to their work.

- Small business owners: Those running a business must account for all operational income and costs, including payroll if applicable.

- Side hustlers: Individuals earning additional income from hobbies or part-time work should also report this income on the worksheet.

Quick guide on how to complete mn self employment income cash accounting

Effortlessly Prepare MN Self Employment Income Cash Accounting on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage MN Self Employment Income Cash Accounting on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and Electronically Sign MN Self Employment Income Cash Accounting with Ease

- Locate MN Self Employment Income Cash Accounting and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign MN Self Employment Income Cash Accounting to maintain excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mn self employment income cash accounting

Create this form in 5 minutes!

People also ask

-

What is a self employment income worksheet?

A self employment income worksheet is a tool that helps freelancers and business owners track their income and expenses accurately. It simplifies the process of calculating net income for tax purposes. Utilizing a self employment income worksheet can signNowly ease the annual tax filing process.

-

How can airSlate SignNow help with my self employment income worksheet?

airSlate SignNow provides an efficient platform for creating and managing your self employment income worksheet. You can easily eSign and share documents with clients and partners, ensuring secure and fast transactions. This streamlines your workflow and helps you maintain accurate financial records.

-

Is there a cost associated with using airSlate SignNow for my self employment income worksheet?

Yes, airSlate SignNow offers flexible pricing plans that can accommodate your needs while using the self employment income worksheet. We provide a comprehensive solution that combines document signing with features tailored for freelancers and self-employed individuals. The pricing is competitive and designed to offer value.

-

What features does airSlate SignNow offer for managing self employment income worksheets?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure document sharing, which are especially beneficial when working with a self employment income worksheet. The platform allows you to generate reports and keep all your financial documents organized in one place. This enhances productivity and ensures compliance.

-

Can I integrate airSlate SignNow with my accounting software for my self employment income worksheet?

Absolutely! airSlate SignNow supports various integrations with popular accounting software. By connecting these tools, you can seamlessly transfer data related to your self employment income worksheet, reducing manual entry and minimizing errors. This integration can help you maintain accurate financial records more efficiently.

-

What are the benefits of using a self employment income worksheet with airSlate SignNow?

Using a self employment income worksheet with airSlate SignNow provides numerous benefits, including time savings, improved organization, and enhanced compliance. The ability to eSign essential documents expedites the process and keeps everything secure. Overall, it allows self-employed individuals to focus more on their business rather than paperwork.

-

How does airSlate SignNow ensure the security of my self employment income worksheet?

AirSlate SignNow takes security seriously and implements industry-standard encryption to protect your self employment income worksheet and other documents. Furthermore, our robust authentication methods ensure that only authorized users can access sensitive information. This commitment to security gives you peace of mind while managing your financial records.

Get more for MN Self Employment Income Cash Accounting

Find out other MN Self Employment Income Cash Accounting

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy