Self Employment Income 2013

Understanding Self Employment Income

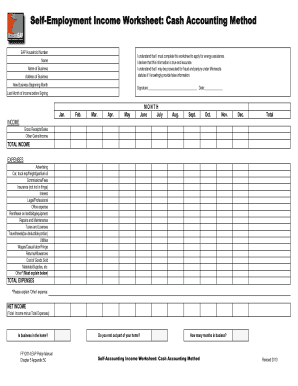

Self employment income refers to the earnings generated by individuals who work for themselves, rather than being employed by an organization. This income can come from various sources, including freelance work, consulting, or running a small business. It is essential for self-employed individuals to track their income accurately, as it impacts tax obligations and financial planning. The self employed income worksheet serves as a vital tool in documenting and organizing this income, making it easier to report to the IRS and manage personal finances.

Steps to Complete the Self Employment Income Worksheet

Completing the self employed income worksheet involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant financial documents, including invoices, bank statements, and receipts. Next, list all sources of income, categorizing them appropriately. Deduct any business expenses to arrive at net income. Finally, review the worksheet for accuracy, ensuring that all figures are correct and that you have included all necessary information. This thorough approach will help in preparing for tax filings and maintaining organized financial records.

Legal Use of the Self Employment Income Worksheet

The self employed income worksheet is legally recognized as a valid document for reporting income to the IRS. It is crucial to ensure that the information provided is accurate and truthful to avoid penalties or audits. The worksheet must be completed in accordance with IRS guidelines, and it should be retained for record-keeping purposes. Utilizing digital tools, such as signNow, can enhance the legal validity of the worksheet by providing secure eSignature options and maintaining compliance with relevant laws.

IRS Guidelines for Self Employment Income

The IRS has specific guidelines regarding self employment income, which must be adhered to by individuals who are self-employed. It is important to report all income accurately, including cash payments and bartering. The IRS requires self-employed individuals to file a Schedule C (Form 1040) to report income and expenses. Understanding these guidelines helps in ensuring compliance and avoiding potential issues with tax authorities. Additionally, self-employed individuals should be aware of estimated tax payments and self-employment tax obligations.

Required Documents for Self Employment Income Reporting

When completing the self employed income worksheet, certain documents are necessary to support the reported income and expenses. These include:

- Invoices issued to clients

- Bank statements reflecting deposits

- Receipts for business-related expenses

- Previous tax returns for reference

- Any contracts or agreements related to work performed

Having these documents organized and readily available will facilitate the accurate completion of the worksheet and ensure compliance with IRS requirements.

Examples of Using the Self Employment Income Worksheet

The self employed income worksheet can be utilized in various scenarios to help individuals manage their finances effectively. For instance, a freelance graphic designer may use the worksheet to track income from multiple clients, ensuring that all earnings are documented. Similarly, a consultant can record income from different projects, allowing for a clear overview of total earnings. These examples illustrate the worksheet's versatility in helping self-employed individuals maintain accurate financial records.

Quick guide on how to complete self employment income

Complete Self Employment Income seamlessly on any device

Managing documents online has become favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents efficiently without delays. Manage Self Employment Income on any platform with airSlate SignNow's Android or iOS applications and streamline any document-based task today.

How to adjust and eSign Self Employment Income effortlessly

- Locate Self Employment Income and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Mark pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and eSign Self Employment Income and ensure exceptional communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct self employment income

Create this form in 5 minutes!

How to create an eSignature for the self employment income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a self employed income worksheet?

A self employed income worksheet is a tool that helps individuals calculate their income and expenses related to self-employment. By organizing financial data, it allows users to assess their profits accurately, which is essential for tax preparation and financial planning.

-

How can the self employed income worksheet benefit my business?

Utilizing a self employed income worksheet can streamline your financial operations, ensuring you account for all necessary expenses and revenues. This tool enhances your understanding of your business's financial health, ultimately aiding in more informed decision-making.

-

Is the self employed income worksheet compatible with airSlate SignNow?

Yes, the self employed income worksheet can be easily integrated into airSlate SignNow for effective document management. Our platform allows users to eSign and share their worksheets securely, enhancing collaboration and workflow efficiency.

-

What features does the self employed income worksheet include?

The self employed income worksheet includes sections for income tracking, expense categorization, and profit analysis. Additionally, it provides built-in calculations to help you quickly determine your taxable income, simplifying the process of preparing your taxes.

-

How do I start using the self employed income worksheet?

To start using the self employed income worksheet, simply create an account with airSlate SignNow. Once registered, you can access our templates and begin filling out your worksheet, benefiting from our user-friendly interface and features.

-

Are there any costs associated with the self employed income worksheet?

The self employed income worksheet is part of our comprehensive solution that offers cost-effective pricing plans tailored to different budgets. This ensures that even self-employed individuals can access essential financial tools without breaking the bank.

-

Can I customize the self employed income worksheet according to my needs?

Absolutely! The self employed income worksheet is fully customizable, allowing you to tailor it to your specific business requirements. You can add or modify sections to ensure that it aligns with your unique financial circumstances.

Get more for Self Employment Income

- Assured grounding equipment inspection form ardent shared ardentshared

- Swp 6851 009 dated 10 may 2016 subj foreign disclosure bb form

- Quality assurance and quality control plan for measurement of indoor form

- Office structure template pdf form

- Aris solutions electronic timesheet form

- Download generic fashion jewelry order form silver stars

- Buffalo blower parts form

- Emergency contact form and medical waiver 2015 summer camp waynewoodrec

Find out other Self Employment Income

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document