Can a LTD Insurance Company Claim Overpayment If Claimant is Form

What is the Can A LTD Insurance Company Claim Overpayment If Claimant Is

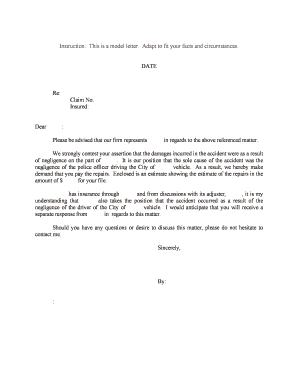

The form "Can A LTD Insurance Company Claim Overpayment If Claimant Is" is designed to address situations where a long-term disability (LTD) insurance company seeks to recover overpayments made to a claimant. This may occur if the insurance company determines that the claimant was overcompensated due to various reasons, such as incorrect reporting of income or changes in the claimant's eligibility. Understanding this form is crucial for both claimants and insurers to ensure that the process is handled correctly and legally.

Key elements of the Can A LTD Insurance Company Claim Overpayment If Claimant Is

This form typically includes several key elements that are essential for its validity and effectiveness. These elements may encompass:

- Claimant Information: Personal details of the claimant, including name, address, and policy number.

- Insurance Company Details: Information about the insurance provider, including contact information and policy specifics.

- Overpayment Details: A clear explanation of the overpayment amount, including the dates and reasons for the overpayment.

- Claimant's Acknowledgment: A section where the claimant acknowledges the overpayment and agrees to the terms outlined in the form.

Steps to complete the Can A LTD Insurance Company Claim Overpayment If Claimant Is

Completing the form accurately is vital for both the claimant and the insurance company. Here are the steps involved:

- Gather necessary documentation, including previous correspondence with the insurance company and any relevant financial records.

- Fill in the claimant's personal information and insurance policy details as required.

- Clearly state the amount of overpayment and provide any supporting evidence that justifies the claim.

- Review the completed form for accuracy and completeness before submission.

- Submit the form through the appropriate channels, whether online, by mail, or in person, as specified by the insurance company.

Legal use of the Can A LTD Insurance Company Claim Overpayment If Claimant Is

This form serves a legal purpose in the context of insurance claims. It is essential for documenting the acknowledgment of overpayment by the claimant and the insurance company's right to recover those funds. The legal implications of this form can affect the claimant's financial responsibilities and the insurance company's compliance with regulations governing claims and overpayments.

Eligibility Criteria

To effectively use the form, claimants must meet specific eligibility criteria. Generally, these may include:

- Being an active claimant under a long-term disability insurance policy.

- Having received payments that exceed the amount entitled based on the policy terms.

- Providing accurate and truthful information regarding income and eligibility status.

Form Submission Methods (Online / Mail / In-Person)

Submitting the "Can A LTD Insurance Company Claim Overpayment If Claimant Is" form can be done through various methods, depending on the insurance company's policies. Common submission methods include:

- Online Submission: Many insurance companies offer secure online portals for submitting forms electronically.

- Mail: Claimants may opt to send the completed form via postal service, ensuring it is sent to the correct address.

- In-Person: Some claimants may prefer to deliver the form directly to the insurance company's local office.

Quick guide on how to complete can a ltd insurance company claim overpayment if claimant is

Complete Can A LTD Insurance Company Claim Overpayment If Claimant Is effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Can A LTD Insurance Company Claim Overpayment If Claimant Is on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

How to modify and eSign Can A LTD Insurance Company Claim Overpayment If Claimant Is with ease

- Find Can A LTD Insurance Company Claim Overpayment If Claimant Is and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight relevant sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Can A LTD Insurance Company Claim Overpayment If Claimant Is to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What should I do if I believe my LTD insurance claim has been overpaid?

If you suspect that there has been an overpayment on your LTD insurance claim, it's crucial to review your claim details and consult with your insurance provider. You may ask, 'Can A LTD Insurance Company Claim Overpayment If Claimant Is?' to clarify your obligations. Document all communications and seek legal advice if necessary.

-

How does airSlate SignNow help with LTD insurance paperwork?

airSlate SignNow streamlines your LTD insurance documentation process by allowing you to eSign and send documents securely. This efficiency is vital, especially when addressing queries like 'Can A LTD Insurance Company Claim Overpayment If Claimant Is?' We ensure that all documents are signed promptly, keeping your claim on track.

-

Can I integrate airSlate SignNow with my existing insurance management software?

Yes, airSlate SignNow offers integrations with various insurance management systems to help you manage paperwork efficiently. By asking, 'Can A LTD Insurance Company Claim Overpayment If Claimant Is?' while using our platform, you can stay informed about your claim's status. This integration supports seamless workflows and improves productivity.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to accommodate different businesses' needs. Understanding costs associated with your LTD insurance claims and the question 'Can A LTD Insurance Company Claim Overpayment If Claimant Is?' can help you prepare. Our solution is cost-effective, ensuring you only pay for what you need.

-

Is airSlate SignNow compliant with legal regulations for signing documents?

Yes, airSlate SignNow adheres strictly to legal standards for electronic signatures to ensure your documents are valid and enforceable. This compliance is essential when dealing with concerns like 'Can A LTD Insurance Company Claim Overpayment If Claimant Is?' to protect both you and your business. Trust our solution for secure and legal documentation.

-

How can airSlate SignNow support my LTD insurance claims process?

Our solution simplifies the entire LTD insurance claims process by enabling you to send and sign documents quickly and easily. When considering if 'Can A LTD Insurance Company Claim Overpayment If Claimant Is?' airSlate SignNow ensures you have the necessary paperwork ready to address any discrepancies swiftly. Our user-friendly interface improves overall efficiency.

-

What feature sets airSlate SignNow apart from other eSignature solutions?

airSlate SignNow stands out with its comprehensive features that include document templates, real-time tracking, and advanced security measures. These features are particularly useful when exploring questions like 'Can A LTD Insurance Company Claim Overpayment If Claimant Is?' because they ensure your documents are in order and easily accessible for review.

Get more for Can A LTD Insurance Company Claim Overpayment If Claimant Is

Find out other Can A LTD Insurance Company Claim Overpayment If Claimant Is

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement