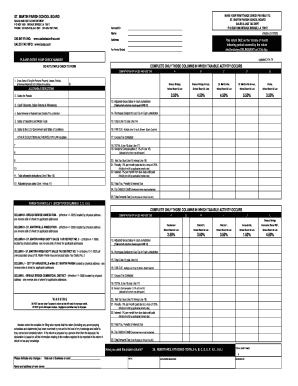

St Martin Parish Sales Tax Form

What is the St Martin Parish Sales Tax

The St Martin Parish sales tax is a tax imposed on the sale of goods and services within St Martin Parish, Louisiana. This tax is a critical source of revenue for local government, funding essential services such as education, infrastructure, and public safety. The sales tax rate can vary depending on the specific goods or services being purchased, as well as any additional local taxes that may apply.

How to use the St Martin Parish Sales Tax

Using the St Martin Parish sales tax involves understanding how it applies to your purchases. When making a purchase, the sales tax is typically added to the total price of the item or service. Businesses are responsible for collecting this tax from consumers and remitting it to the parish. It is important for both consumers and businesses to be aware of the current sales tax rate to ensure compliance and accurate financial planning.

Steps to complete the St Martin Parish Sales Tax

Completing the St Martin Parish sales tax process involves several steps:

- Determine the applicable sales tax rate for your purchase.

- Calculate the total sales tax by multiplying the purchase price by the sales tax rate.

- Collect the sales tax from the customer at the point of sale.

- Remit the collected sales tax to the St Martin Parish government by the specified deadline.

Following these steps ensures that businesses remain compliant with local tax regulations.

Legal use of the St Martin Parish Sales Tax

Legal use of the St Martin Parish sales tax requires adherence to local and state laws regarding tax collection and remittance. Businesses must register with the appropriate tax authorities and obtain any necessary permits. Additionally, accurate records of sales and tax collected must be maintained to facilitate reporting and compliance. Understanding these legal obligations helps avoid penalties and ensures smooth operations.

Filing Deadlines / Important Dates

Filing deadlines for the St Martin Parish sales tax are crucial for businesses to avoid late fees and penalties. Typically, sales tax returns must be filed on a monthly or quarterly basis, depending on the volume of sales. Key dates include:

- Monthly filing deadlines: Due on the 20th of the following month.

- Quarterly filing deadlines: Due on the 20th of the month following the end of the quarter.

Staying informed of these deadlines is essential for maintaining compliance.

Penalties for Non-Compliance

Failure to comply with St Martin Parish sales tax regulations can result in significant penalties. These may include:

- Late fees for overdue tax returns.

- Interest on unpaid taxes.

- Potential legal action for persistent non-compliance.

Understanding these penalties can motivate timely and accurate filing, ensuring that businesses remain in good standing with local authorities.

Quick guide on how to complete st martin parish sales tax

Effortlessly Prepare St Martin Parish Sales Tax on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage St Martin Parish Sales Tax on any device with airSlate SignNow's Android or iOS applications and simplify any document-based process today.

How to Modify and eSign St Martin Parish Sales Tax with Ease

- Locate St Martin Parish Sales Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you select. Modify and eSign St Martin Parish Sales Tax to ensure excellent communication at any stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st martin parish sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the current St Martin Parish sales tax rate?

The current St Martin Parish sales tax rate is a combined rate of state and local taxes that may fluctuate. It's essential for businesses to stay updated on the St Martin Parish sales tax rate to ensure compliance and accurate tax collection.

-

How does the St Martin Parish sales tax rate impact my business?

The St Martin Parish sales tax rate directly affects the amount of tax you collect from customers and subsequently the revenue you report. Understanding the St Martin Parish sales tax rate can help businesses set competitive pricing while maintaining profitability.

-

Can airSlate SignNow help me manage sales tax documentation?

Yes, airSlate SignNow simplifies the process of managing sales tax documentation. With its easy-to-use platform, you can easily eSign and manage documents related to the St Martin Parish sales tax rate, ensuring you have everything in order for audits.

-

Is there any cost associated with tracking the St Martin Parish sales tax rate?

Tracking the St Martin Parish sales tax rate with airSlate SignNow involves no additional costs, as our platform is designed to offer cost-effective solutions. We provide tools that help you easily track necessary information without any added fees.

-

How do I stay updated on changes to the St Martin Parish sales tax rate?

To stay updated on changes to the St Martin Parish sales tax rate, integrate reliable resources or consult with tax professionals. airSlate SignNow can assist in managing documentation and reminders, making it easier to adapt to any changes.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow offers a range of features for tax-related documents, including secure eSigning, document templates, and real-time tracking. These features help ensure compliance with the St Martin Parish sales tax rate while streamlining your workflow.

-

Can I integrate airSlate SignNow with my accounting software?

Yes, airSlate SignNow can be integrated with various accounting software solutions. This allows you to seamlessly manage sales tax calculations alongside the St Martin Parish sales tax rate, simplifying your financial processes.

Get more for St Martin Parish Sales Tax

Find out other St Martin Parish Sales Tax

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile