521 Real Estate Transfer Statement Nebraska Department of Revenue Form

What is the 521 Real Estate Transfer Statement Nebraska Department Of Revenue

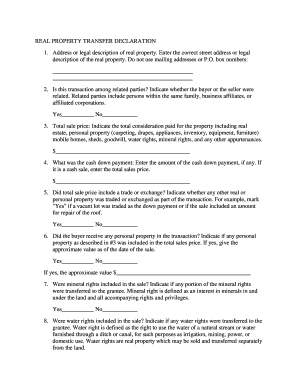

The 521 Real Estate Transfer Statement is a document required by the Nebraska Department of Revenue during real estate transactions. This form provides essential information about the property being transferred, including its value, the parties involved, and the nature of the transaction. It is crucial for ensuring compliance with state tax regulations and helps in calculating any applicable transfer taxes.

Steps to complete the 521 Real Estate Transfer Statement Nebraska Department Of Revenue

Completing the 521 Real Estate Transfer Statement involves several key steps:

- Gather necessary information about the property, including its legal description, address, and assessed value.

- Identify the buyer and seller, including their names and contact information.

- Provide details on the type of transfer, such as sale, gift, or inheritance.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

Key elements of the 521 Real Estate Transfer Statement Nebraska Department Of Revenue

Several key elements must be included in the 521 Real Estate Transfer Statement to ensure its validity:

- Property Information: Legal description, address, and assessed value.

- Parties Involved: Names and addresses of the buyer and seller.

- Type of Transfer: Indicate whether it is a sale, gift, or other type of transfer.

- Signature: Both parties must sign the document to validate the transfer.

Legal use of the 521 Real Estate Transfer Statement Nebraska Department Of Revenue

The 521 Real Estate Transfer Statement serves a legal purpose in the state of Nebraska. It is used to document the transfer of real property and is essential for tax assessment purposes. Proper completion and submission of this form ensure compliance with state laws and help prevent any legal disputes regarding property ownership.

Form Submission Methods for the 521 Real Estate Transfer Statement Nebraska Department Of Revenue

The 521 Real Estate Transfer Statement can be submitted in various ways to the Nebraska Department of Revenue:

- Online: Some jurisdictions may allow electronic submission through designated platforms.

- By Mail: Print and send the completed form to the appropriate address.

- In-Person: Deliver the form directly to the local county assessor's office.

Who Issues the 521 Real Estate Transfer Statement Nebraska Department Of Revenue

The 521 Real Estate Transfer Statement is issued by the Nebraska Department of Revenue. This state agency is responsible for overseeing tax compliance and ensuring that all real estate transactions are properly documented and assessed for tax purposes.

Quick guide on how to complete 521 real estate transfer statement nebraska department of revenue

Manage 521 Real Estate Transfer Statement Nebraska Department Of Revenue effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle 521 Real Estate Transfer Statement Nebraska Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign 521 Real Estate Transfer Statement Nebraska Department Of Revenue with ease

- Obtain 521 Real Estate Transfer Statement Nebraska Department Of Revenue and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that task.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 521 Real Estate Transfer Statement Nebraska Department Of Revenue and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 521 Real Estate Transfer Statement Nebraska Department Of Revenue?

The 521 Real Estate Transfer Statement Nebraska Department Of Revenue is a required document for property transactions in Nebraska. This statement provides essential information about the transfer of real estate and is mandatory for recording deeds in the state. Understanding this document is crucial for both buyers and sellers in real estate transactions.

-

How can airSlate SignNow help with the 521 Real Estate Transfer Statement Nebraska Department Of Revenue?

airSlate SignNow simplifies the process of completing and eSigning the 521 Real Estate Transfer Statement Nebraska Department Of Revenue. Our platform allows users to fill out the necessary fields and send the document for electronic signatures, streamlining what can be a cumbersome task. This ensures that you comply with state regulations efficiently.

-

Are there any fees associated with using airSlate SignNow for the 521 Real Estate Transfer Statement Nebraska Department Of Revenue?

While airSlate SignNow offers various pricing plans, the costs associated with eSigning documents, including the 521 Real Estate Transfer Statement Nebraska Department Of Revenue, are generally affordable. Our competitive pricing ensures that businesses can access essential tools without breaking the bank. Review our pricing page for specific details on different plans.

-

What features does airSlate SignNow offer for managing the 521 Real Estate Transfer Statement Nebraska Department Of Revenue?

airSlate SignNow provides a range of features to manage your documents effectively, including templates, cloud storage, and tracking capabilities. When it comes to the 521 Real Estate Transfer Statement Nebraska Department Of Revenue, you can also customize fields and set reminders for signatures. This enhances organization and ensures timely completion of your real estate transactions.

-

Can I integrate airSlate SignNow with other applications for the 521 Real Estate Transfer Statement Nebraska Department Of Revenue?

Yes, airSlate SignNow seamlessly integrates with various applications and platforms to facilitate the handling of the 521 Real Estate Transfer Statement Nebraska Department Of Revenue. By using integrations, you can sync data between different tools, making the process more efficient. This interconnectedness enhances your document management capabilities.

-

Is airSlate SignNow secure for sending the 521 Real Estate Transfer Statement Nebraska Department Of Revenue?

Absolutely! airSlate SignNow prioritizes the security and confidentiality of your documents, including the 521 Real Estate Transfer Statement Nebraska Department Of Revenue. We employ advanced encryption and compliance measures to ensure that your transactions remain safe and private. Feel confident in sending sensitive information with our platform.

-

What benefits does airSlate SignNow provide for real estate professionals regarding the 521 Real Estate Transfer Statement Nebraska Department Of Revenue?

For real estate professionals, airSlate SignNow offers signNow benefits, including increased efficiency and reduced turnaround time for the 521 Real Estate Transfer Statement Nebraska Department Of Revenue. The platform allows for easy collaboration and quick access to documents, which enhances client satisfaction. These advantages can contribute to more successful transactions and improved business workflows.

Get more for 521 Real Estate Transfer Statement Nebraska Department Of Revenue

- Komatsu pc228uslc 3 service manual form

- 221g form download

- Ole ph1 form

- Oregon sublease agreement form

- Pharmacy assistant admission form

- Hra reasonable accommodation form

- Volunteer training confirmation group child care centers dcf f cfs2027 form for web

- Itwi abbreviation stands for internationally trained workers initiative form

Find out other 521 Real Estate Transfer Statement Nebraska Department Of Revenue

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement