5080, Sales, Use and Withholding Taxes Monthly Michigan 2021

Understanding the Michigan 2210 Tax Form

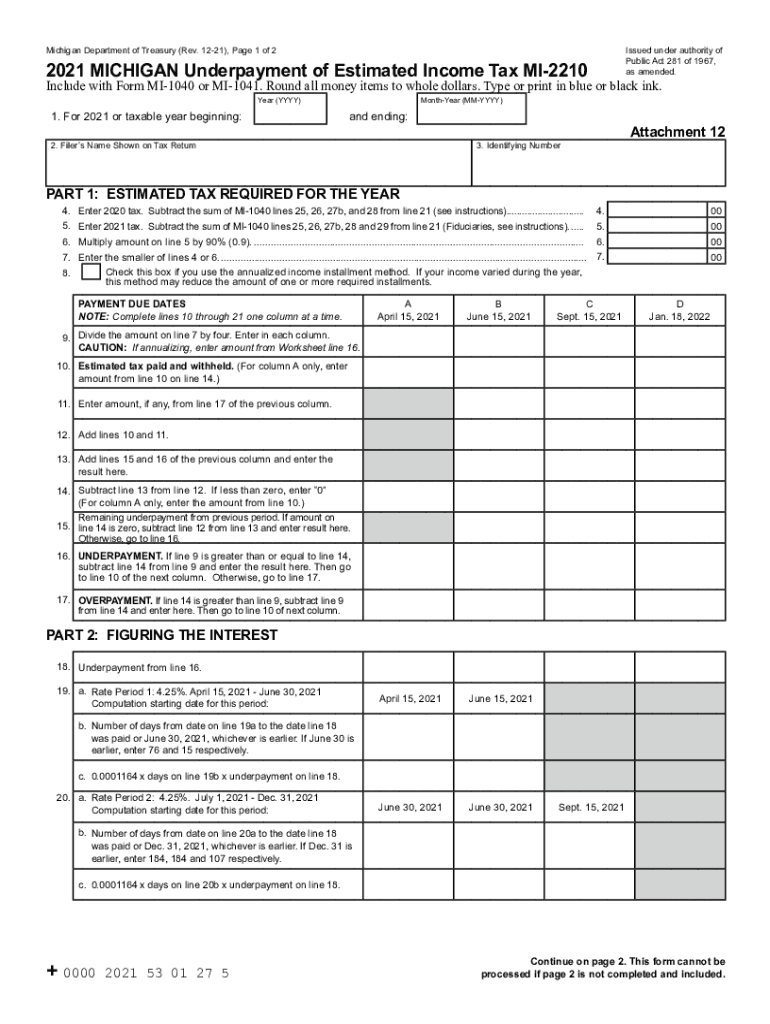

The Michigan 2210 form is essential for taxpayers who need to report underpayment of estimated income tax. This form is particularly relevant for individuals and businesses that did not pay enough tax throughout the year and may face penalties. It is crucial to understand the requirements and implications of using the Michigan 2210 to ensure compliance with state tax laws.

Steps to Complete the Michigan 2210 Form

Filling out the Michigan 2210 form involves several steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect your income details, tax payments made, and any relevant deductions.

- Calculate Your Tax Liability: Determine your total tax liability for the year to assess if you have underpaid.

- Complete the Form: Fill in the required fields on the Michigan 2210, including your personal information and tax calculations.

- Review for Accuracy: Double-check all entries for correctness to avoid errors that could lead to penalties.

- Submit the Form: File the completed form with the Michigan Department of Treasury by the specified deadline.

Legal Use of the Michigan 2210 Form

The Michigan 2210 form must be completed in accordance with state tax regulations to be considered legally valid. It is important to ensure that all calculations are accurate and that the form is submitted on time to avoid any legal repercussions. Compliance with the Michigan Treasury's guidelines is essential for the form to hold up in case of audits or inquiries.

Filing Deadlines for the Michigan 2210

Timely filing of the Michigan 2210 form is critical. The form is typically due on the same date as your annual income tax return. For most taxpayers, this means it must be submitted by April fifteenth of the following year. However, if you file for an extension, be sure to check specific deadlines to avoid penalties.

Penalties for Non-Compliance with the Michigan 2210

Failing to file the Michigan 2210 form or underpaying your estimated taxes can result in penalties. The state may impose interest on the unpaid tax amount, and additional fines may apply for late submissions. Understanding these penalties can help motivate timely and accurate filing.

Who Issues the Michigan 2210 Form

The Michigan 2210 form is issued by the Michigan Department of Treasury. This state agency is responsible for tax administration and ensures that taxpayers comply with state tax laws. For any questions or clarifications regarding the form, taxpayers can contact the Department of Treasury directly.

Quick guide on how to complete 5080 sales use and withholding taxes monthly michigan

Complete 5080, Sales, Use And Withholding Taxes Monthly Michigan effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage 5080, Sales, Use And Withholding Taxes Monthly Michigan on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign 5080, Sales, Use And Withholding Taxes Monthly Michigan seamlessly

- Find 5080, Sales, Use And Withholding Taxes Monthly Michigan and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign 5080, Sales, Use And Withholding Taxes Monthly Michigan and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5080 sales use and withholding taxes monthly michigan

Create this form in 5 minutes!

People also ask

-

What is the mi 2210 and how does airSlate SignNow utilize it?

The mi 2210 is an important feature within airSlate SignNow that streamlines the electronic signing process. It allows users to securely send and receive eSignatures on important documents via a user-friendly interface. With the mi 2210, businesses can ensure compliance and enhance their workflow efficiency.

-

How much does it cost to use airSlate SignNow with mi 2210?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including the features of the mi 2210. Depending on the plan you select, costs can range from affordable monthly subscriptions to comprehensive annual packages. This ensures that businesses of all sizes can access the benefits of the mi 2210 without breaking the bank.

-

What features does the mi 2210 include?

The mi 2210 encompasses a wide range of features, such as customizable document templates, secure cloud storage, and automated workflows. These functionalities enable users to efficiently manage their signing processes and signNowly reduce turnaround time on contracts and agreements. With the mi 2210, simplicity and security go hand in hand.

-

What are the benefits of using airSlate SignNow’s mi 2210 for businesses?

Using the mi 2210 within airSlate SignNow can greatly enhance operational efficiency and reduce paper usage. Businesses can expect faster signature collection, improved document tracking, and seamless collaboration among team members. By integrating the mi 2210, companies can boost productivity while maintaining a professional image.

-

Can mi 2210 integrate with other software tools?

Yes, the mi 2210 is designed to integrate smoothly with a variety of third-party applications, enhancing its functionality. Popular integrations include CRMs, file storage solutions, and project management tools, allowing for a comprehensive digital workflow. This capability makes the mi 2210 an invaluable asset for any tech-savvy business.

-

Is the mi 2210 secure for sending sensitive documents?

Absolutely, the mi 2210 prioritizes security, ensuring that all documents are protected during the transmission process. airSlate SignNow utilizes advanced encryption methods and complies with industry standards for confidentiality. Users can confidently send sensitive documents without fear of unauthorized access.

-

How does mi 2210 enhance document tracking and management?

The mi 2210 offers robust document tracking features that allow users to monitor the status of their agreements in real-time. Users can see who has viewed, signed, or declined a document, aiding in effective follow-ups. This enhanced visibility simplifies document management and ensures a smoother signing process.

Get more for 5080, Sales, Use And Withholding Taxes Monthly Michigan

Find out other 5080, Sales, Use And Withholding Taxes Monthly Michigan

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract