Fillable Online Revenue Louisiana Tax Forms Louisiana 2022

What is the Fillable Online Revenue Louisiana Tax Forms

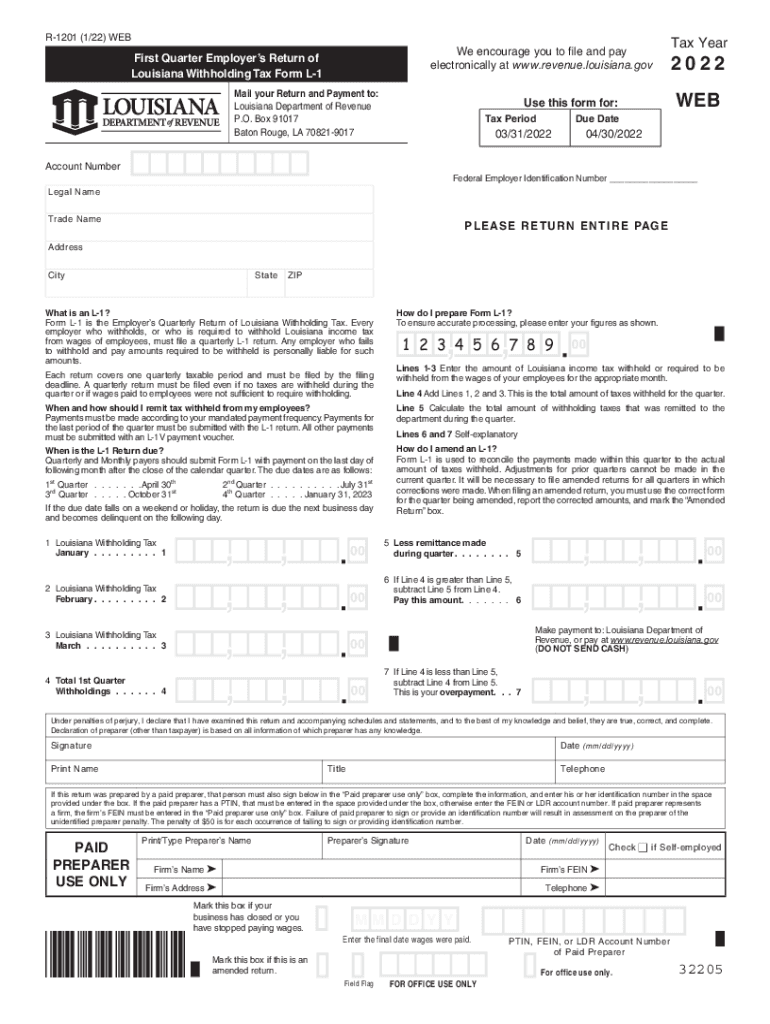

The Fillable Online Revenue Louisiana Tax Forms are official documents used by residents and businesses in Louisiana to report their income and calculate their tax obligations. These forms are essential for filing state taxes and include various types such as the Louisiana L-1 form, which is specifically designed for income tax reporting. The online version allows users to fill out the forms digitally, making the process more efficient and accessible. This digital format ensures that taxpayers can complete their forms from anywhere, streamlining the filing process.

Steps to Complete the Fillable Online Revenue Louisiana Tax Forms

Completing the Fillable Online Revenue Louisiana Tax Forms involves several key steps:

- Access the official online forms through the Louisiana Department of Revenue website.

- Select the appropriate form based on your tax situation, such as the L-1 form for individual income tax.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or print it for mailing, depending on your preference.

Legal Use of the Fillable Online Revenue Louisiana Tax Forms

The Fillable Online Revenue Louisiana Tax Forms are legally recognized documents that must be completed accurately to ensure compliance with state tax laws. When submitted correctly, these forms fulfill your legal obligation to report income and pay taxes. It is crucial to maintain records of your submissions, as they may be required for future audits or inquiries by the Louisiana Department of Revenue.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is essential for avoiding penalties. Typically, the deadline for filing Louisiana state income tax returns is May fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes in deadlines that may occur due to legislation or state announcements.

Required Documents

To complete the Fillable Online Revenue Louisiana Tax Forms, you will need several documents, including:

- Your Social Security number or Employer Identification Number (EIN).

- W-2 forms from employers, detailing your income.

- 1099 forms for any additional income sources.

- Records of deductions and credits you plan to claim.

Form Submission Methods (Online / Mail / In-Person)

The Fillable Online Revenue Louisiana Tax Forms can be submitted through various methods. The most efficient way is to file electronically via the Louisiana Department of Revenue website. Alternatively, you can print the completed forms and mail them to the appropriate address. In-person submissions are also accepted at designated state offices, providing flexibility for taxpayers who prefer face-to-face interactions.

Quick guide on how to complete fillable online revenue louisiana tax forms louisiana

Complete Fillable Online Revenue Louisiana Tax Forms Louisiana effortlessly on any device

Web-based document management has surged in popularity among businesses and individuals alike. It presents an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, alter, and eSign your documents quickly and without hassle. Manage Fillable Online Revenue Louisiana Tax Forms Louisiana on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Fillable Online Revenue Louisiana Tax Forms Louisiana with ease

- Obtain Fillable Online Revenue Louisiana Tax Forms Louisiana and click Get Form to initiate.

- Utilize the tools provided to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Fillable Online Revenue Louisiana Tax Forms Louisiana and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online revenue louisiana tax forms louisiana

Create this form in 5 minutes!

How to create an eSignature for the fillable online revenue louisiana tax forms louisiana

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is la revenue tax and how does it affect my business?

La revenue tax refers to the taxation on income generated by businesses and individuals within a specified region. It is crucial for businesses to understand how this tax works in order to comply with local regulations. Knowing about la revenue tax helps businesses plan their finances and implement effective accounting strategies.

-

How can airSlate SignNow assist with la revenue tax documentation?

With airSlate SignNow, you can easily create and manage documents related to la revenue tax. Our platform allows you to eSign tax forms securely and store them for future reference. This streamlined process reduces the hassle of paper-based documentation and ensures compliance with tax regulations.

-

What features does airSlate SignNow offer for managing la revenue tax forms?

AirSlate SignNow provides features such as customizable templates for la revenue tax forms, automated workflows, and secure eSigning capabilities. These features simplify the process of preparing, sending, and signing tax documents. Additionally, our integration options allow for seamless data transfer to your accounting software.

-

Is there a cost associated with using airSlate SignNow for la revenue tax documents?

Yes, airSlate SignNow offers a variety of pricing plans that cater to businesses of all sizes. The cost is dependent on the features you choose, but our solutions are designed to be cost-effective, especially for managing la revenue tax documentation. You can try our service with a free trial to see how it fits your needs.

-

Can airSlate SignNow integrate with other accounting tools for la revenue tax preparation?

Absolutely! AirSlate SignNow supports integrations with popular accounting software, which facilitates efficient management of la revenue tax-related documents. This integration ensures that all financial data is accurately reflected and helps simplify your tax preparation process.

-

What benefits does airSlate SignNow provide for handling la revenue tax compliance?

Using airSlate SignNow helps ensure that your la revenue tax compliance is handled smoothly and efficiently. The platform offers secure eSigning, audit trails, and reminders for filings, which all contribute to avoiding penalties. Our user-friendly interface makes compliance easier for both businesses and their accountants.

-

How secure is airSlate SignNow when dealing with sensitive la revenue tax data?

AirSlate SignNow prioritizes security, implementing advanced encryption and data protection measures to safeguard all sensitive la revenue tax information. We adhere to industry standards and regulations to ensure your documents are protected. You can trust that your data is safe while using our eSigning platform.

Get more for Fillable Online Revenue Louisiana Tax Forms Louisiana

Find out other Fillable Online Revenue Louisiana Tax Forms Louisiana

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement