Revenue Louisiana Gov TaxForms 210NRi122Underpayment of Individual Income Revenue Louisiana Gov 2021

Understanding the Revenue Louisiana Gov TaxForms 210NRi122 Underpayment of Individual Income

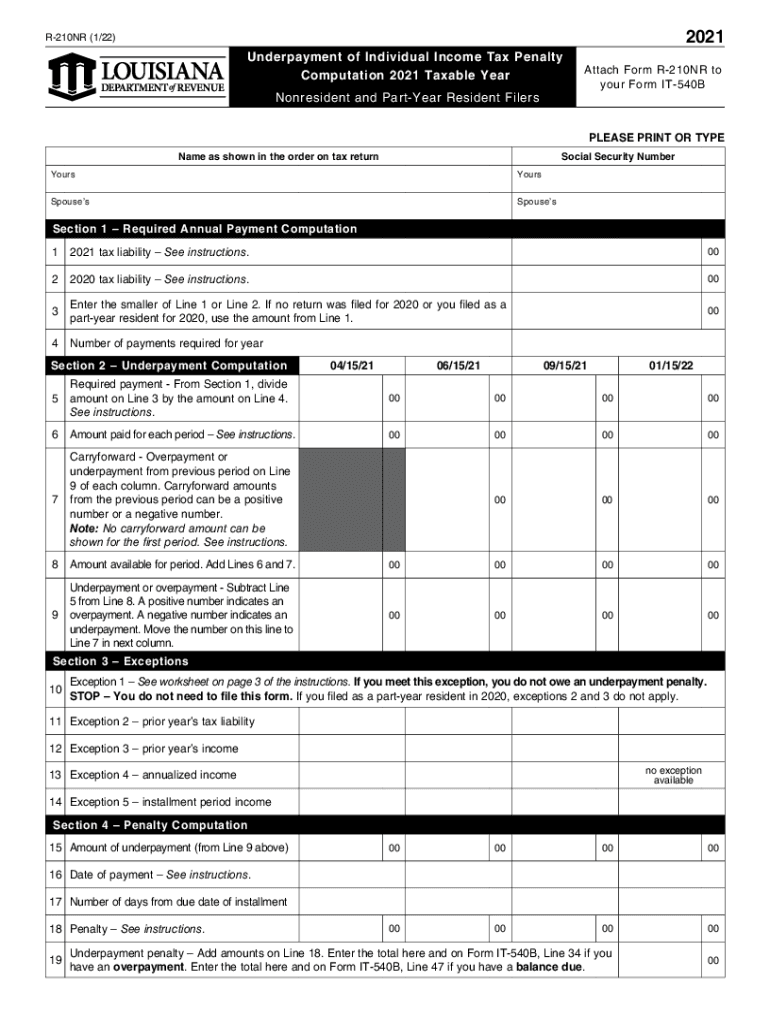

The Revenue Louisiana Gov TaxForms 210NRi122 is specifically designed for individuals who have underpaid their income tax in Louisiana. This form is essential for calculating any penalties or additional taxes owed due to insufficient payments made throughout the tax year. It is crucial to understand the implications of underpayment and how this form can help rectify any discrepancies with the state tax authority.

Steps to Complete the Revenue Louisiana Gov TaxForms 210NRi122

Completing the Revenue Louisiana Gov TaxForms 210NRi122 involves several key steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Calculate your total income and determine the amount of tax you should have paid based on that income.

- Compare the calculated tax with the amount you actually paid to identify any underpayment.

- Fill out the form accurately, ensuring that all calculations are correct and all required fields are completed.

- Review the form for any errors before submission.

Legal Use of the Revenue Louisiana Gov TaxForms 210NRi122

The legal validity of the Revenue Louisiana Gov TaxForms 210NRi122 is established under Louisiana state tax laws. To ensure that the form is accepted by the Department of Revenue, it must be filled out correctly and submitted within the required deadlines. The form serves as an official document that can be used to resolve underpayment issues, and it must comply with all applicable tax regulations.

Penalties for Non-Compliance

Failing to file the Revenue Louisiana Gov TaxForms 210NRi122 or submitting it late can result in significant penalties. These may include:

- Interest on the unpaid tax amount, which accrues over time.

- Additional penalties for late filing, which can increase the total amount owed.

- Potential legal action from the state if the underpayment is not addressed.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with the Revenue Louisiana Gov TaxForms 210NRi122. Typically, the form must be submitted by the deadline for individual income tax returns, which is usually April 15 of the following year. However, if you have received an extension, ensure that you submit the form by the extended deadline to avoid penalties.

Obtaining the Revenue Louisiana Gov TaxForms 210NRi122

The Revenue Louisiana Gov TaxForms 210NRi122 can be obtained directly from the Louisiana Department of Revenue's website or through authorized tax preparation services. It is important to ensure that you are using the most current version of the form to avoid any issues during submission.

Quick guide on how to complete revenuelouisianagov taxforms 210nri122underpayment of individual income revenuelouisianagov

Easily prepare Revenue louisiana gov TaxForms 210NRi122Underpayment Of Individual Income Revenue louisiana gov on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can find the necessary form and store it securely online. airSlate SignNow equips you with all the features you require to create, modify, and eSign your documents efficiently without delays. Handle Revenue louisiana gov TaxForms 210NRi122Underpayment Of Individual Income Revenue louisiana gov on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Revenue louisiana gov TaxForms 210NRi122Underpayment Of Individual Income Revenue louisiana gov effortlessly

- Find Revenue louisiana gov TaxForms 210NRi122Underpayment Of Individual Income Revenue louisiana gov and click Get Form to begin.

- Make use of the tools available to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and then select the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that require new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Revenue louisiana gov TaxForms 210NRi122Underpayment Of Individual Income Revenue louisiana gov to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenuelouisianagov taxforms 210nri122underpayment of individual income revenuelouisianagov

Create this form in 5 minutes!

How to create an eSignature for the revenuelouisianagov taxforms 210nri122underpayment of individual income revenuelouisianagov

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is individual computation in the context of airSlate SignNow?

Individual computation refers to the process by which users can customize the document signing experience according to their specific needs. With airSlate SignNow, individual computation allows businesses to tailor workflows and automate processes, making it easier to manage document signing efficiently and effectively.

-

How does airSlate SignNow support individual computation for businesses?

airSlate SignNow provides features that enable individual computation by allowing users to create custom templates, set signers' roles, and automate reminders. This means businesses can streamline their signing process, reducing time and ensuring that documents are completed correctly according to their unique requirements.

-

Are there any costs associated with using airSlate SignNow's individual computation features?

Yes, airSlate SignNow offers various pricing plans that include access to individual computation features. You can choose a plan that best fits your business needs, ensuring that you receive the right tools for efficient document management and e-signing without overspending.

-

What are the main benefits of utilizing individual computation with airSlate SignNow?

Utilizing individual computation with airSlate SignNow allows businesses to enhance efficiency, improve accuracy, and ensure compliance. By customizing workflows and automating tasks, companies can reduce manual errors and save valuable time, providing a better experience for both employees and customers.

-

Can I integrate airSlate SignNow with other applications for individual computation?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications such as Google Workspace, Salesforce, and Microsoft Office. This further enhances individual computation capabilities, allowing users to streamline their workflows across multiple platforms.

-

Is individual computation user-friendly in airSlate SignNow?

Yes, airSlate SignNow prioritizes user-friendliness, making individual computation features accessible even to those with minimal technical expertise. The intuitive interface simplifies the customization process, enabling users to focus on their business operations without extensive training.

-

How secure is the individual computation process with airSlate SignNow?

airSlate SignNow prioritizes security and complies with industry standards to protect your data during individual computation. With features such as encryption and secure cloud storage, businesses can trust that their sensitive information is kept safe while undergoing the document signing process.

Get more for Revenue louisiana gov TaxForms 210NRi122Underpayment Of Individual Income Revenue louisiana gov

- Mississippi deed trust 497313813 form

- Closing statement template form

- Mississippi renunciation and disclaimer of property ira annuity or bond mississippi form

- Ms husband form

- Warranty deed from husband and wife to llc mississippi form

- Letter from landlord to tenant as notice to remove wild animals in premises mississippi form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises mississippi form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497313822 form

Find out other Revenue louisiana gov TaxForms 210NRi122Underpayment Of Individual Income Revenue louisiana gov

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document