Chapter 13 Bankruptcy an Overview of the Process Form

What is Chapter 13 Bankruptcy?

Chapter 13 bankruptcy is a legal process designed for individuals with a regular income who wish to reorganize their debts. Unlike Chapter 7 bankruptcy, which involves liquidation of assets, Chapter 13 allows debtors to keep their property while repaying their debts over a specified period, typically three to five years. This form of bankruptcy is often referred to as a wage earner's plan, as it enables individuals to create a manageable repayment plan based on their income and expenses.

Steps to Complete Chapter 13 Bankruptcy

Completing the Chapter 13 bankruptcy process involves several key steps:

- Credit Counseling: Before filing, individuals must undergo credit counseling from an approved agency.

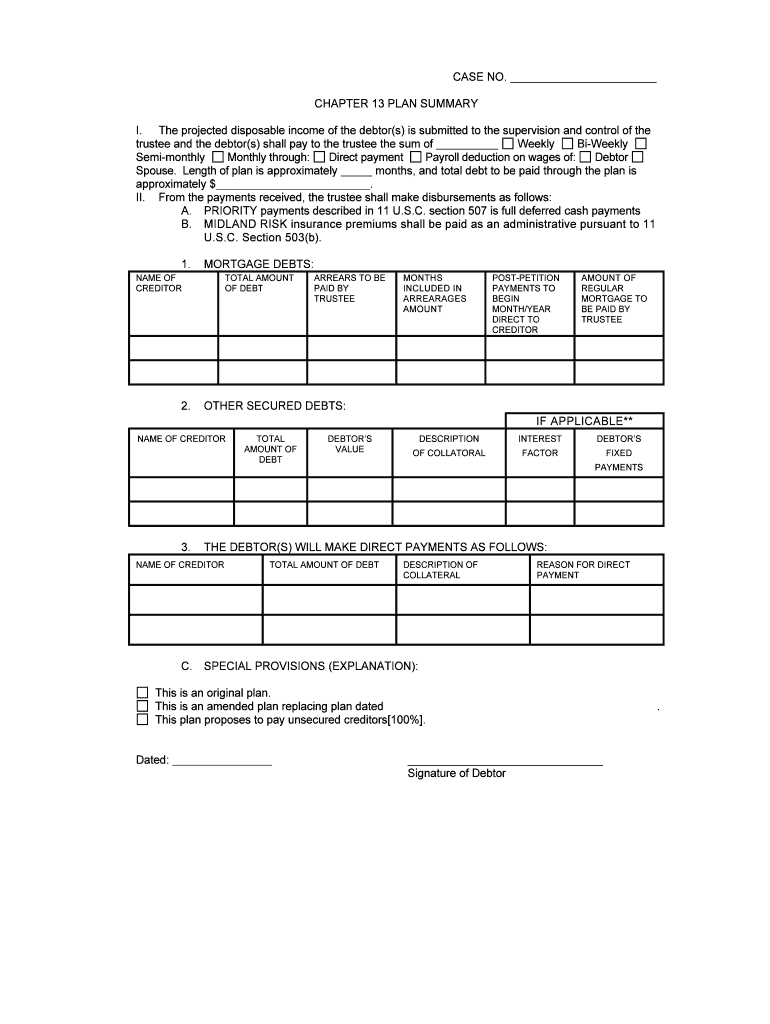

- Filing the Petition: Submit the bankruptcy petition along with necessary schedules and forms to the bankruptcy court.

- Meeting of Creditors: Attend a meeting where creditors can question the debtor about their financial situation.

- Plan Confirmation: The bankruptcy court must approve the repayment plan, which outlines how debts will be repaid.

- Making Payments: Begin making payments according to the confirmed plan, which will last for three to five years.

Required Documents for Chapter 13 Bankruptcy

To successfully file for Chapter 13 bankruptcy, individuals must gather and submit various documents, including:

- Proof of income, such as pay stubs or tax returns.

- A list of all debts, including secured and unsecured obligations.

- A list of assets and property owned.

- Monthly living expenses, detailing necessary costs for housing, utilities, and food.

- Credit counseling certificate, proving completion of the required counseling session.

Eligibility Criteria for Chapter 13 Bankruptcy

To qualify for Chapter 13 bankruptcy, individuals must meet specific eligibility criteria, including:

- Having a regular income, which can include wages, self-employment income, or other sources.

- Debt limits, which are subject to change, must not exceed certain thresholds for secured and unsecured debts.

- Filing the petition in good faith, demonstrating an intention to repay debts.

Legal Use of Chapter 13 Bankruptcy

Chapter 13 bankruptcy is legally recognized in the United States as a means for individuals to reorganize their debts. It provides a structured way to repay creditors while protecting the debtor's assets from liquidation. The process is governed by federal bankruptcy laws, and compliance with these laws is essential for a successful outcome. Individuals must adhere to the terms of the repayment plan and maintain communication with the bankruptcy court throughout the process.

Form Submission Methods for Chapter 13 Bankruptcy

Individuals can submit their Chapter 13 bankruptcy forms through various methods:

- Online: Many courts allow electronic filing of bankruptcy petitions through their websites.

- Mail: Forms can be printed and mailed to the appropriate bankruptcy court.

- In-Person: Individuals may also file documents in person at the bankruptcy court clerk's office.

Quick guide on how to complete chapter 13 bankruptcy an overview of the process

Complete Chapter 13 Bankruptcy An Overview Of The Process effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly without delays. Manage Chapter 13 Bankruptcy An Overview Of The Process on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to alter and eSign Chapter 13 Bankruptcy An Overview Of The Process seamlessly

- Locate Chapter 13 Bankruptcy An Overview Of The Process and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you would like to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from your preferred device. Edit and eSign Chapter 13 Bankruptcy An Overview Of The Process to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Chapter 13 Bankruptcy and how does the process work?

Chapter 13 Bankruptcy is a legal process that allows individuals with a regular income to create a plan to repay all or part of their debts over three to five years. The process begins with filing a petition in bankruptcy court, followed by the creation of a repayment plan that is approved by the court. This overview of the process includes documenting your income, debts, and expenses to ensure a feasible repayment plan.

-

What are the benefits of choosing Chapter 13 Bankruptcy?

Chapter 13 Bankruptcy offers several benefits, including the ability to keep your property while repaying debts over time. Unlike Chapter 7, it helps avoid foreclosure and can reduce your overall debt load through negotiation. This process can also allow you to catch up on missed payments or eliminate certain unsecured debts.

-

How much does it cost to file for Chapter 13 Bankruptcy?

The cost of filing for Chapter 13 Bankruptcy includes court fees as well as attorney fees, which can vary based on the complexity of your case. Most courts have a standard fee for filing, often ranging from $300 to $400. It's important to consult with a bankruptcy attorney to get a clear understanding of all potential costs associated with the Chapter 13 Bankruptcy process.

-

How can I prepare for filing Chapter 13 Bankruptcy?

Preparation for Chapter 13 Bankruptcy starts with gathering all necessary documentation regarding your income, debts, and expenses. You will also need to complete credit counseling with an approved agency 180 days before filing. Understanding the full scope of your financial situation is essential in creating an effective repayment plan during this process.

-

Can I keep my home during Chapter 13 Bankruptcy?

Yes, one of the signNow advantages of Chapter 13 Bankruptcy is the ability to retain your home while repaying your mortgage arrears through the repayment plan. This process allows you to catch up on missed payments and halt foreclosure actions. It is crucial to work closely with your attorney to ensure that your home is protected throughout the Chapter 13 Bankruptcy process.

-

How does Chapter 13 Bankruptcy affect my credit score?

Filing for Chapter 13 Bankruptcy does impact your credit score, resulting in a decrease that can stay on your credit report for up to seven years. However, it may provide a pathway to improve your credit score over time, as you complete the repayment plan and manage financial responsibilities. Understanding this process can help you make informed decisions about your financial future.

-

What happens after I complete my Chapter 13 Bankruptcy repayment plan?

Upon successful completion of your Chapter 13 Bankruptcy repayment plan, any remaining unsecured debts that were included in the plan are typically discharged. This marks the end of your bankruptcy process and paves the way for rebuilding your financial life. You receive a fresh start, having honored your financial obligations during the repayment process.

Get more for Chapter 13 Bankruptcy An Overview Of The Process

Find out other Chapter 13 Bankruptcy An Overview Of The Process

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure