Form AR D

What is the Form AR D

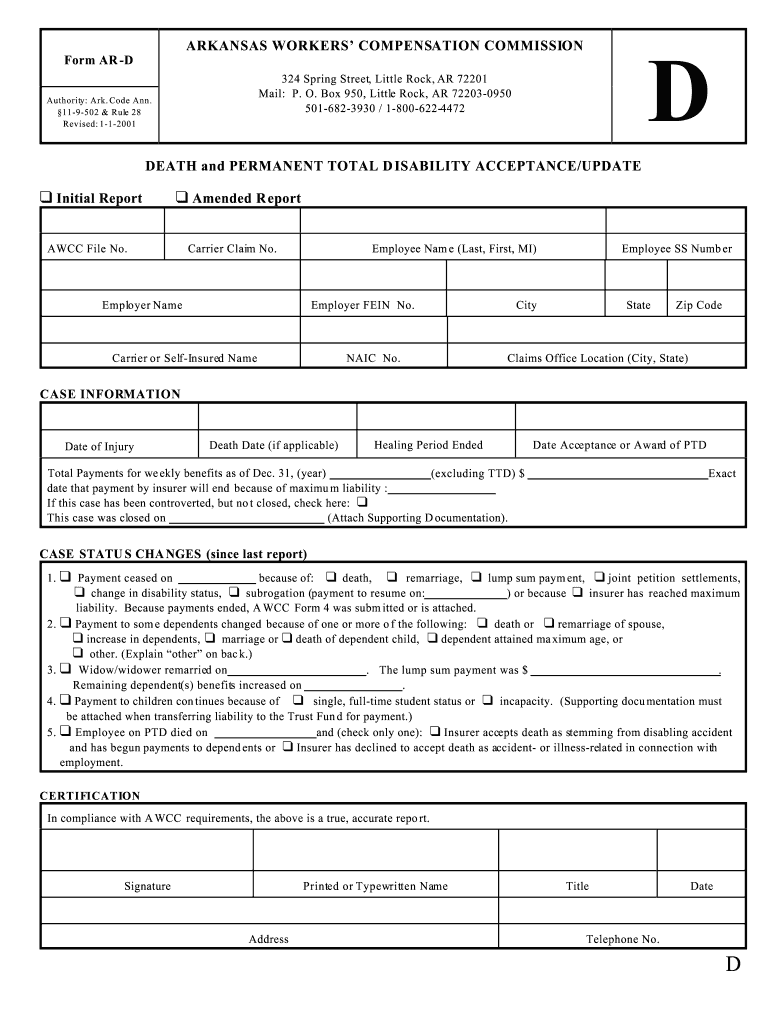

The Form AR D is a specific document used primarily in the context of tax filings and compliance within the United States. It is designed to assist individuals or businesses in reporting certain financial information to the relevant authorities. This form is crucial for ensuring that all necessary data is accurately captured and submitted, which helps maintain compliance with federal regulations.

How to use the Form AR D

Using the Form AR D involves several steps to ensure that all required information is accurately filled out. Begin by gathering all necessary financial documents and data relevant to the form. Carefully read the instructions provided with the form to understand each section's requirements. Fill in the form completely, ensuring that all entries are correct and legible. Once completed, review the form to confirm that all information is accurate before submission.

Steps to complete the Form AR D

Completing the Form AR D requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all relevant financial documents, including previous tax returns and income statements.

- Read the instructions carefully to understand the requirements for each section of the form.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check all entries for accuracy and completeness.

- Submit the form via the appropriate method, whether online, by mail, or in person.

Legal use of the Form AR D

The legal use of the Form AR D is essential for ensuring compliance with tax laws and regulations. When filled out correctly, this form serves as a legally binding document that can be used in various legal contexts. It is important to adhere to all guidelines and requirements set forth by the IRS to avoid potential penalties or issues with compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form AR D are critical to ensure timely submission and compliance with tax regulations. Typically, the form must be filed by specific dates set by the IRS, which may vary depending on the tax year and the individual's or business's filing status. It is advisable to keep track of these dates and plan accordingly to avoid late filing penalties.

Required Documents

To complete the Form AR D, certain documents are required to provide the necessary information. These may include:

- Previous tax returns for reference.

- Income statements, such as W-2s or 1099 forms.

- Any supporting documentation related to deductions or credits being claimed.

Form Submission Methods (Online / Mail / In-Person)

The Form AR D can be submitted through various methods, providing flexibility based on individual preferences. Options include:

- Online submission through the IRS website or authorized e-filing services.

- Mailing the completed form to the appropriate IRS address based on the filing instructions.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete form ar d

Complete Form AR D effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form AR D on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Form AR D without breaking a sweat

- Locate Form AR D and click on Get Form to get started.

- Use the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns of lost or misfiled documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Form AR D and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form AR D and how can it benefit my business?

Form AR D is a document that streamlines the process of reporting and verifying certain business accounts. By utilizing airSlate SignNow, your business can easily eSign and send Form AR D, ensuring efficiency and compliance in your documentation process.

-

How does airSlate SignNow facilitate the completion of Form AR D?

airSlate SignNow provides a user-friendly interface that simplifies the process of filling out and eSigning Form AR D. With customizable templates and easy navigation, you can ensure that all necessary information is captured accurately and promptly.

-

Is there a cost associated with using airSlate SignNow for Form AR D?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. You can choose a plan that fits your budget while benefiting from the efficient handling of documents such as Form AR D.

-

Can I integrate airSlate SignNow with other software to manage Form AR D?

Absolutely! airSlate SignNow supports integration with numerous third-party applications, allowing you to manage Form AR D alongside your existing business tools. This enhances workflow efficiency and keeps your document management process centralized.

-

What features does airSlate SignNow offer for handling Form AR D?

airSlate SignNow includes features like customizable templates, automated workflows, and secure eSigning that are perfect for managing Form AR D. These features help ensure that your document processes are not only efficient but also secure and compliant.

-

How secure is the eSigning process for Form AR D on airSlate SignNow?

The eSigning process for Form AR D on airSlate SignNow is highly secure, utilizing advanced encryption and authentication methods. This ensures that your documents are protected and that you can trust the integrity of your signed paperwork.

-

What industries can benefit from using Form AR D with airSlate SignNow?

Various industries, including finance, healthcare, and real estate, can benefit from using Form AR D with airSlate SignNow. The platform accommodates diverse use cases, making it a versatile solution for eSigning important documents.

Get more for Form AR D

- Orleans county traffic diversion program form

- By the landlord protection agency inc appliance agreement premises this appliance agreement addendum is made this day of 20 and form

- Oregon form 40 esv

- Dofe participant enrolment form havant air cadets havantaircadets org

- Huruf cetak form

- Greenshield scholarship form

- Oath refund form

- Narrative nonfiction writing checklist for the teacher form

Find out other Form AR D

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure