Irs Form 56

What is the IRS Form 56?

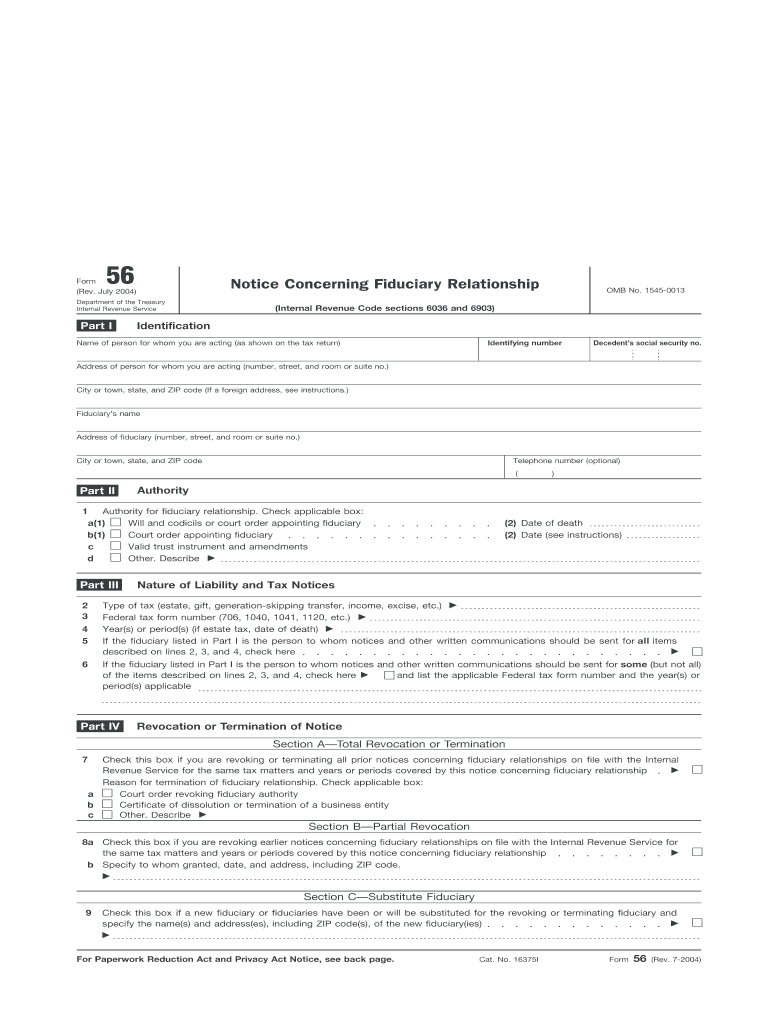

The IRS Form 56, officially known as the Notice Concerning Fiduciary Relationship, is a tax form used to inform the Internal Revenue Service of the establishment of a fiduciary relationship. This form is essential for individuals acting on behalf of another party, such as an estate, trust, or other legal entity. By filing this form, fiduciaries can ensure that the IRS recognizes their authority to act on behalf of the taxpayer, allowing them to manage tax matters effectively.

How to use the IRS Form 56

Using the IRS Form 56 involves several steps to ensure proper completion and submission. First, gather all necessary information about the fiduciary relationship, including the names and addresses of both the fiduciary and the taxpayer. Next, accurately fill out the form, providing details such as the effective date of the fiduciary relationship. Once completed, the form must be submitted to the IRS, which can be done either by mail or electronically, depending on the specific requirements.

Steps to complete the IRS Form 56

Completing the IRS Form 56 requires careful attention to detail. Follow these steps for accurate submission:

- Obtain the latest version of the IRS Form 56 from the IRS website or a trusted source.

- Fill in the fiduciary's name, address, and taxpayer identification number (TIN).

- Provide the taxpayer's name and TIN, ensuring all information is correct.

- Indicate the type of fiduciary relationship, such as executor, administrator, or trustee.

- Sign and date the form, confirming that the information provided is accurate.

- Submit the completed form to the IRS by the appropriate method.

Legal use of the IRS Form 56

The IRS Form 56 is legally binding when completed correctly and submitted to the IRS. It serves as official notification of a fiduciary relationship, which is crucial for managing tax responsibilities on behalf of another party. To ensure legal validity, the form must be filled out in accordance with IRS guidelines and submitted within the required timeframes. Failure to do so may result in complications regarding the fiduciary's authority to act on behalf of the taxpayer.

Key elements of the IRS Form 56

Several key elements must be included when filling out the IRS Form 56 to ensure its effectiveness:

- Fiduciary Information: Include the fiduciary's name, address, and TIN.

- Taxpayer Information: Provide the taxpayer's name, address, and TIN.

- Type of Relationship: Clearly state the nature of the fiduciary relationship.

- Effective Date: Specify the date when the fiduciary relationship began.

- Signature: The fiduciary must sign and date the form to validate it.

Form Submission Methods

The IRS Form 56 can be submitted through various methods, depending on the preferences of the fiduciary. The primary submission methods include:

- Mail: The completed form can be mailed directly to the IRS at the address specified in the form instructions.

- Electronic Submission: In certain cases, the form may be submitted electronically through approved IRS channels, streamlining the process.

Quick guide on how to complete form 56 rev 7 2004 notice concerning fiduciary relationship irs

Complete Irs Form 56 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed papers, enabling you to locate the correct form and securely archive it online. airSlate SignNow offers all the necessary tools to produce, modify, and eSign your documents swiftly without delays. Manage Irs Form 56 on any device using airSlate SignNow's Android or iOS applications and simplify any document-focused procedure today.

The easiest way to alter and eSign Irs Form 56 seamlessly

- Locate Irs Form 56 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Irs Form 56 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 56 rev 7 2004 notice concerning fiduciary relationship irs

How to generate an electronic signature for your Form 56 Rev 7 2004 Notice Concerning Fiduciary Relationship Irs in the online mode

How to make an eSignature for the Form 56 Rev 7 2004 Notice Concerning Fiduciary Relationship Irs in Google Chrome

How to generate an eSignature for putting it on the Form 56 Rev 7 2004 Notice Concerning Fiduciary Relationship Irs in Gmail

How to make an electronic signature for the Form 56 Rev 7 2004 Notice Concerning Fiduciary Relationship Irs straight from your smartphone

How to make an eSignature for the Form 56 Rev 7 2004 Notice Concerning Fiduciary Relationship Irs on iOS

How to create an eSignature for the Form 56 Rev 7 2004 Notice Concerning Fiduciary Relationship Irs on Android OS

People also ask

-

What is the IRS 56 form?

The IRS 56 form, also known as the Notice Concerning Fiduciary Relationship, is used to inform the IRS of a fiduciary relationship. This form is essential for individuals or entities acting on behalf of another in tax matters, ensuring proper communication with the IRS.

-

How can airSlate SignNow assist with the IRS 56 form?

With airSlate SignNow, you can easily create, send, and eSign the IRS 56 form securely. The platform simplifies the process of managing your IRS forms, ensuring that they are completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the IRS 56 form?

AirSlate SignNow offers various pricing plans to suit different business needs. Whether you’re a small business or a large organization, you’ll find a cost-effective solution that enables you to eSign documents like the IRS 56 form efficiently.

-

What features does airSlate SignNow offer for faxing the IRS 56 form?

AirSlate SignNow provides a robust set of features, including document templates, secure cloud storage, and the ability to fax the IRS 56 form directly from the platform. This makes it easy to manage your tax documents with a single solution.

-

Can airSlate SignNow integrate with other software for handling the IRS 56 form?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications, enhancing your workflow when managing the IRS 56 form. By integrating with tools like CRM systems and accounting software, you can streamline your processes.

-

How secure is it to use airSlate SignNow for the IRS 56 form?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption methods and complies with industry standards to ensure that your IRS 56 form and other documents are protected from unauthorized access.

-

What benefits does eSigning the IRS 56 form provide?

eSigning the IRS 56 form with airSlate SignNow accelerates the signing process and reduces paper waste. It also ensures you have a secure, timestamped record of the transaction that simplifies record keeping and compliance with IRS requirements.

Get more for Irs Form 56

- Employers exposure incident reporting form peir

- Patient amp employer information

- Accidentincident report form 4 h alberta

- Special incident report form

- How you decide to allocate your assets is the very heart of your financial strategy form

- F51 122a industrial alliance form

- Maternity andor parental benefits annex 3 form

- Annex 3 form

Find out other Irs Form 56

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast