CREDITOR'S GARNISHMENT REPORT EARNINGS Form

What is the CREDITOR'S GARNISHMENT REPORT EARNINGS

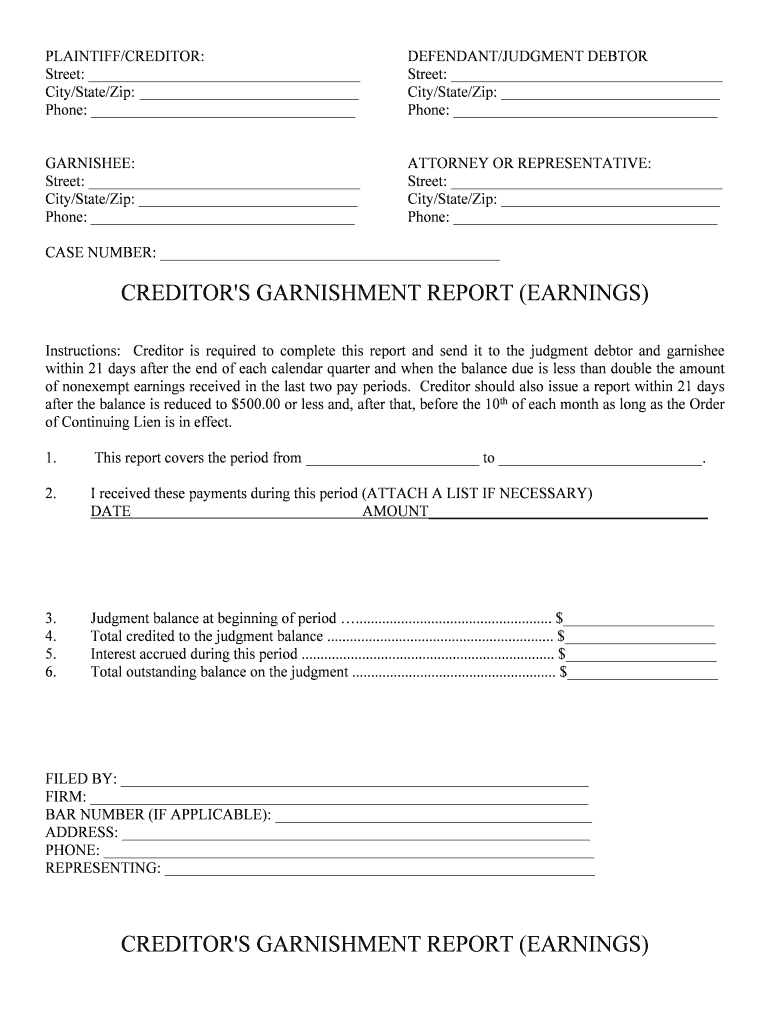

The creditor's garnishment report earnings form is a legal document used in the United States to provide information about a debtor's income and earnings. This form is typically required by a court or creditor when a creditor seeks to garnish a debtor's wages or bank account to satisfy a debt. It outlines the debtor's financial situation, including their earnings from employment, other income sources, and any deductions that may apply. This information helps the court determine the appropriate amount that can be garnished from the debtor's earnings.

Steps to complete the CREDITOR'S GARNISHMENT REPORT EARNINGS

Completing the creditor's garnishment report earnings form involves several key steps to ensure accuracy and compliance with legal requirements. First, gather all necessary documentation, including pay stubs, tax returns, and any other relevant financial records. Next, accurately fill out the form by entering your personal information, such as your name, address, and Social Security number. Provide detailed information about your income, including your employer's name, your job title, and your earnings before and after deductions. Finally, review the completed form for accuracy and ensure that all required signatures are present before submitting it to the appropriate court or creditor.

Legal use of the CREDITOR'S GARNISHMENT REPORT EARNINGS

The creditor's garnishment report earnings form serves a critical legal purpose in the debt collection process. It is legally binding when completed correctly and submitted to the court. The information provided in this form must be truthful and accurate, as any discrepancies could lead to legal consequences. Courts rely on this document to make informed decisions regarding wage garnishment, ensuring that debtors are treated fairly while allowing creditors to recover owed amounts. Understanding the legal implications of this form is essential for both debtors and creditors in the garnishment process.

How to obtain the CREDITOR'S GARNISHMENT REPORT EARNINGS

Obtaining the creditor's garnishment report earnings form is typically straightforward. The form can often be accessed through the website of the court where the garnishment is being filed. Additionally, many state and local government websites provide downloadable versions of the form. It is important to ensure that you are using the correct version of the form that corresponds to your jurisdiction, as requirements may vary by state. If you have difficulty locating the form online, you may also contact the court clerk's office for assistance.

Key elements of the CREDITOR'S GARNISHMENT REPORT EARNINGS

Several key elements must be included in the creditor's garnishment report earnings form to ensure it is complete and valid. These elements typically include:

- Debtor's Information: Full name, address, and Social Security number.

- Employer Details: Name and address of the debtor's employer.

- Earnings Information: Gross and net income, including any additional income sources.

- Deductions: Any mandatory deductions such as taxes, health insurance, or retirement contributions.

- Signature: The debtor's signature, affirming the accuracy of the information provided.

State-specific rules for the CREDITOR'S GARNISHMENT REPORT EARNINGS

Each state in the U.S. may have specific rules and regulations governing the use of the creditor's garnishment report earnings form. These rules can include limitations on the amount that can be garnished, specific procedures for filing the form, and variations in the information required. It is essential for both creditors and debtors to be aware of their state's laws to ensure compliance and avoid potential legal issues. Consulting with a legal professional or reviewing state statutes can provide clarity on these regulations.

Quick guide on how to complete creditors garnishment report earnings

Complete CREDITOR'S GARNISHMENT REPORT EARNINGS effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents rapidly without complications. Manage CREDITOR'S GARNISHMENT REPORT EARNINGS on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to alter and eSign CREDITOR'S GARNISHMENT REPORT EARNINGS with ease

- Obtain CREDITOR'S GARNISHMENT REPORT EARNINGS and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign CREDITOR'S GARNISHMENT REPORT EARNINGS and ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Creditor's Garnishment Report Earnings?

A Creditor's Garnishment Report Earnings is a document that details an individual's income to determine the amount that can be garnished by creditors. It serves as a crucial tool for employers and financial institutions. With airSlate SignNow, you can efficiently create, sign, and manage such reports, ensuring compliance and accuracy in your documentation.

-

How can airSlate SignNow help with preparing a Creditor's Garnishment Report Earnings?

airSlate SignNow simplifies the process of preparing a Creditor's Garnishment Report Earnings by providing easy-to-use templates and eSignature capabilities. Our platform allows users to customize reports, collect required signatures, and distribute them securely. This streamlining ensures that you can handle garnishment reports quickly and efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans that fit different business needs, from basic to advanced features. Each plan includes the tools necessary for generating crucial documents like the Creditor's Garnishment Report Earnings. By selecting the right plan, you can optimize your document management process while staying budget-friendly.

-

Are there integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications, including CRM and accounting software. This ensures that you can create and manage your Creditor's Garnishment Report Earnings alongside your existing business processes. Automating document workflows helps enhance efficiency and reduces the chances of error.

-

What are the key benefits of using airSlate SignNow for document management?

Using airSlate SignNow for your document management provides numerous benefits, such as enhanced security, increased efficiency, and improved compliance. The platform enables you to generate important documents like the Creditor's Garnishment Report Earnings with ease. By streamlining your workflow, you can save time and avoid common pitfalls associated with manual documentation.

-

Is airSlate SignNow compliant with legal standards for garnishment reporting?

Yes, airSlate SignNow is designed to comply with relevant legal standards for garnishment reporting. When creating a Creditor's Garnishment Report Earnings, it ensures that all necessary legal requirements are met. This compliance helps protect your organization from potential legal disputes and enhances credibility.

-

Can I track the status of my Creditor's Garnishment Report Earnings with airSlate SignNow?

Absolutely! airSlate SignNow offers robust tracking features that allow you to monitor the status of your Creditor's Garnishment Report Earnings. You can see who has viewed and signed the document, ensuring transparency and timely processing of garnishment reports.

Get more for CREDITOR'S GARNISHMENT REPORT EARNINGS

- Ha 504 form

- Getting to yes negotiating agreement without giving in pdf form

- Pellissippi state immunization form 328197

- Iec 60890 pdf form

- Statement of responsibilities regarding asbestos form

- Tsdpurchasersclaimforsalestaxrefundaffidavitst 12 b form

- Dr 0104 colorado individual income tax return 771908872 form

- Car purchase agreement template form

Find out other CREDITOR'S GARNISHMENT REPORT EARNINGS

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors