At 115 Form

What is the AT 115

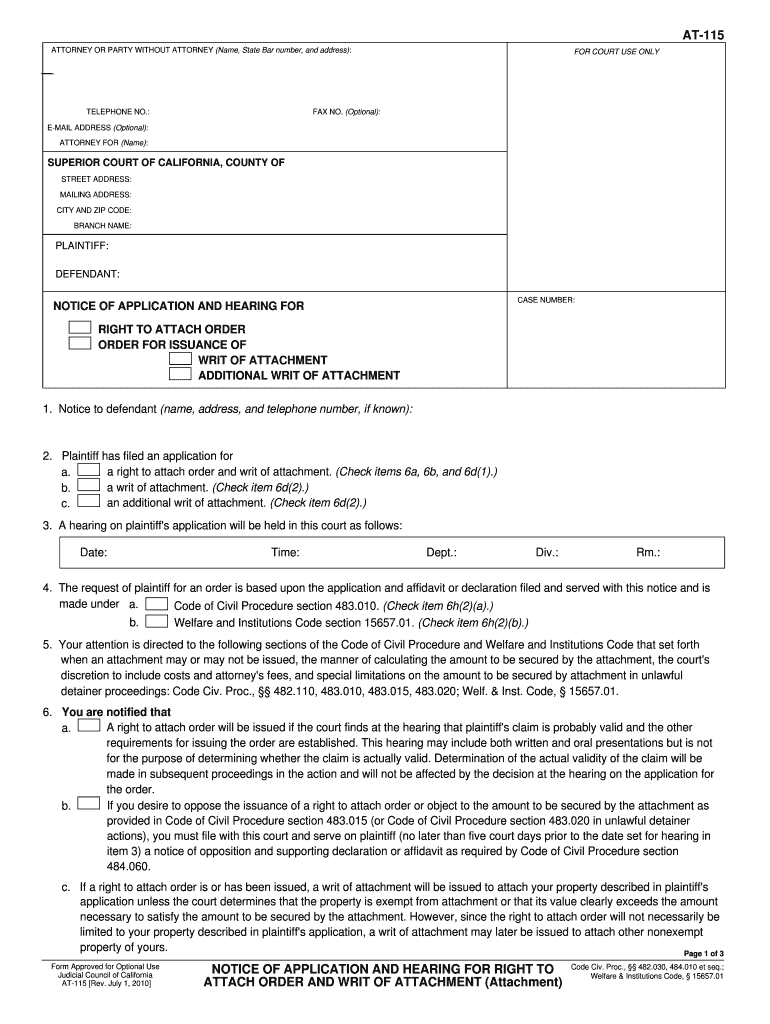

The AT 115 form is a crucial document used primarily for tax purposes in the United States. It serves as a declaration of certain financial information, which may be required by various government entities. Understanding the purpose of the AT 115 is essential for individuals and businesses to ensure compliance with tax regulations and to avoid potential penalties. This form is often utilized to report income, deductions, and other pertinent financial details that can affect an individual’s or entity’s tax obligations.

How to obtain the AT 115

Obtaining the AT 115 form is a straightforward process. Individuals can typically access it through the official website of the relevant tax authority or agency. In many cases, the form is available for download in a PDF format, allowing users to print and fill it out manually. Additionally, some tax software programs may include the AT 115 form, making it easier to complete electronically. It is important to ensure that you are using the most current version of the form to comply with any updates in tax regulations.

Steps to complete the AT 115

Completing the AT 115 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, carefully fill out each section of the form, providing accurate information as required. Double-check all entries for errors or omissions, as inaccuracies can lead to delays or penalties. Finally, review the completed form to ensure it meets all requirements before submission.

Legal use of the AT 115

The legal use of the AT 115 form is governed by specific regulations that dictate how the information provided must be handled. When completed correctly, the form serves as a legally binding document that can be used in various legal and financial contexts. Compliance with relevant laws ensures that the information submitted is valid and can be relied upon by tax authorities. It is essential to maintain accurate records of the form and any supporting documentation for future reference.

Filing Deadlines / Important Dates

Filing deadlines for the AT 115 form can vary depending on the specific tax year and the individual's or business's circumstances. Generally, it is advisable to submit the form by the established tax deadline to avoid any late fees or penalties. Important dates may include the initial filing deadline, any extensions available, and specific dates for amendments if necessary. Keeping track of these deadlines is crucial for maintaining compliance with tax obligations.

Required Documents

To complete the AT 115 form accurately, certain documents are typically required. These may include income statements, previous tax returns, and documentation related to deductions or credits claimed. Having these documents ready can facilitate a smoother completion process and help ensure that all information provided is accurate and complete. It is advisable to keep copies of all documents submitted with the AT 115 form for your records.

Quick guide on how to complete at 115

Effortlessly Prepare AT 115 on Any Device

Managing documents online has become popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle AT 115 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign AT 115 with Ease

- Find AT 115 and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight relevant parts of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new document prints. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign AT 115 and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is AT 115 and how does it relate to airSlate SignNow?

AT 115 is a powerful feature within airSlate SignNow that allows users to streamline the document signing process. With AT 115, businesses can easily create, send, and manage electronic signatures, enhancing productivity and efficiency.

-

What are the pricing options for AT 115 in airSlate SignNow?

airSlate SignNow offers multiple pricing tiers that include access to AT 115 features. Pricing is competitive and designed to fit the needs of businesses of all sizes, ensuring you get value with every transaction.

-

What are the key features of AT 115 in airSlate SignNow?

AT 115 includes features such as real-time document tracking, customizable templates, and secure cloud storage. These features are designed to simplify the eSigning process and enhance user experience.

-

How can AT 115 benefit my business?

Implementing AT 115 can signNowly reduce the time and costs associated with traditional document signing. With its user-friendly interface, your team can quickly adopt this solution and improve workflow efficiency.

-

Does AT 115 support integrations with other tools?

Yes, AT 115 seamlessly integrates with various business tools and applications. This allows for smooth document management and enhances overall productivity by syncing with your existing workflows.

-

Is AT 115 secure for handling sensitive documents?

Absolutely! AT 115 in airSlate SignNow employs robust security measures, including encryption and secure cloud storage, ensuring that your sensitive documents are protected. You can confidently manage electronic signatures with peace of mind.

-

Can I customize my experience with AT 115 in airSlate SignNow?

Yes, AT 115 allows for customization of templates and workflows, enabling you to tailor the signing experience to your business's unique needs. This flexibility helps ensure that your document signing process aligns perfectly with your operations.

Get more for AT 115

- Auto express vehicle appraisal form autoexpress co

- Primary caregiver tax credit level of care equivalency guideline form

- Peoples bank account opening application form

- Laser lipo consent form

- Peterborough housing register form

- Non secure tenancy agreement form

- Special needs regisitration form

- 12934 nursing home ombudsman poster the agency for health form

Find out other AT 115

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple