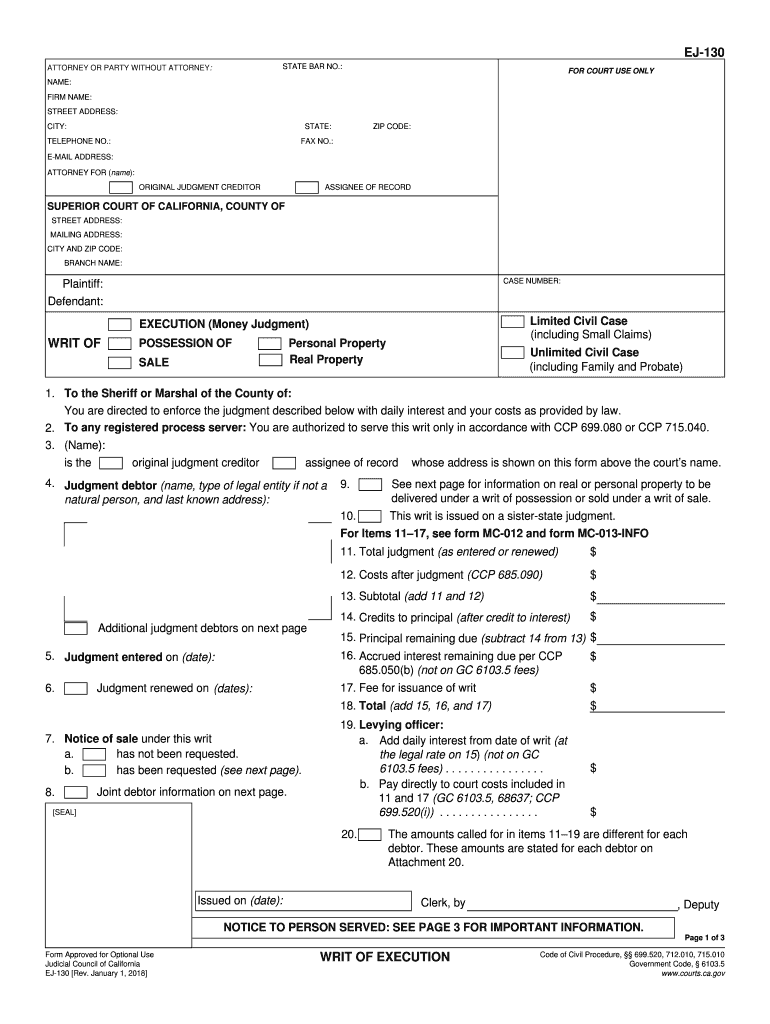

ORIGINAL JUDGMENT CREDITOR Form

What is the Original Judgment Creditor?

The original judgment creditor is the individual or entity that has been awarded a judgment in a court of law, entitling them to collect a specific amount of money from the debtor. This legal recognition arises from a court ruling that confirms the creditor's right to receive payment for a debt owed. Understanding the role of the original judgment creditor is crucial for both creditors and debtors, as it influences the collection process and the legal obligations involved.

How to Use the Original Judgment Creditor

Using the original judgment creditor involves several steps to ensure that the judgment is enforced properly. First, the creditor must obtain a copy of the judgment from the court. This document serves as proof of the debt owed. Next, the creditor may need to file the judgment with the local county clerk's office to establish a lien against the debtor's property. This step is important for protecting the creditor's interests in case the debtor attempts to sell or refinance their assets. Finally, the creditor can initiate collection actions, which may include garnishing wages or placing levies on bank accounts, depending on state laws.

Steps to Complete the Original Judgment Creditor

Completing the process as an original judgment creditor involves a series of systematic steps:

- Obtain the court judgment: Secure a certified copy of the judgment from the court where the case was heard.

- File the judgment: Submit the judgment to the appropriate local county office to create a public record.

- Notify the debtor: Send a formal notice to the debtor, informing them of the judgment and the amount owed.

- Initiate collection actions: Depending on the situation, consider various collection methods, such as wage garnishment or bank levies.

- Maintain records: Keep detailed records of all communications and actions taken regarding the collection process.

Legal Use of the Original Judgment Creditor

The legal use of the original judgment creditor is governed by state laws and regulations. It is essential for creditors to understand their rights and responsibilities when pursuing collections. The judgment must be enforced within the statute of limitations, which varies by state. Additionally, creditors must comply with federal regulations, such as the Fair Debt Collection Practices Act, which protects debtors from abusive collection practices. Failure to adhere to these legal requirements can result in penalties and the dismissal of collection efforts.

Key Elements of the Original Judgment Creditor

Several key elements define the role of the original judgment creditor:

- Judgment Amount: The specific monetary amount awarded by the court.

- Debtor Information: Accurate details about the debtor, including their name and contact information.

- Judgment Date: The date when the court issued the judgment, which is crucial for determining the statute of limitations.

- Enforcement Methods: Various legal avenues available for collecting the debt, such as wage garnishment or property liens.

State-Specific Rules for the Original Judgment Creditor

Each state has its own rules and procedures regarding the enforcement of judgments. Creditors must familiarize themselves with the specific regulations in their state to ensure compliance. This includes understanding the allowable methods of collection, the time limits for enforcing judgments, and any exemptions that may protect certain assets from seizure. Consulting with a legal professional can provide valuable guidance tailored to the creditor's state and situation.

Quick guide on how to complete original judgment creditor

Effortlessly Prepare ORIGINAL JUDGMENT CREDITOR on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow equips you with all the necessary tools for swiftly creating, editing, and eSigning your documents without delays. Manage ORIGINAL JUDGMENT CREDITOR on any platform using the airSlate SignNow applications for Android or iOS, streamlining any document-driven process today.

How to Edit and eSign ORIGINAL JUDGMENT CREDITOR with Ease

- Find ORIGINAL JUDGMENT CREDITOR and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Mark important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Edit and eSign ORIGINAL JUDGMENT CREDITOR and ensure effective communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an ORIGINAL JUDGMENT CREDITOR?

An ORIGINAL JUDGMENT CREDITOR is the party that has received a judgment against a debtor in a legal proceeding. This individual or entity has the right to seek remedies to collect the owed amount following the court's decision. Understanding this term is vital for anyone navigating legal debt recovery.

-

How can airSlate SignNow assist an ORIGINAL JUDGMENT CREDITOR?

airSlate SignNow empowers an ORIGINAL JUDGMENT CREDITOR by streamlining the document signing process, making it faster and more efficient. With our platform, you can easily send legal documents for eSignature, ensuring that your collection processes are not delayed. This can signNowly speed up your operations and improve cash flow.

-

What features does airSlate SignNow offer for handling legal documents?

airSlate SignNow offers a range of features tailored for legal documents, which are invaluable for an ORIGINAL JUDGMENT CREDITOR. Key capabilities include customizable templates, secure storage, advanced signing workflows, and real-time tracking of document status. These features ensure accuracy and accountability in the collection process.

-

Is airSlate SignNow a cost-effective solution for ORIGINAL JUDGMENT CREDITORS?

Yes, airSlate SignNow provides a cost-effective solution ideal for an ORIGINAL JUDGMENT CREDITOR. Our pricing plans are designed to accommodate businesses of all sizes and provide excellent value through advanced features that reduce operational costs and increase efficiency. This means you can focus more on collecting debts and less on administrative overhead.

-

What integrations does airSlate SignNow have that benefit ORIGINAL JUDGMENT CREDITORS?

airSlate SignNow integrates seamlessly with various platforms, enhancing the efficiency of an ORIGINAL JUDGMENT CREDITOR's operations. Our integrations with CRM systems, document storage solutions, and communication tools allow you to manage all aspects of your workflow in one place. This results in streamlined processes and improved team collaboration.

-

How secure is airSlate SignNow for an ORIGINAL JUDGMENT CREDITOR?

Security is a top priority for airSlate SignNow, especially for an ORIGINAL JUDGMENT CREDITOR handling sensitive legal documents. Our platform utilizes bank-level encryption and complies with data protection regulations to ensure that your documents and personal information are protected. You can trust that your data is safe with us.

-

Can I use airSlate SignNow for remote signing needs as an ORIGINAL JUDGMENT CREDITOR?

Absolutely! airSlate SignNow is designed for remote signing, making it perfect for an ORIGINAL JUDGMENT CREDITOR who needs flexibility. Whether your signers are in the same office or spread across the globe, you can easily send documents for eSignature without logistical delays. This feature saves time and simplifies the collection process.

Get more for ORIGINAL JUDGMENT CREDITOR

- Declaration undertaking for obc candidates only form

- Purchase and sales agreement form

- Dl 389 form 403182565

- Verbal employment reference check form kansas adjutant kansastag

- Hw052 22520270 form

- Bond and or permit fee waiver form state of indiana state in

- Application for mechanical permit bondurant iowa form

- Form ca4 this form should be completed if you require a letter of clearance form it8 in respect of securities monies in bank

Find out other ORIGINAL JUDGMENT CREDITOR

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission