Property Should Your Partner Predecease You and the Provisions for Distribution Contained in Form

Understanding the Property Should Your Partner Predecease You And The Provisions For Distribution Contained In

The form regarding property distribution upon the death of a partner is essential for ensuring that your assets are handled according to your wishes. This document outlines how your property should be distributed if your partner passes away before you. It serves as a legal directive that can help prevent disputes among heirs and ensures that your estate is managed according to your preferences.

Typically, this form includes details about your assets, beneficiaries, and any specific provisions you wish to include. It is crucial to understand the implications of this form, as it can significantly affect how your estate is settled and the financial security of your loved ones.

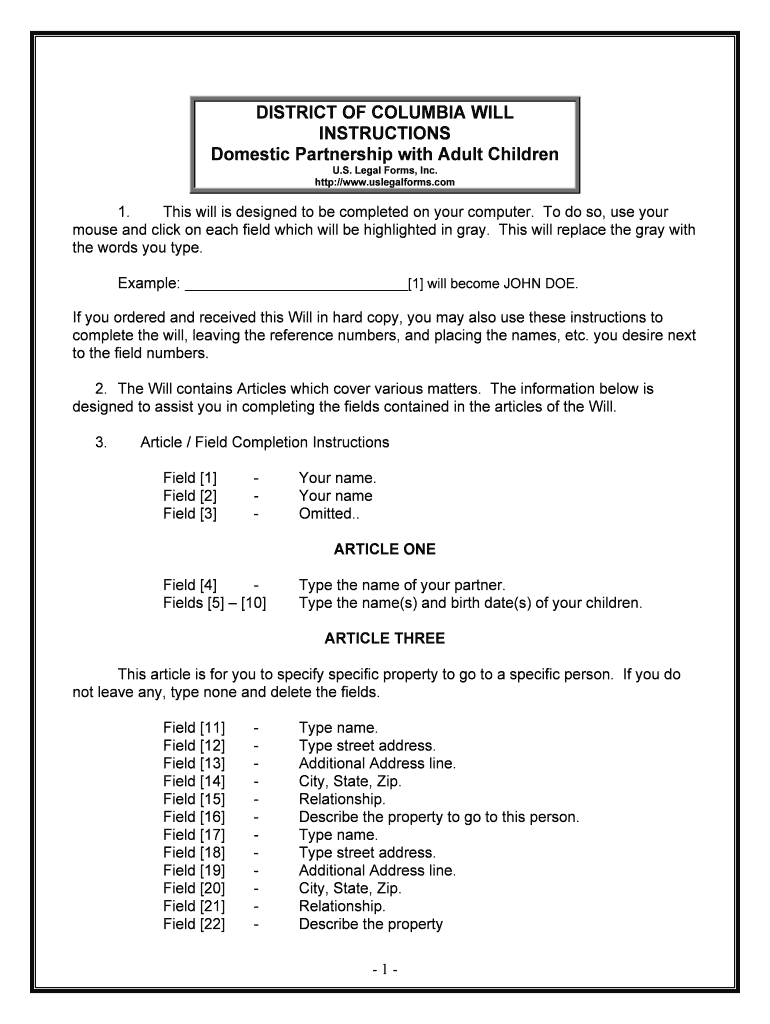

Steps to Complete the Property Should Your Partner Predecease You And The Provisions For Distribution Contained In

Completing the form requires careful attention to detail. Start by gathering all necessary information about your assets, including real estate, bank accounts, investments, and personal property. Next, identify your beneficiaries and decide how you want your assets distributed among them.

Follow these steps:

- Fill in your personal information and details about your partner.

- List all assets you wish to include in the distribution.

- Specify the percentage or amount each beneficiary will receive.

- Include any specific instructions or conditions related to the distribution.

- Review the form for accuracy and completeness before signing.

Once completed, ensure that the form is signed in accordance with state laws to validate its legality.

Legal Use of the Property Should Your Partner Predecease You And The Provisions For Distribution Contained In

This form is legally binding when executed properly, meaning it must comply with state laws regarding wills and estate planning. It is important to ensure that the form is signed in the presence of witnesses or a notary, as required by your state to enhance its enforceability.

Additionally, the form must clearly articulate your intentions regarding the distribution of your property. Ambiguities can lead to legal challenges, so clarity is vital. Consulting with a legal professional can help ensure that your form meets all necessary legal standards.

State-Specific Rules for the Property Should Your Partner Predecease You And The Provisions For Distribution Contained In

Each state has its own regulations governing the distribution of property upon death. It is crucial to understand these rules, as they can affect how your form is interpreted and enforced. Some states may require specific language, while others may have unique requirements for witnesses or notarization.

Research your state’s laws or consult with an estate planning attorney to ensure that your form complies with local regulations. This will help prevent any potential issues during the probate process.

Examples of Using the Property Should Your Partner Predecease You And The Provisions For Distribution Contained In

Consider a scenario where a couple owns a home and several bank accounts. If one partner predeceases the other, the surviving partner may wish to ensure that the home is passed on to their children. By completing the form, they can specify that the home should go to the children and outline how the bank accounts should be divided.

Another example could involve a couple with a business. If one partner passes away, the surviving partner may want to ensure that their share of the business is passed to a specific family member or business partner. The form allows for such specific instructions, helping to maintain the continuity of the business and protect the interests of all parties involved.

Quick guide on how to complete property should your partner predecease you and the provisions for distribution contained in

Complete Property Should Your Partner Predecease You And The Provisions For Distribution Contained In effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and safely store it online. airSlate SignNow provides all the tools you require to generate, edit, and electronically sign your documents quickly and without delays. Manage Property Should Your Partner Predecease You And The Provisions For Distribution Contained In on any device using airSlate SignNow mobile applications for Android or iOS and enhance any document-related task today.

How to modify and eSign Property Should Your Partner Predecease You And The Provisions For Distribution Contained In with ease

- Locate Property Should Your Partner Predecease You And The Provisions For Distribution Contained In and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Design your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign Property Should Your Partner Predecease You And The Provisions For Distribution Contained In and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What happens to my property should your partner predecease you?

In the event that your partner predeceases you, the distribution of your shared property will depend on the legal agreements you have in place. It is essential to have a clear understanding of the provisions for distribution contained in your will or trust to ensure that your wishes are honored.

-

How does airSlate SignNow help with estate planning documents?

airSlate SignNow simplifies the process of creating and signing estate planning documents, such as wills and powers of attorney. With our platform, you can ensure that all provisions for distribution contained in these documents are clearly outlined and securely saved.

-

Are there any costs associated with using airSlate SignNow for document eSigning?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs. Each plan is designed to provide an affordable solution for eSigning documents, which is crucial when addressing matters like property should your partner predecease you and the provisions for distribution contained in.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, document tracking, and audit trails. These features are vital for ensuring that your estate planning documents, including those that specify property should your partner predecease you and the provisions for distribution contained in, are handled efficiently.

-

Is airSlate SignNow compliant with legal standards?

Absolutely! airSlate SignNow complies with eSignature legislation, ensuring your documents are legally binding. This compliance is particularly important when creating provisions for distribution contained in your estate plans concerning property should your partner predecease you.

-

Can airSlate SignNow integrate with other business tools?

Yes, airSlate SignNow integrates seamlessly with various business applications, such as Google Drive, Salesforce, and more. This capability enhances your workflow, making it easier to manage documents related to property should your partner predecease you and the provisions for distribution contained in.

-

How secure is my information on airSlate SignNow?

Security is a top priority for airSlate SignNow. We use industry-standard encryption and secure access protocols to protect your sensitive information, particularly when dealing with provisions for distribution contained in documents about property should your partner predecease you.

Get more for Property Should Your Partner Predecease You And The Provisions For Distribution Contained In

Find out other Property Should Your Partner Predecease You And The Provisions For Distribution Contained In

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement