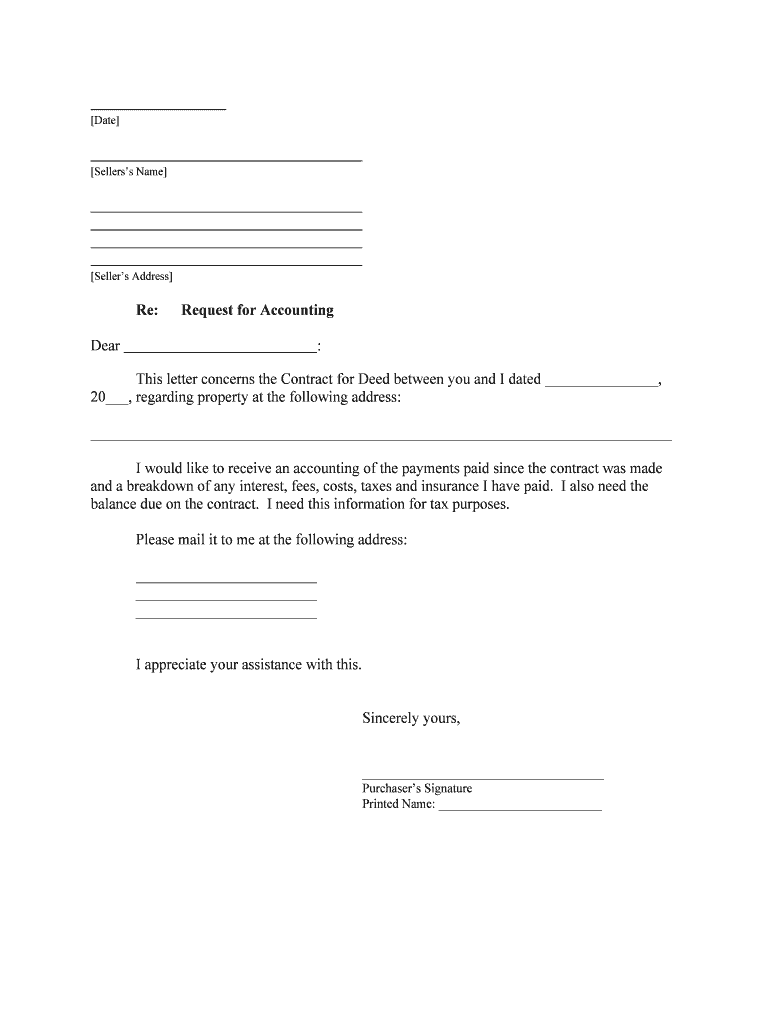

I Need This Information for Tax Purposes

What is the I Need This Information For Tax Purposes

The phrase "I Need This Information For Tax Purposes" typically refers to a request for specific data required for tax filing or compliance. This information can include income statements, deductions, credits, and other financial details necessary for accurately completing tax forms. Understanding what this information entails is crucial for individuals and businesses alike, as it ensures compliance with IRS regulations and helps avoid potential penalties.

How to use the I Need This Information For Tax Purposes

Using the information required for tax purposes involves gathering all necessary documents and data to complete your tax return accurately. This process includes collecting W-2 forms, 1099s, and any other relevant financial records. Once you have compiled this information, you can either fill out paper forms or utilize digital tools to streamline the process. Many find that using electronic filing systems simplifies the submission of their tax returns.

Steps to complete the I Need This Information For Tax Purposes

Completing the necessary information for tax purposes involves several key steps:

- Gather all relevant financial documents, such as income statements and expense records.

- Determine any deductions or credits you may qualify for.

- Choose a method for filing your taxes, whether online or via paper forms.

- If filing online, input your information into the chosen software or platform.

- Review all entries for accuracy before submission.

- Submit your completed tax return by the designated deadline.

Legal use of the I Need This Information For Tax Purposes

The legal use of information for tax purposes is governed by IRS regulations and federal law. It is essential to ensure that all data provided is accurate and truthful to avoid legal repercussions. Misrepresentation or failure to provide required information can lead to penalties, including fines or audits. Using a reliable digital signature solution can further enhance the legality of your submissions by ensuring compliance with eSignature laws.

IRS Guidelines

The IRS provides specific guidelines regarding the information required for tax purposes. Taxpayers must adhere to these guidelines to ensure that their filings are compliant. This includes understanding which forms to use, deadlines for submission, and the types of documentation needed to substantiate claims. Familiarizing yourself with these guidelines can help streamline the filing process and reduce the risk of errors.

Filing Deadlines / Important Dates

Filing deadlines are critical for ensuring compliance with tax regulations. Typically, individual tax returns are due on April fifteenth, while businesses may have different deadlines depending on their structure. Knowing these dates helps taxpayers avoid late fees and penalties. It is advisable to mark these dates on your calendar and prepare your documents well in advance to ensure timely submission.

Quick guide on how to complete i need this information for tax purposes

Effortlessly Prepare I Need This Information For Tax Purposes on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle I Need This Information For Tax Purposes on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The Easiest Way to Edit and eSign I Need This Information For Tax Purposes Seamlessly

- Locate I Need This Information For Tax Purposes and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget the hassle of lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign I Need This Information For Tax Purposes and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How can airSlate SignNow help me if I need this information for tax purposes?

airSlate SignNow allows you to securely eSign and store documents that are critical for tax purposes. You can easily access your signed documents, which can help simplify your tax filing process and ensure you have all necessary information.

-

What features does airSlate SignNow offer for document management related to taxes?

With airSlate SignNow, you can create, send, and eSign documents efficiently. Features like templates and reminders ensure that you gather all essential information for tax purposes on time, reducing stress during tax season.

-

Is airSlate SignNow a cost-effective solution for businesses that need information for tax purposes?

Yes, airSlate SignNow is designed to be a cost-effective solution. With various pricing plans, it allows businesses to choose a package that meets their needs while ensuring they have the necessary tools for collecting information essential for tax purposes.

-

What types of documents can I eSign using airSlate SignNow for tax-related needs?

You can eSign a variety of documents, including tax forms, contracts, and agreements using airSlate SignNow. This flexibility ensures that you can gather all necessary information for tax purposes efficiently.

-

How does airSlate SignNow integrate with accounting software for tax purposes?

airSlate SignNow integrates seamlessly with various accounting and financial software, allowing you to synchronize data and collect documents needed for tax purposes. This integration streamlines your workflow and ensures accuracy in your tax documentation.

-

Can I track the status of my documents eSigned through airSlate SignNow for tax documentation?

Yes, airSlate SignNow provides tracking features that let you monitor the status of your sent documents. This is particularly useful when you need this information for tax purposes, as you can ensure that all relevant documents are completed on time.

-

What security measures does airSlate SignNow implement to protect information for tax purposes?

airSlate SignNow employs industry-standard security measures such as encryption and secure cloud storage to protect your documents. This ensures that sensitive information required for tax purposes remains confidential and secure.

Get more for I Need This Information For Tax Purposes

- California franchise tax 3539 form

- Bparental guarantee formb college town properties llc

- Illinois food allergy emergency action plan wrightslaw isbe form

- Nps form 10 930

- Ttb f 52206 form 5847350

- Northampton community college withdrawal form

- Restriction removal notification form

- Founder equity agreement template form

Find out other I Need This Information For Tax Purposes

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF