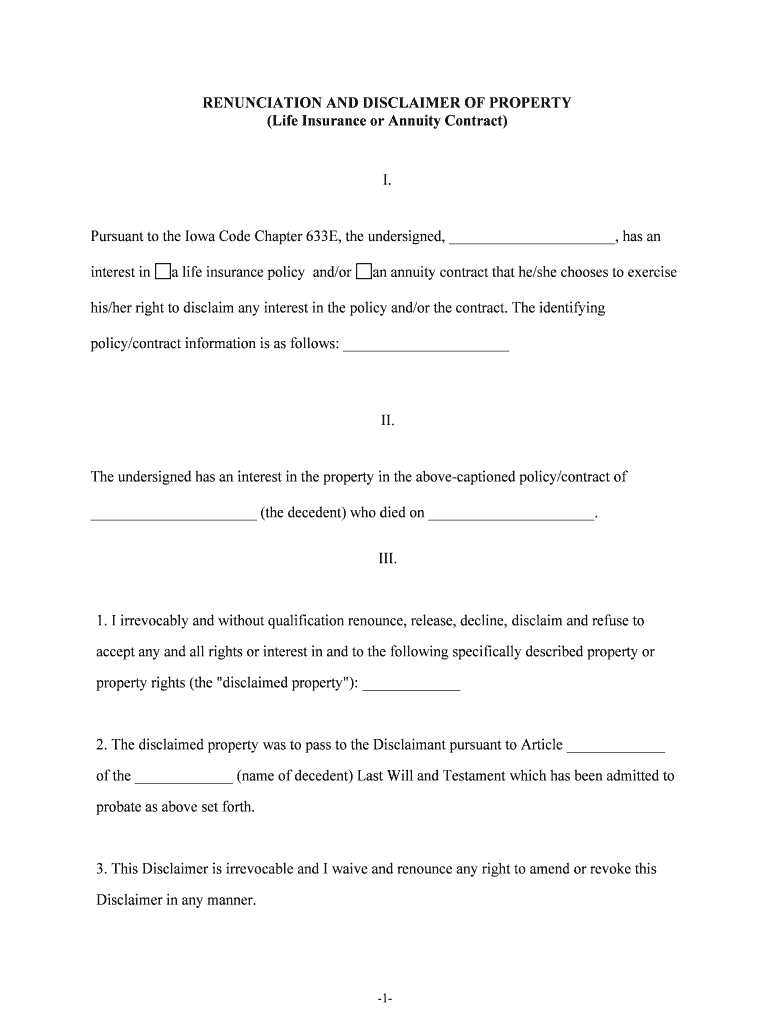

Life Insurance or Annuity Contract Form

What is the Life Insurance Or Annuity Contract

A life insurance contract is a legal agreement between an insurer and an individual, providing financial protection to beneficiaries upon the insured's death. An annuity contract, on the other hand, is designed to provide a steady income stream, typically during retirement. Both contracts serve distinct purposes, yet they can complement each other in financial planning. Understanding the differences and benefits of each can help individuals make informed decisions about their financial future.

How to use the Life Insurance Or Annuity Contract

Using a life insurance or annuity contract involves several steps, starting with assessing personal financial needs and goals. Individuals should evaluate their current financial situation, including debts, savings, and future expenses. Once goals are established, selecting the appropriate type of coverage or investment is crucial. After choosing a policy, completing the application process accurately and thoroughly is essential to ensure that the contract is valid and effective.

Steps to complete the Life Insurance Or Annuity Contract

Completing a life insurance or annuity contract involves specific steps to ensure accuracy and compliance. Begin by gathering necessary personal information, such as identification, financial details, and health history. Next, fill out the application form carefully, ensuring all sections are completed. After submitting the application, the insurer may require additional documentation or medical examinations. Finally, review the policy terms and conditions before signing to confirm understanding and agreement.

Legal use of the Life Insurance Or Annuity Contract

The legal use of a life insurance or annuity contract is governed by state and federal regulations. Each contract must meet specific legal requirements to be enforceable. This includes clear terms regarding coverage, premiums, and benefits. Additionally, both parties must sign the contract to validate it legally. Understanding these legal aspects is crucial for policyholders to ensure their rights and obligations are protected.

Key elements of the Life Insurance Or Annuity Contract

Key elements of a life insurance or annuity contract include the policyholder's information, coverage details, premium amounts, and beneficiary designations. For life insurance, the death benefit amount and terms of payout are critical components. In annuity contracts, the payment schedule, interest rates, and withdrawal options are essential. Understanding these elements helps individuals assess their policies and make informed decisions regarding their financial planning.

Eligibility Criteria

Eligibility criteria for life insurance or annuity contracts vary by provider and policy type. Generally, applicants must meet age requirements, provide personal and financial information, and undergo health assessments. Some policies may have specific conditions based on lifestyle choices, such as smoking or hazardous occupations. Understanding these criteria is important for individuals seeking to obtain coverage or investment options that align with their needs.

Application Process & Approval Time

The application process for life insurance or annuity contracts typically involves submitting an application form, providing necessary documentation, and possibly undergoing a medical examination. Approval times can vary based on the insurer and the complexity of the application. Generally, straightforward applications may receive approval within a few days, while more complex cases can take several weeks. Staying informed about the application process helps applicants manage their expectations and plan accordingly.

Quick guide on how to complete life insurance or annuity contract

Complete Life Insurance Or Annuity Contract effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it on the internet. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Life Insurance Or Annuity Contract on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign Life Insurance Or Annuity Contract with ease

- Locate Life Insurance Or Annuity Contract and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Revise and electronically sign Life Insurance Or Annuity Contract to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the difference between a Life Insurance Or Annuity Contract?

A Life Insurance Or Annuity Contract serves different purposes: life insurance provides financial protection to beneficiaries upon the policyholder's death, while annuities are designed for retirement income. Understanding the distinctions can help you decide which option better suits your financial goals.

-

How do I know if I need a Life Insurance Or Annuity Contract?

Your financial situation and life goals can help determine whether a Life Insurance Or Annuity Contract is right for you. Consider factors such as dependents, retirement plans, and overall financial security when making your decision.

-

What are the typical costs associated with obtaining a Life Insurance Or Annuity Contract?

The costs of a Life Insurance Or Annuity Contract can vary widely based on factors like age, health, and the type of coverage desired. It's essential to compare quotes and consider your long-term financial needs to find the best option.

-

What benefits do I gain from signing a Life Insurance Or Annuity Contract?

A Life Insurance Or Annuity Contract provides financial security, ensuring that your loved ones are protected after your passing, or offering a steady income during retirement. These contracts can help you achieve peace of mind and long-term financial stability.

-

Can I customize my Life Insurance Or Annuity Contract to fit my needs?

Yes, many providers offer customizable Life Insurance Or Annuity Contracts that allow you to tailor coverage options to your specific requirements. You can select features such as coverage amounts and additional riders to enhance your policy's benefits.

-

How do I integrate a Life Insurance Or Annuity Contract into my financial plan?

Integrating a Life Insurance Or Annuity Contract into your financial plan involves assessing your current assets and future needs. Consider working with a financial advisor who can help you evaluate how these contracts fit into your long-term strategy for wealth management.

-

What features should I look for in a Life Insurance Or Annuity Contract?

When selecting a Life Insurance Or Annuity Contract, look for features such as flexibility, suitable payout options, and additional benefits like accelerated death benefits. Understanding these features will help ensure that your policy aligns with your financial objectives.

Get more for Life Insurance Or Annuity Contract

- Brat diet eating after an upset stomach or vomiting familydoctor org form

- Little league baseball game pitch log ll production uploads form

- Kmf application no form

- Bronx community college transcripts form

- Walsall council postal vote form

- Irs form 3520 instructions

- Manager managed llc operating agreement template form

- Manager managed operating agreement template form

Find out other Life Insurance Or Annuity Contract

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile