Lender Lien Holder Form

What is the Lender Lien Holder

The lender lien holder refers to an entity or individual that has a legal claim or interest in a property due to a loan. This status typically arises when a borrower secures financing to purchase real estate, and the lender retains a lien on the property until the loan is repaid. The lien serves as collateral, allowing the lender to reclaim the property if the borrower defaults on the loan. Understanding the role of a lender lien holder is crucial for both borrowers and lenders, as it outlines the rights and responsibilities associated with the loan agreement.

How to Use the Lender Lien Holder

Utilizing the lender lien holder form involves several key steps. First, ensure that you have the correct version of the form, which can typically be obtained from the lender or relevant financial institution. Next, gather all necessary information, including details about the property, the borrower, and the loan terms. Once you have completed the form, it should be signed by both parties to validate the agreement. It is advisable to keep a copy of the signed document for your records, as it serves as proof of the lien holder's interest in the property.

Steps to Complete the Lender Lien Holder

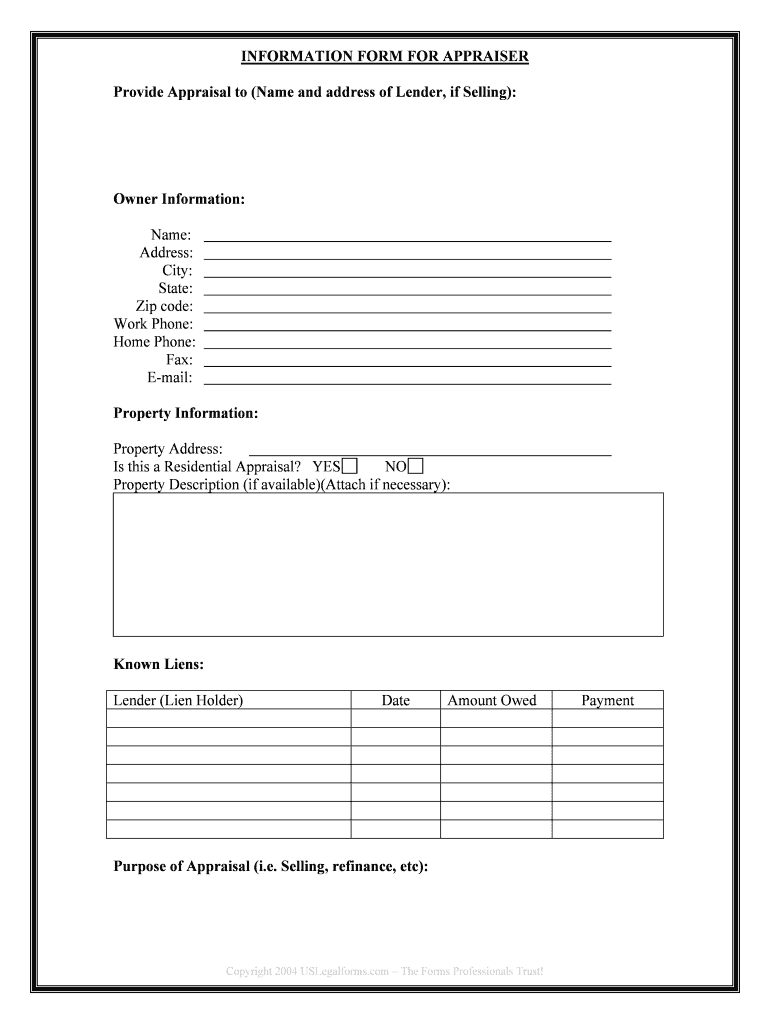

Completing the lender lien holder form requires careful attention to detail. Follow these steps to ensure accuracy:

- Obtain the form from your lender or financial institution.

- Fill in the borrower's information, including their full name and address.

- Provide details about the property, such as the address and legal description.

- Include the loan amount and any relevant terms associated with the loan.

- Sign and date the form, ensuring that all parties involved do the same.

- Make copies for your records and submit the original to the appropriate authority.

Legal Use of the Lender Lien Holder

The legal use of the lender lien holder form is governed by state and federal laws. It is essential that the form is filled out correctly to ensure its enforceability in a court of law. The lender must have a legitimate interest in the property, and the borrower must acknowledge the lien through their signature. Compliance with the Uniform Commercial Code (UCC) and other relevant regulations is necessary to uphold the legality of the lien. This ensures that the lender's rights are protected in the event of default.

Key Elements of the Lender Lien Holder

Several key elements define the lender lien holder form. These include:

- The names and addresses of the borrower and lender.

- A detailed description of the property being financed.

- The loan amount and interest rate.

- The terms of repayment, including due dates and penalties for late payments.

- Signatures of all parties involved, indicating their consent to the terms.

State-Specific Rules for the Lender Lien Holder

Each state in the U.S. may have specific rules and regulations regarding lender lien holders. It is important to be aware of these variations, as they can affect the validity and enforcement of the lien. For instance, some states may require additional documentation or specific language to be included in the lien holder form. Consulting with a legal professional or the appropriate state agency can provide clarity on these requirements and help ensure compliance.

Quick guide on how to complete lender lien holder

Effortlessly Prepare Lender Lien Holder on Any Device

The management of online documents has gained signNow traction among businesses and individuals. It offers an ideal environmentally conscious substitute for conventional printed and signed documents, as you can easily locate the correct form and securely archive it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without any complications. Manage Lender Lien Holder on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to Modify and Electronically Sign Lender Lien Holder with Ease

- Obtain Lender Lien Holder and click Get Form to begin.

- Employ the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information using tools that are specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in a few clicks from your chosen device. Modify and electronically sign Lender Lien Holder and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Lender Lien Holder in the context of airSlate SignNow?

A Lender Lien Holder refers to a financial institution or lender that has a legal right to pursue a property if the borrower defaults on a loan. With airSlate SignNow, these entities can streamline document signing and management, simplifying their processes and ensuring compliance with loan agreements.

-

How does airSlate SignNow benefit Lender Lien Holders?

airSlate SignNow provides Lender Lien Holders with an efficient platform for sending and eSigning vital documents. This reduces turnaround time and enhances the overall borrower experience, making it easier for lenders to handle transactions securely and effectively.

-

What features does airSlate SignNow offer for Lender Lien Holders?

Key features of airSlate SignNow for Lender Lien Holders include customizable document templates, advanced security options, and tracking capabilities for document status. These features help lenders manage their obligations and maintain compliance effortlessly.

-

Is airSlate SignNow cost-effective for Lender Lien Holders?

Yes, airSlate SignNow offers competitive pricing plans suitable for Lender Lien Holders of all sizes. By utilizing this solution, lenders can save on administrative costs while improving the efficiency of their document processes.

-

Can Lender Lien Holders integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow allows Lender Lien Holders to integrate seamlessly with various software applications, enhancing their existing workflow. This integration empowers lenders to connect their document management processes with CRM systems, banking software, and more.

-

How does airSlate SignNow ensure the security of documents for Lender Lien Holders?

airSlate SignNow employs advanced encryption and authentication measures to protect the sensitive information of Lender Lien Holders. These security protocols ensure that all electronic signatures and documents remain confidential and legally binding.

-

What is the onboarding process for Lender Lien Holders using airSlate SignNow?

The onboarding process for Lender Lien Holders is user-friendly and straightforward. After signing up, lenders can access tutorials and guides to quickly familiarize themselves with the platform, ensuring they can start eSigning and managing documents effectively in no time.

Get more for Lender Lien Holder

- Income tax forms department of taxation and finance ny gov

- Title and registration oregon department of transportation odot state or form

- Osap family breakdown letter sample form

- Pre possession agreement form

- 91 crossword puzzle answers form

- Gpf final payment form

- Mascotapplication 14 15doc doc form

- California state university nonresident tuition ex form

Find out other Lender Lien Holder

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form