Section 394 610 Right to Disclaim Succession, Ky Rev Stat Form

What is the Section 394 610 Right To Disclaim Succession, Ky Rev Stat

The Section 394 610 Right To Disclaim Succession under Kentucky Revised Statutes provides individuals the legal ability to refuse inheritance of property or assets from a deceased person. This statute allows heirs to formally decline their share of an estate, preventing any associated liabilities or obligations that may come with the inheritance. By disclaiming succession, individuals can ensure that they are not held responsible for debts or other encumbrances tied to the inherited property.

How to use the Section 394 610 Right To Disclaim Succession, Ky Rev Stat

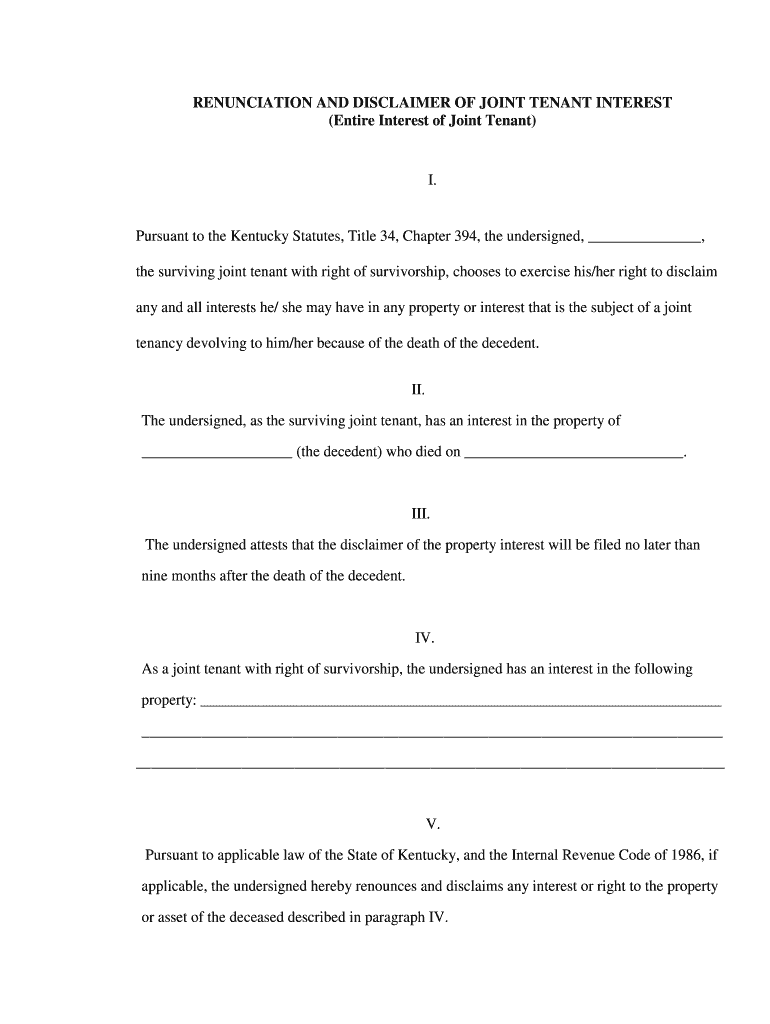

To utilize the Section 394 610 Right To Disclaim Succession, individuals must complete a formal disclaimer document. This document should clearly state the intent to disclaim the inheritance and must be signed by the disclaimant. It is essential to ensure that the disclaimer is filed within the legally prescribed time frame, typically nine months from the date of the decedent's death. Once filed, the disclaimer effectively transfers the inheritance to the next eligible beneficiary, as if the disclaimant had predeceased the decedent.

Steps to complete the Section 394 610 Right To Disclaim Succession, Ky Rev Stat

Completing the Section 394 610 Right To Disclaim Succession involves several key steps:

- Review the estate documents to understand the inheritance details.

- Prepare the disclaimer document, ensuring it includes necessary information such as the decedent's name, the disclaimant's name, and a clear statement of intent.

- Sign the disclaimer in the presence of a notary public, if required.

- File the completed disclaimer with the appropriate court or estate administrator within the specified time limit.

- Keep a copy of the filed disclaimer for personal records.

Key elements of the Section 394 610 Right To Disclaim Succession, Ky Rev Stat

Several key elements define the Section 394 610 Right To Disclaim Succession:

- The disclaimer must be in writing and signed by the individual disclaiming the inheritance.

- The disclaimer should specify the property or interest being disclaimed.

- It must be filed within nine months of the decedent's death to be valid.

- Individuals must not have accepted any benefits from the inheritance prior to filing the disclaimer.

- The disclaimer is irrevocable once filed, meaning the individual cannot later change their decision.

Legal use of the Section 394 610 Right To Disclaim Succession, Ky Rev Stat

The legal use of the Section 394 610 Right To Disclaim Succession is crucial for individuals wishing to avoid potential financial burdens associated with an inheritance. By formally disclaiming, individuals can protect themselves from debts linked to the estate and ensure that the property is redistributed according to the laws of intestacy or the decedent's will. This legal provision serves as a protective measure, allowing individuals to make informed decisions about their inheritance rights.

Eligibility Criteria

To be eligible to use the Section 394 610 Right To Disclaim Succession, individuals must meet certain criteria:

- They must be a legal heir or beneficiary under the decedent's will or the laws of intestacy.

- The disclaimer must be executed within the nine-month period following the decedent's death.

- Individuals must not have accepted any part of the inheritance, including property or financial benefits.

Quick guide on how to complete section 394610 right to disclaim succession ky rev stat

Prepare Section 394 610 Right To Disclaim Succession, Ky Rev Stat effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a great environmentally friendly substitute for traditional printed and signed papers, as you can easily access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Section 394 610 Right To Disclaim Succession, Ky Rev Stat on any device using the airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

The simplest method to modify and eSign Section 394 610 Right To Disclaim Succession, Ky Rev Stat with ease

- Locate Section 394 610 Right To Disclaim Succession, Ky Rev Stat and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, either by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Section 394 610 Right To Disclaim Succession, Ky Rev Stat and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Section 394 610 Right To Disclaim Succession, Ky Rev Stat.?

Section 394 610 Right To Disclaim Succession, Ky Rev Stat. provides individuals the legal right to refuse an inheritance or bequest. This statute helps simplify the succession process by allowing disclaimers, thereby reducing potential tax liabilities and facilitating a more efficient distribution of assets.

-

How can airSlate SignNow assist with documents related to Section 394 610 Right To Disclaim Succession, Ky Rev Stat.?

airSlate SignNow offers a streamlined platform for drafting and electronically signing documents concerning Section 394 610 Right To Disclaim Succession, Ky Rev Stat. Our user-friendly interface ensures that necessary disclaimers can be executed quickly and securely, making the legal process smoother for all parties involved.

-

What pricing options does airSlate SignNow offer for document signing services?

airSlate SignNow provides affordable pricing plans tailored to various business needs. All our plans include features that support compliance with laws, including those related to Section 394 610 Right To Disclaim Succession, Ky Rev Stat., making it easy for users to manage their document processes effectively.

-

What are the key features of airSlate SignNow that relate to succession planning?

Key features of airSlate SignNow include robust electronic signature capabilities, document templates, and secure document storage. These features are particularly beneficial for managing succession documents, including those relevant to Section 394 610 Right To Disclaim Succession, Ky Rev Stat., ensuring that users can handle their legal obligations with ease.

-

Can airSlate SignNow help in integrating with other applications for managing succession documents?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your document management workflow. By integrating with platforms used in succession planning and legal contexts, users can efficiently handle processes involving Section 394 610 Right To Disclaim Succession, Ky Rev Stat., while keeping all pertinent information in one place.

-

How does airSlate SignNow ensure the security of documents concerning Section 394 610 Right To Disclaim Succession, Ky Rev Stat.?

airSlate SignNow prioritizes document security with advanced encryption and compliance with industry standards. When dealing with legal documents related to Section 394 610 Right To Disclaim Succession, Ky Rev Stat., users can trust that their information is protected and only accessible to authorized individuals.

-

What benefits does airSlate SignNow provide for users managing legal disclaimers?

Using airSlate SignNow simplifies the creation and signing of legal disclaimers, which is critical for claims under Section 394 610 Right To Disclaim Succession, Ky Rev Stat. Our platform enhances productivity, ensures legal compliance, and reduces turnaround times, allowing users to focus on other vital aspects of their succession planning.

Get more for Section 394 610 Right To Disclaim Succession, Ky Rev Stat

- Mcknet form

- Ach information form

- My written statement of facts form

- Child care services wage verification form workforce wfsolutions

- Memorandum of sale template word form

- Form 1040 nr u s nonresident alien income tax return

- S corporation income tax department of revenue form

- Form 1120 f u s income tax return of a foreign corporation

Find out other Section 394 610 Right To Disclaim Succession, Ky Rev Stat

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later