Internal Revenue Code, for a Certificate of Discharge Form

Understanding the Internal Revenue Code for a Certificate of Discharge

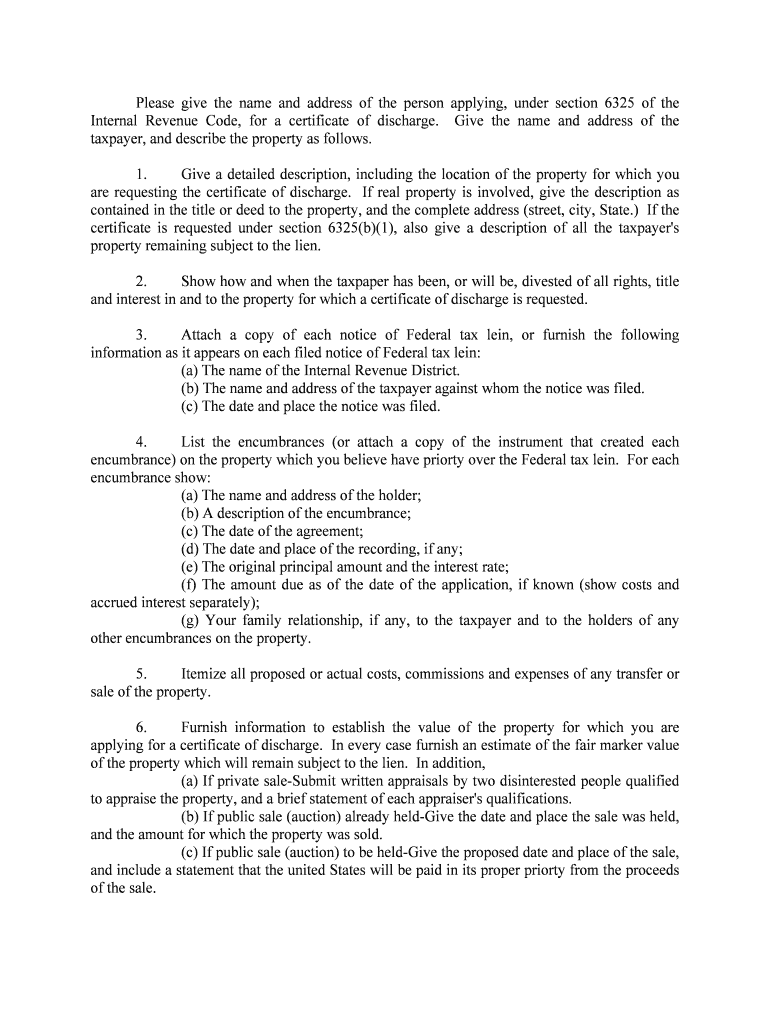

The Internal Revenue Code for a Certificate of Discharge is a crucial document that allows taxpayers to formally request the release of a federal tax lien. This form is essential for individuals or businesses who have settled their tax debts and wish to clear their financial records. The certificate signifies that the IRS acknowledges the payment of the tax liability, thus enabling the taxpayer to move forward without the burden of the lien. Understanding this code is vital for ensuring compliance and protecting one’s financial standing.

Steps to Complete the Internal Revenue Code for a Certificate of Discharge

Completing the Internal Revenue Code for a Certificate of Discharge involves several key steps:

- Gather necessary documentation, including proof of payment for the tax liability.

- Fill out the required form accurately, ensuring all information is correct to avoid delays.

- Submit the form to the appropriate IRS office, either online or via mail, depending on your preference.

- Monitor the status of your application to ensure timely processing.

Following these steps carefully can help facilitate a smooth discharge process.

Legal Use of the Internal Revenue Code for a Certificate of Discharge

The legal use of the Internal Revenue Code for a Certificate of Discharge is governed by specific IRS regulations. This form is legally binding once properly filled out and submitted, provided that all conditions for discharge are met. It is essential to ensure that all documentation is accurate and complete to avoid potential legal issues. Additionally, understanding the implications of the discharge on future financial transactions is crucial for compliance with federal tax laws.

Required Documents for the Internal Revenue Code for a Certificate of Discharge

To successfully file for a Certificate of Discharge, several documents are typically required:

- Proof of payment for the tax liability, such as receipts or bank statements.

- Identification information, including your Social Security number or Employer Identification Number.

- Any previous correspondence with the IRS regarding the tax lien.

Having these documents ready can expedite the process and ensure that your application is complete.

IRS Guidelines for the Internal Revenue Code for a Certificate of Discharge

The IRS provides specific guidelines for the use of the Internal Revenue Code for a Certificate of Discharge. These guidelines outline the eligibility criteria, required forms, and submission processes. It is important to review these guidelines thoroughly to ensure compliance and to understand the implications of the discharge. Familiarizing yourself with IRS expectations can help prevent errors and facilitate a smoother process.

Eligibility Criteria for the Internal Revenue Code for a Certificate of Discharge

Eligibility for the Internal Revenue Code for a Certificate of Discharge typically includes:

- Full payment of the tax liability associated with the lien.

- Compliance with all IRS regulations and guidelines.

- Submission of all required documentation and forms.

Meeting these criteria is essential for obtaining a successful discharge and ensuring that your financial records are clear of any tax liens.

Quick guide on how to complete internal revenue code for a certificate of discharge

Complete Internal Revenue Code, For A Certificate Of Discharge smoothly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Internal Revenue Code, For A Certificate Of Discharge on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Internal Revenue Code, For A Certificate Of Discharge with ease

- Locate Internal Revenue Code, For A Certificate Of Discharge and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced paperwork, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Modify and eSign Internal Revenue Code, For A Certificate Of Discharge and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Internal Revenue Code, For A Certificate Of Discharge?

The Internal Revenue Code, For A Certificate Of Discharge, refers to the IRS regulations governing the discharge of federal tax liens. It's vital for businesses to understand these codes to ensure compliance and avoid legal issues. airSlate SignNow simplifies the documentation process required for this discharge.

-

How can airSlate SignNow help with the Internal Revenue Code, For A Certificate Of Discharge?

airSlate SignNow offers an intuitive platform that allows you to quickly prepare and eSign the necessary documents related to the Internal Revenue Code, For A Certificate Of Discharge. This streamlines your workflow and reduces the time you spend on paperwork, helping you focus on what matters most—growing your business.

-

What are the pricing options for airSlate SignNow when dealing with IRS document management?

airSlate SignNow provides flexible pricing models that cater to businesses of all sizes. You can select a plan that meets your needs, whether you're working on documents related to the Internal Revenue Code, For A Certificate Of Discharge or any other tasks. Detailed pricing can be found on our website.

-

What features does airSlate SignNow offer for managing IRS forms?

airSlate SignNow includes robust features such as document templates, real-time collaboration, and secure eSigning, all tailored for IRS forms including those tied to the Internal Revenue Code, For A Certificate Of Discharge. These features ensure that your documentation is efficient and compliant.

-

Can I integrate airSlate SignNow with my existing software for tax management?

Yes, airSlate SignNow offers various integrations that allow you to connect with your existing software tools for seamless tax management. This can be particularly beneficial when handling documents related to the Internal Revenue Code, For A Certificate Of Discharge, ensuring all your systems work harmoniously.

-

Is airSlate SignNow secure for submitting IRS-related documents?

Absolutely! airSlate SignNow prioritizes security and uses top-tier encryption protocols to protect your documents, including those related to the Internal Revenue Code, For A Certificate Of Discharge. This ensures that sensitive data remains confidential and secure throughout the signing process.

-

How can I get started with airSlate SignNow for IRS document preparation?

Getting started with airSlate SignNow is easy! Simply visit our website to sign up for an account and explore our user-friendly platform. You'll be ready to handle your documents related to the Internal Revenue Code, For A Certificate Of Discharge in no time.

Find out other Internal Revenue Code, For A Certificate Of Discharge

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement