Any Amounts Not Paid When Due Shall Bear Interest at the Rate of 1 % Per Month until Paid Form

Understanding the Any Amounts Not Paid When Due Shall Bear Interest At The Rate Of 1 % Per Month Until Paid

The phrase "Any amounts not paid when due shall bear interest at the rate of 1 % per month until paid" refers to a financial stipulation often included in contracts or agreements. This clause indicates that if a payment is not made by its due date, it will accrue interest at a rate of one percent per month. This interest continues to accumulate until the outstanding amount is fully paid. It serves as a deterrent against late payments and provides a clear financial consequence for failing to meet payment obligations.

Steps to Complete the Any Amounts Not Paid When Due Shall Bear Interest At The Rate Of 1 % Per Month Until Paid

Completing the form related to this financial clause involves several key steps:

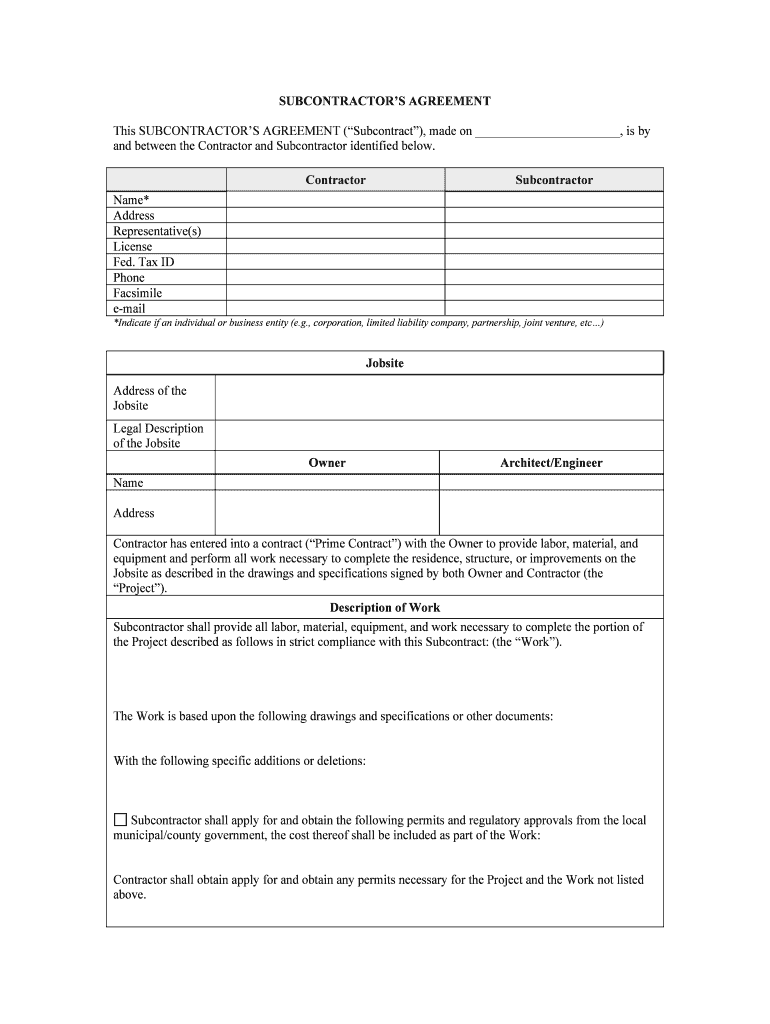

- Gather necessary information such as the names of the parties involved, payment amounts, and due dates.

- Clearly state the payment terms, including the interest rate of one percent per month for late payments.

- Ensure all parties review the terms to avoid misunderstandings.

- Use a reliable electronic signature platform to sign the document, ensuring compliance with legal standards.

- Store the signed document securely for future reference.

Legal Use of the Any Amounts Not Paid When Due Shall Bear Interest At The Rate Of 1 % Per Month Until Paid

This clause is legally enforceable in the United States, provided it is clearly stated in a written agreement. It is important that both parties understand and agree to the terms. The inclusion of this clause helps protect the interests of the party expecting payment, as it establishes a clear consequence for non-compliance. To ensure enforceability, it is advisable to consult legal counsel when drafting agreements that include this stipulation.

Key Elements of the Any Amounts Not Paid When Due Shall Bear Interest At The Rate Of 1 % Per Month Until Paid

Several key elements should be included in the agreement:

- The exact interest rate applied to late payments, specified as one percent per month.

- The timeframe for when payments are considered overdue.

- Details regarding how interest will be calculated and applied to the outstanding balance.

- Any applicable fees or additional charges related to late payments.

- Provisions for dispute resolution should disagreements arise regarding payment terms.

Examples of Using the Any Amounts Not Paid When Due Shall Bear Interest At The Rate Of 1 % Per Month Until Paid

This clause can be applied in various scenarios, such as:

- A service agreement between a contractor and a client, where timely payment is critical for ongoing work.

- A lease agreement where tenants are responsible for monthly rent payments.

- Sales contracts for goods where payment terms are established upfront.

In each case, the clause serves to encourage timely payments and provides a clear financial implication for delays.

State-Specific Rules for the Any Amounts Not Paid When Due Shall Bear Interest At The Rate Of 1 % Per Month Until Paid

While this clause is generally enforceable across the United States, specific state laws may affect its application. Some states have regulations regarding maximum allowable interest rates or requirements for how such clauses must be presented in contracts. It is essential to be aware of local laws to ensure compliance and enforceability. Consulting with a legal professional familiar with state-specific regulations can help clarify any concerns.

Quick guide on how to complete any amounts not paid when due shall bear interest at the rate of 1 per month until paid

Complete Any Amounts Not Paid When Due Shall Bear Interest At The Rate Of 1 % Per Month Until Paid seamlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Any Amounts Not Paid When Due Shall Bear Interest At The Rate Of 1 % Per Month Until Paid on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Any Amounts Not Paid When Due Shall Bear Interest At The Rate Of 1 % Per Month Until Paid effortlessly

- Find Any Amounts Not Paid When Due Shall Bear Interest At The Rate Of 1 % Per Month Until Paid and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information carefully and click the Done button to confirm your changes.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Any Amounts Not Paid When Due Shall Bear Interest At The Rate Of 1 % Per Month Until Paid and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What happens if a payment is missed after the due date?

Any amounts not paid when due shall bear interest at the rate of 1% per month until paid. This means that late payments will accrue interest, making it essential to stay on top of your billing. To avoid additional charges, we recommend utilizing our automated reminders for upcoming payment due dates.

-

How does airSlate SignNow handle document security?

At airSlate SignNow, your documents are secure with advanced encryption and authentication measures. Given that any amounts not paid when due shall bear interest at the rate of 1% per month until paid, protecting your digital transactions is a priority. You can trust our platform to safeguard your sensitive information while ensuring compliance.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow simplifies your document management process, allowing you to eSign legally-binding documents quickly and securely. Remember, any amounts not paid when due shall bear interest at the rate of 1% per month until paid, so timely processing is crucial. This not only saves time but also enhances your operational efficiency.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow integrates seamlessly with various software applications, including CRM, project management, and accounting tools. This enhances your workflow and helps manage your finances, especially considering that any amounts not paid when due shall bear interest at the rate of 1% per month until paid. Integrating these tools allows for better tracking and management of your obligations.

-

What pricing plans does airSlate SignNow offer?

We offer flexible pricing plans tailored to meet the needs of businesses of all sizes. It’s important to note that any amounts not paid when due shall bear interest at the rate of 1% per month until paid, so choose a plan that aligns with your budget. Detailed information is available on our website to help you make an informed decision.

-

Is airSlate SignNow user-friendly for new users?

Absolutely! airSlate SignNow is designed to be intuitive and easy to navigate, making it perfect for both tech-savvy users and beginners. Given that any amounts not paid when due shall bear interest at the rate of 1% per month until paid, a streamlined process can help prevent delays and ensure timely transactions.

-

Are there any mobile features in airSlate SignNow?

Yes, our mobile application allows you to send and sign documents on the go, ensuring that you're never locked out of your workflow. With features integrated directly into your mobile device, you can keep track of your obligations since any amounts not paid when due shall bear interest at the rate of 1% per month until paid. This flexibility is ideal for busy professionals.

Get more for Any Amounts Not Paid When Due Shall Bear Interest At The Rate Of 1 % Per Month Until Paid

- Do i need to file form 8938 statement of specified irs

- Este formulario aparece en color irs

- 2018 instructions for form 8829 instructions for form 8829 expenses for business use of your home

- 2012 instructions 2018 2019 form

- Irs 8938 instructions form 2018 2019

- Form it 2142019claim for real property tax credit for homeowners and rentersit214

- Enhanced form it 2 summary of w 2 statements taxnygov

- Form it 2012019resident income tax return taxnygov

Find out other Any Amounts Not Paid When Due Shall Bear Interest At The Rate Of 1 % Per Month Until Paid

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe