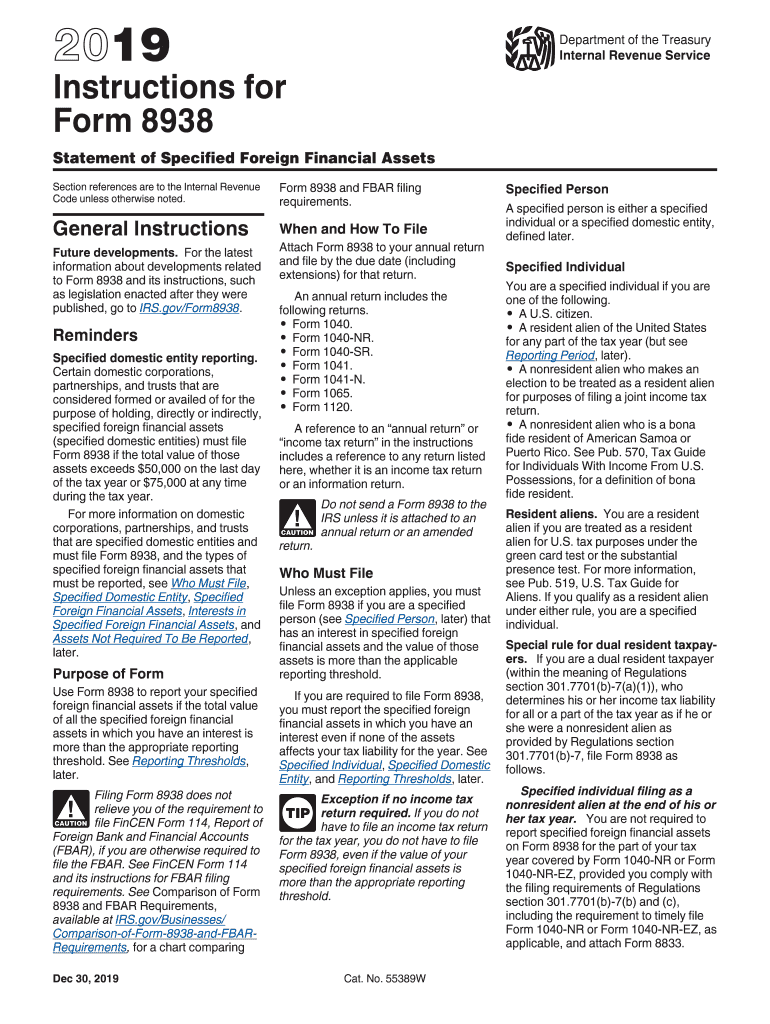

Irs 8938 Instructions 2019

What is the IRS 8938 Instructions?

The IRS 8938 instructions provide guidance for taxpayers who are required to report specified foreign financial assets. This form is part of the Foreign Account Tax Compliance Act (FATCA) and is used by U.S. taxpayers to disclose foreign assets to the Internal Revenue Service (IRS). The form is essential for individuals who meet specific thresholds for foreign financial assets, ensuring compliance with U.S. tax laws.

Steps to Complete the IRS 8938 Instructions

Completing the IRS 8938 form involves several key steps:

- Gather Information: Collect details about your foreign financial assets, including bank accounts, stocks, and other investments.

- Determine Reporting Thresholds: Understand the asset thresholds that apply to your filing status and residency.

- Fill Out the Form: Accurately complete the form by entering required information about each asset, including the maximum value during the year.

- Review for Accuracy: Double-check all entries to ensure compliance and accuracy before submission.

- Submit the Form: File the completed form with your annual tax return, ensuring it is submitted by the deadline.

Legal Use of the IRS 8938 Instructions

The IRS 8938 instructions are legally binding and must be followed to ensure compliance with U.S. tax regulations. Failure to accurately report foreign financial assets can lead to significant penalties. The form must be completed in accordance with the guidelines set forth by the IRS, which outline the necessary information and documentation required for proper submission.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the IRS 8938 form. The form is typically due on the same date as your federal income tax return, including extensions. For most taxpayers, this means the form is due on April fifteenth, unless that date falls on a weekend or holiday, in which case the due date may be adjusted. It is crucial to keep track of these deadlines to avoid penalties for late filing.

Required Documents

To complete the IRS 8938 form, you will need several documents, including:

- Account statements for foreign financial accounts.

- Documentation of foreign assets, such as investment statements or property deeds.

- Tax identification numbers for foreign financial institutions, if applicable.

Having these documents ready will facilitate the completion of the form and ensure accurate reporting.

Penalties for Non-Compliance

Non-compliance with the IRS 8938 reporting requirements can result in severe penalties. Taxpayers who fail to file the form when required may face a penalty of up to $10,000. Additionally, continued failure to report can lead to further penalties, which may accumulate over time. It is essential to understand these consequences to ensure compliance and avoid unnecessary financial burdens.

Quick guide on how to complete do i need to file form 8938 statement of specified irs

Complete Irs 8938 Instructions seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources essential to create, modify, and eSign your documents swiftly without delays. Handle Irs 8938 Instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Irs 8938 Instructions effortlessly

- Locate Irs 8938 Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key parts of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select how you'd like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Irs 8938 Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct do i need to file form 8938 statement of specified irs

Create this form in 5 minutes!

How to create an eSignature for the do i need to file form 8938 statement of specified irs

How to create an electronic signature for the Do I Need To File Form 8938 Statement Of Specified Irs online

How to generate an eSignature for your Do I Need To File Form 8938 Statement Of Specified Irs in Chrome

How to create an eSignature for signing the Do I Need To File Form 8938 Statement Of Specified Irs in Gmail

How to generate an eSignature for the Do I Need To File Form 8938 Statement Of Specified Irs from your smartphone

How to make an eSignature for the Do I Need To File Form 8938 Statement Of Specified Irs on iOS devices

How to generate an eSignature for the Do I Need To File Form 8938 Statement Of Specified Irs on Android OS

People also ask

-

What is the 8938 form 2016 no No Download Needed needed?

The 8938 form 2016 no No Download Needed needed is a tax form required by the IRS for reporting specified foreign financial assets. It is crucial for U.S. taxpayers with a signNow foreign asset portfolio. Using airSlate SignNow, you can easily manage and eSign this form without any downloads.

-

How can airSlate SignNow help me with the 8938 form 2016 no No Download Needed needed?

airSlate SignNow provides a seamless platform for completing and eSigning the 8938 form 2016 no No Download Needed needed. With its cloud-based solution, you can access the form from anywhere and ensure that your sensitive information is securely handled. Streamlining your workflow has never been easier.

-

Is there any cost associated with using airSlate SignNow for the 8938 form 2016 no No Download Needed needed?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs. You can choose a plan that allows you to efficiently manage and eSign the 8938 form 2016 no No Download Needed needed at a cost-effective rate. Check our website for the latest pricing details.

-

Can I integrate airSlate SignNow with other applications for the 8938 form 2016 no No Download Needed needed?

Absolutely! airSlate SignNow can be easily integrated with popular applications such as Google Drive and signNow. This integration allows you to manage the 8938 form 2016 no No Download Needed needed smoothly alongside your other business tools, boosting your productivity.

-

What features does airSlate SignNow offer for the 8938 form 2016 no No Download Needed needed?

AirSlate SignNow offers features like reusable templates, real-time collaboration, and secure cloud storage, which enhance the experience of handling the 8938 form 2016 no No Download Needed needed. These tools simplify the eSigning process, making it easy for users to share and receive documents efficiently.

-

How secure is the airSlate SignNow platform for handling the 8938 form 2016 no No Download Needed needed?

Security is a top priority at airSlate SignNow. The platform uses bank-level encryption to ensure your data remains safe while handling the 8938 form 2016 no No Download Needed needed. You can sign and store your documents with peace of mind.

-

Can I access the 8938 form 2016 no No Download Needed needed on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is optimized for mobile devices, allowing you to access and eSign the 8938 form 2016 no No Download Needed needed from anywhere, at any time. This mobile support ensures that your documentation process is flexible and convenient, catering to your on-the-go needs.

Get more for Irs 8938 Instructions

- Heath center physical exam form army and navy academy armyandnavyacademy

- Example of emergency contacts canadian form staff ncyf

- Form 2447pdffillercom

- First energy retired employees direct deposit form

- Enrollmentchange form delta dental of arkansas

- Employee change bformsb luderman amp konst inc

- Carrier broker agreement form

- Rcoc sir form

Find out other Irs 8938 Instructions

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word