Form 8938 Fill Online 2018

What is the Form 8938 Fill Online

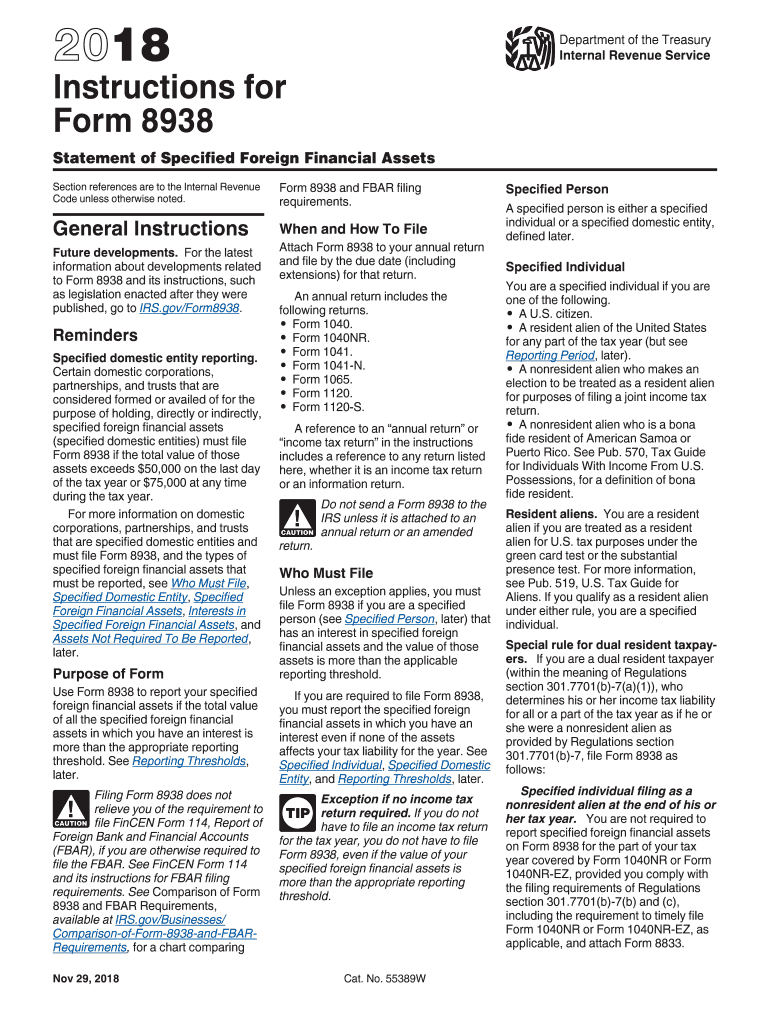

The Form 8938, officially known as the Statement of Specified Foreign Financial Assets, is a tax form required by the Internal Revenue Service (IRS) for certain U.S. taxpayers. This form is used to report specified foreign financial assets if the total value exceeds certain thresholds. The 2 instructions form provides detailed guidelines on how to accurately report these assets, ensuring compliance with U.S. tax laws. Taxpayers must be aware of their obligations to avoid penalties for non-compliance.

Steps to complete the Form 8938 Fill Online

Completing the 2 instructions form online involves several key steps to ensure accurate reporting. First, gather all necessary information regarding your foreign financial assets, including account numbers, names of financial institutions, and the maximum value of each asset during the tax year. Next, access the online form and input the required data in the designated fields. It is crucial to review your entries for accuracy before submission. Finally, ensure that you electronically sign the form to validate it, as a digital signature is recognized as legally binding under U.S. law.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 8938, which are essential for compliance. Taxpayers must understand the reporting thresholds based on their filing status, as these thresholds determine whether the form is required. The IRS also outlines the types of foreign financial assets that must be reported, including bank accounts, stocks, and certain foreign trusts. Familiarizing yourself with these guidelines can help prevent errors and potential penalties during tax filing.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8938 align with the annual tax return due date. For most taxpayers, this means the form is due on April 15 of the following year. However, extensions may be available, allowing additional time to file. It is important to stay informed about any changes to deadlines, as the IRS occasionally adjusts these dates. Missing the filing deadline can result in penalties, making timely submission crucial for compliance.

Required Documents

To complete the 2 instructions form accurately, certain documents are required. Taxpayers should have access to their foreign financial institution statements, documentation detailing the maximum value of each asset, and any relevant tax treaties that may apply. Additionally, having prior year tax returns can assist in ensuring consistency in reporting. Collecting these documents beforehand can streamline the completion process and reduce the likelihood of errors.

Penalties for Non-Compliance

Failure to file the Form 8938 when required can result in significant penalties. The IRS imposes a penalty of $10,000 for not filing the form, with additional penalties accruing for continued failure to file after receiving a notice from the IRS. Furthermore, taxpayers may face a penalty of up to $50,000 for underreporting foreign financial assets. Understanding these potential penalties underscores the importance of compliance with the reporting requirements set forth by the IRS.

Digital vs. Paper Version

While the Form 8938 can be completed on paper, the digital version offers several advantages. Filing electronically allows for easier data entry, automatic calculations, and immediate submission to the IRS. Additionally, electronic filing often provides confirmation of receipt, reducing the risk of lost documents. Taxpayers are encouraged to consider the digital option for its efficiency and convenience, especially when dealing with complex foreign asset reporting.

Quick guide on how to complete irs 8938 instructions form 2018 2019

Prepare Form 8938 Fill Online easily on any device

Online document management has gained popularity among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any delays. Manage Form 8938 Fill Online on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 8938 Fill Online effortlessly

- Find Form 8938 Fill Online and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from the device of your choice. Edit and eSign Form 8938 Fill Online to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 8938 instructions form 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the irs 8938 instructions form 2018 2019

How to make an electronic signature for the Irs 8938 Instructions Form 2018 2019 in the online mode

How to generate an eSignature for the Irs 8938 Instructions Form 2018 2019 in Google Chrome

How to make an eSignature for putting it on the Irs 8938 Instructions Form 2018 2019 in Gmail

How to make an electronic signature for the Irs 8938 Instructions Form 2018 2019 from your smartphone

How to create an eSignature for the Irs 8938 Instructions Form 2018 2019 on iOS devices

How to create an eSignature for the Irs 8938 Instructions Form 2018 2019 on Android

People also ask

-

What is Form 8938 and why do I need to fill it out?

Form 8938 is an IRS form used by certain taxpayers to report their foreign financial assets. Filling out Form 8938 Fill Online is crucial for compliance with tax regulations. By accurately reporting these assets, you can avoid penalties and ensure that your tax filings are complete.

-

How can I fill out Form 8938 online using airSlate SignNow?

To fill out Form 8938 Fill Online with airSlate SignNow, simply upload your document, and use our intuitive editor to complete the form. Our platform allows you to easily input information and make necessary adjustments, streamlining the entire process.

-

Is there a cost associated with using airSlate SignNow to fill out Form 8938?

Yes, there is a cost to use airSlate SignNow, but our pricing is designed to be cost-effective, especially for businesses. You can choose from various subscription plans that suit your needs, making it easy to access the features required to fill out Form 8938 online.

-

What features does airSlate SignNow offer for filling out Form 8938?

When you fill out Form 8938 Fill Online with airSlate SignNow, you benefit from features such as eSignature capabilities, document sharing, and cloud storage. These tools enhance your efficiency and help ensure that your form is completed accurately and securely.

-

Can I integrate airSlate SignNow with other applications while filling out Form 8938?

Absolutely! airSlate SignNow offers seamless integrations with various applications and services, allowing you to streamline your workflow while filling out Form 8938 online. This means you can connect your existing tools and enhance productivity without any hassle.

-

Is airSlate SignNow secure for filling out sensitive forms like Form 8938?

Yes, airSlate SignNow prioritizes security, especially when it comes to sensitive forms such as Form 8938. Our platform uses advanced encryption and compliance measures to ensure that your data and documents are safe throughout the entire filling process.

-

How can using airSlate SignNow improve my experience when filling out Form 8938?

Using airSlate SignNow to fill out Form 8938 online simplifies the entire process by providing an easy-to-use interface, quick eSigning options, and the ability to track document status. This not only saves you time but also reduces the stress associated with tax filings.

Get more for Form 8938 Fill Online

- Online vaf5 formpdffillercom

- License to sell nursery stock california department of food and suttercounty form

- Eastlake building department form

- Form bi100a industrial injuries disablement benefit 27 pages to nwpolfed

- Signs of safety form

- Pip application form pdf

- Army parental consent form

- Certification of unremarried widow or widower form

Find out other Form 8938 Fill Online

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy