Form 8938 Fill Online 2018

What is the Form 8938 Fill Online

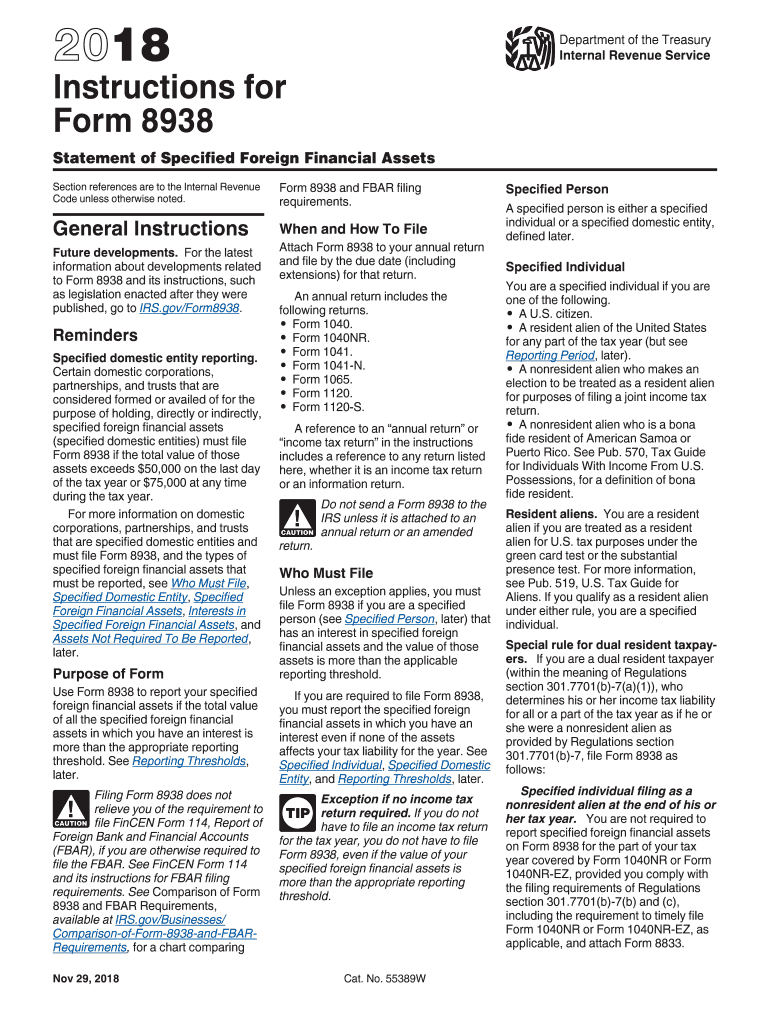

The Form 8938, officially known as the Statement of Specified Foreign Financial Assets, is a tax form required by the Internal Revenue Service (IRS) for certain U.S. taxpayers. This form is used to report specified foreign financial assets if the total value exceeds certain thresholds. The 2 instructions form provides detailed guidelines on how to accurately report these assets, ensuring compliance with U.S. tax laws. Taxpayers must be aware of their obligations to avoid penalties for non-compliance.

Steps to complete the Form 8938 Fill Online

Completing the 2 instructions form online involves several key steps to ensure accurate reporting. First, gather all necessary information regarding your foreign financial assets, including account numbers, names of financial institutions, and the maximum value of each asset during the tax year. Next, access the online form and input the required data in the designated fields. It is crucial to review your entries for accuracy before submission. Finally, ensure that you electronically sign the form to validate it, as a digital signature is recognized as legally binding under U.S. law.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 8938, which are essential for compliance. Taxpayers must understand the reporting thresholds based on their filing status, as these thresholds determine whether the form is required. The IRS also outlines the types of foreign financial assets that must be reported, including bank accounts, stocks, and certain foreign trusts. Familiarizing yourself with these guidelines can help prevent errors and potential penalties during tax filing.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8938 align with the annual tax return due date. For most taxpayers, this means the form is due on April 15 of the following year. However, extensions may be available, allowing additional time to file. It is important to stay informed about any changes to deadlines, as the IRS occasionally adjusts these dates. Missing the filing deadline can result in penalties, making timely submission crucial for compliance.

Required Documents

To complete the 2 instructions form accurately, certain documents are required. Taxpayers should have access to their foreign financial institution statements, documentation detailing the maximum value of each asset, and any relevant tax treaties that may apply. Additionally, having prior year tax returns can assist in ensuring consistency in reporting. Collecting these documents beforehand can streamline the completion process and reduce the likelihood of errors.

Penalties for Non-Compliance

Failure to file the Form 8938 when required can result in significant penalties. The IRS imposes a penalty of $10,000 for not filing the form, with additional penalties accruing for continued failure to file after receiving a notice from the IRS. Furthermore, taxpayers may face a penalty of up to $50,000 for underreporting foreign financial assets. Understanding these potential penalties underscores the importance of compliance with the reporting requirements set forth by the IRS.

Digital vs. Paper Version

While the Form 8938 can be completed on paper, the digital version offers several advantages. Filing electronically allows for easier data entry, automatic calculations, and immediate submission to the IRS. Additionally, electronic filing often provides confirmation of receipt, reducing the risk of lost documents. Taxpayers are encouraged to consider the digital option for its efficiency and convenience, especially when dealing with complex foreign asset reporting.

Quick guide on how to complete irs 8938 instructions form 2018 2019

Prepare Form 8938 Fill Online easily on any device

Online document management has gained popularity among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any delays. Manage Form 8938 Fill Online on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 8938 Fill Online effortlessly

- Find Form 8938 Fill Online and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from the device of your choice. Edit and eSign Form 8938 Fill Online to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 8938 instructions form 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the irs 8938 instructions form 2018 2019

How to make an electronic signature for the Irs 8938 Instructions Form 2018 2019 in the online mode

How to generate an eSignature for the Irs 8938 Instructions Form 2018 2019 in Google Chrome

How to make an eSignature for putting it on the Irs 8938 Instructions Form 2018 2019 in Gmail

How to make an electronic signature for the Irs 8938 Instructions Form 2018 2019 from your smartphone

How to create an eSignature for the Irs 8938 Instructions Form 2018 2019 on iOS devices

How to create an eSignature for the Irs 8938 Instructions Form 2018 2019 on Android

People also ask

-

What is the purpose of the 2016 8938 instructions form?

The 2016 8938 instructions form is used to report specified foreign financial assets to the IRS. It determines whether U.S. taxpayers need to file Form 8938 based on their foreign asset holdings, aiding compliance with tax regulations.

-

How can I access the 2016 8938 instructions form?

You can access the 2016 8938 instructions form directly from the IRS website or through various tax preparation software, which often includes helpful tools for completing the form accurately.

-

Are there any penalties for not filing the 2016 8938 instructions form?

Yes, there are signNow penalties for failing to file the 2016 8938 instructions form, including a hefty fine, which can accumulate if the omission continues. It is crucial to follow IRS guidelines to avoid these penalties.

-

How does airSlate SignNow assist with the 2016 8938 instructions form filing?

AirSlate SignNow enables you to easily manage, sign, and send documents, including the 2016 8938 instructions form. With its user-friendly interface, you can streamline the filing process and ensure all documents are signed and submitted promptly.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow offers a range of features including eSignature, document templates, and automated workflows that simplify the process of handling documents like the 2016 8938 instructions form. These tools enhance efficiency and reliability in document processing.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow provides a cost-effective solution for small businesses looking to manage their documents digitally. Its pricing plans are designed to accommodate various budgets while offering robust features for tasks such as filing the 2016 8938 instructions form.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! AirSlate SignNow offers integration capabilities with various applications, enhancing your workflow and allowing for seamless document management related to the 2016 8938 instructions form and other essential documents.

Get more for Form 8938 Fill Online

- Application for examination or employment rev franklin county franklincony form

- Spoa application nassau county ny form

- Claim form nassau county nassaucountyny

- Application for electrical permit lackawanna form

- Foil application inc village of malverne ny malvernevillage form

- Foil request form city of port jervis portjervisny

- Hwseta regnohw591pa1212477 form syracuse ny

- Short assessment form

Find out other Form 8938 Fill Online

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation