W3pr 2018

What is the W-3PR?

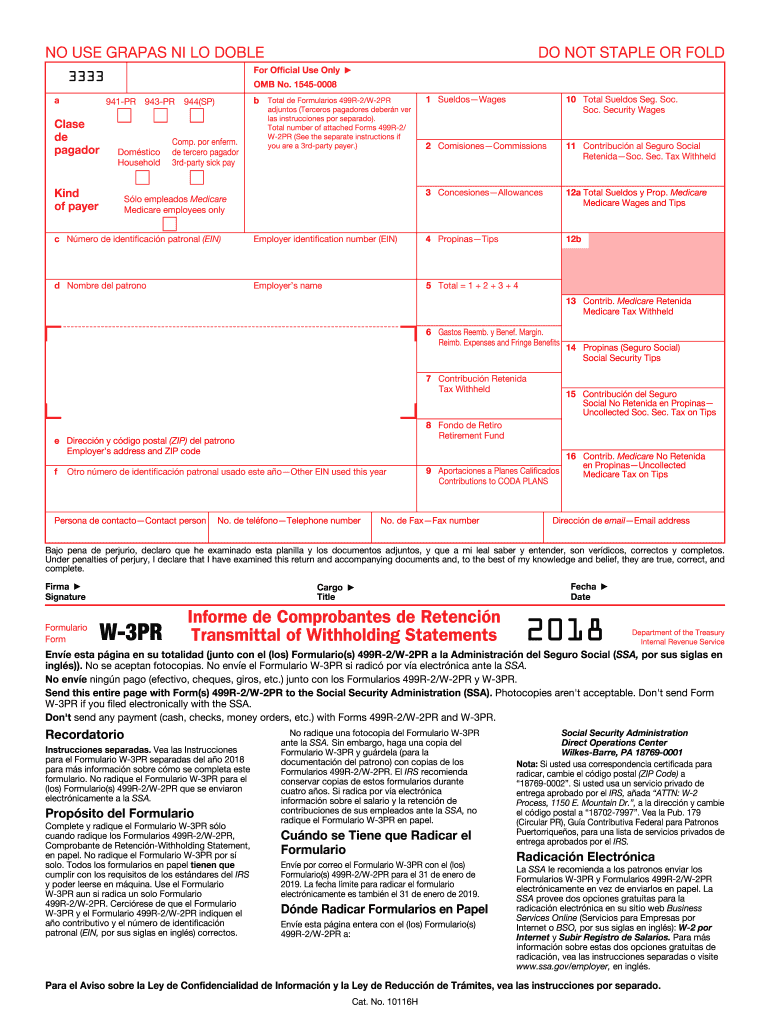

The W-3PR is a form used in Puerto Rico for reporting annual wages and withholding information for employees. It serves as a summary of the W-2 forms issued by employers to their employees. The W-3PR consolidates the total wages paid and the total taxes withheld for the year, providing the Internal Revenue Service (IRS) with essential data for tax purposes. This form is crucial for both employers and employees to ensure accurate tax reporting and compliance with local regulations.

How to Use the W-3PR

To effectively use the W-3PR, employers must first complete the individual W-2 forms for each employee. After compiling this information, the W-3PR form is filled out to summarize the total amounts from all W-2 forms. It is important to ensure that the figures on the W-3PR match the totals reported on the W-2 forms. Once completed, the W-3PR must be submitted to the IRS along with the W-2 forms by the designated filing deadline.

Steps to Complete the W-3PR

Completing the W-3PR involves several key steps:

- Gather all W-2 forms issued to employees for the tax year.

- Calculate the total wages paid to all employees.

- Determine the total federal income tax withheld from employee wages.

- Fill out the W-3PR form with the calculated totals.

- Review the form for accuracy to ensure it aligns with the W-2 forms.

- Submit the W-3PR along with the W-2 forms to the IRS by the deadline.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the W-3PR. Employers must ensure that the form is filled out accurately and completely to avoid penalties. The IRS requires that the W-3PR be submitted electronically if there are more than 250 W-2 forms. Additionally, employers must keep copies of the W-2 and W-3PR forms for their records for at least four years. Following these guidelines helps ensure compliance and smooth processing of tax documents.

Filing Deadlines / Important Dates

Employers need to be aware of the filing deadlines for the W-3PR. Typically, the W-3PR must be submitted to the IRS by January thirty-first of the year following the tax year being reported. It is essential to adhere to this deadline to avoid late filing penalties. Employers should also keep in mind that if they are filing electronically, they may have different deadlines, which should be verified with the IRS guidelines.

Penalties for Non-Compliance

Failure to file the W-3PR correctly or on time can result in significant penalties. The IRS may impose fines for late submissions, inaccuracies, or failure to file altogether. These penalties can accumulate quickly, making it crucial for employers to ensure that their filings are accurate and timely. Understanding the potential consequences of non-compliance can motivate employers to prioritize their tax reporting responsibilities.

Quick guide on how to complete este formulario aparece en color irs

Complete W3pr effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents promptly without delays. Manage W3pr on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign W3pr seamlessly

- Locate W3pr and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Craft your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Adapt and eSign W3pr and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct este formulario aparece en color irs

Create this form in 5 minutes!

How to create an eSignature for the este formulario aparece en color irs

How to create an eSignature for your Este Formulario Aparece En Color Irs online

How to create an eSignature for your Este Formulario Aparece En Color Irs in Chrome

How to create an electronic signature for signing the Este Formulario Aparece En Color Irs in Gmail

How to create an electronic signature for the Este Formulario Aparece En Color Irs right from your mobile device

How to create an eSignature for the Este Formulario Aparece En Color Irs on iOS devices

How to make an eSignature for the Este Formulario Aparece En Color Irs on Android OS

People also ask

-

What is the form w 3 pr 2017?

The form w 3 pr 2017 is a summary of all W-2 forms that an employer must submit to the IRS, reporting the total earnings and taxes withheld for employees. It plays a crucial role in tax processing for organizations, ensuring compliance with federal regulations.

-

How can airSlate SignNow help with the form w 3 pr 2017?

airSlate SignNow provides businesses with a streamlined solution to electronically sign and send the form w 3 pr 2017. By utilizing our platform, you can easily manage employee documentation and ensure timely submissions, minimizing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the form w 3 pr 2017?

Yes, there is a cost associated with using airSlate SignNow; however, it is designed to be cost-effective. Pricing plans are available to suit different business needs, and the convenience of electronically managing the form w 3 pr 2017 can ultimately save time and resources.

-

What features does airSlate SignNow offer for the form w 3 pr 2017?

airSlate SignNow offers features such as customizable templates, secure electronic signatures, and automatic reminders for submissions related to the form w 3 pr 2017. These tools enhance productivity and encourage compliance with tax-related documentation.

-

Can I integrate airSlate SignNow with my existing software for handling the form w 3 pr 2017?

Yes, airSlate SignNow offers various integrations with popular software systems, allowing seamless management of the form w 3 pr 2017 alongside your existing tools. This integration ensures you can maintain your workflow without disruption while benefiting from our electronic signing capabilities.

-

What are the benefits of using airSlate SignNow for the form w 3 pr 2017?

Using airSlate SignNow for the form w 3 pr 2017 enhances efficiency by reducing the need for paper documentation and physical signatures. Additionally, our platform's tracking features ensure you have visibility over the status of your submissions, minimizing delays in processing.

-

How secure is airSlate SignNow for sending the form w 3 pr 2017?

airSlate SignNow employs top-notch security measures, including encryption and secure access protocols, to protect your data when sending the form w 3 pr 2017. Our commitment to security ensures that sensitive information remains confidential and meets industry standards.

Get more for W3pr

- Mayo clinic health care directive form

- Consent form for the treatment of minors mayo clinic health system

- Well sealing permit application city of minneapolis ci minneapolis mn form

- Letter trespass notice form

- Position title administratorclerk treasurer city of parkers prairie parkersprairie form

- 880 lease form

- Chapter 11 powers of congress section 1 the scope of bb tds form

- Friend in deed springfield il form

Find out other W3pr

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF