Hawaii Tax Clearance Application Online Form 2012

What is the Hawaii Tax Clearance Application Online Form

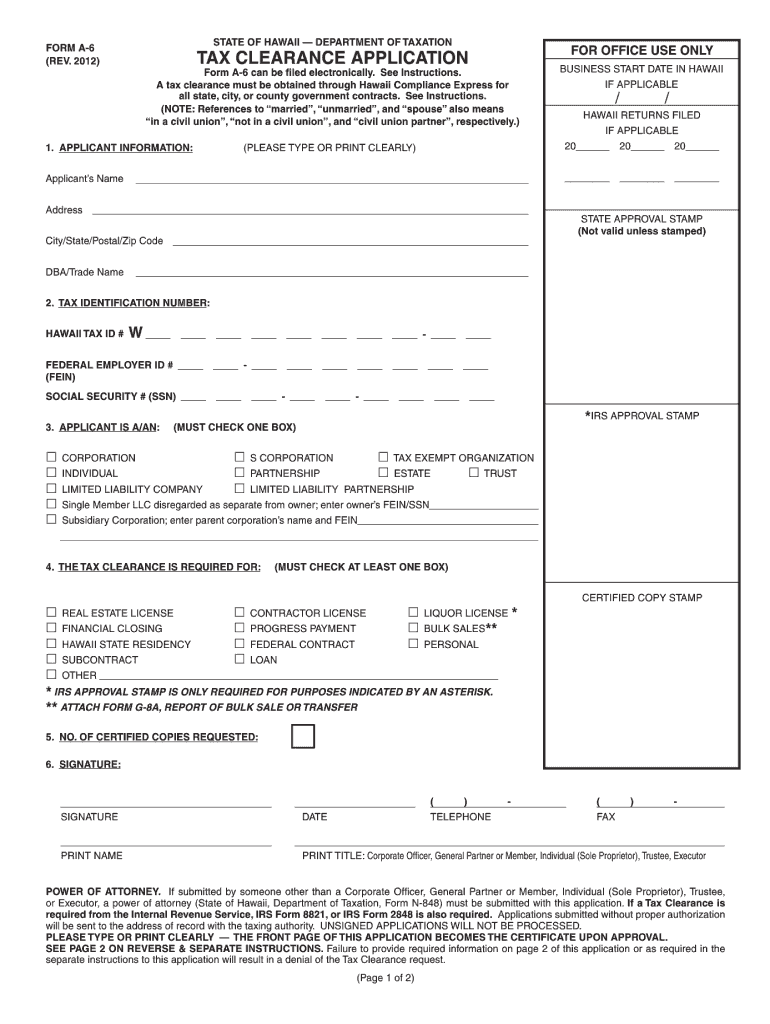

The Hawaii Tax Clearance Application Online Form is a digital document designed for individuals and businesses to request a tax clearance certificate from the Hawaii Department of Taxation. This certificate confirms that all tax obligations have been met, which is often necessary for various transactions, such as securing loans, obtaining licenses, or completing business transactions. The online version streamlines the application process, allowing users to fill out the form electronically, reducing the need for paper submissions and in-person visits.

How to use the Hawaii Tax Clearance Application Online Form

Using the Hawaii Tax Clearance Application Online Form involves several straightforward steps. First, access the form through the designated online portal. Next, fill in the required fields, which typically include personal identification information, tax identification numbers, and any relevant details concerning your tax history. After completing the form, review all entries for accuracy. Finally, submit the application electronically, ensuring to keep a copy for your records. This process enhances efficiency and helps avoid common errors associated with paper forms.

Steps to complete the Hawaii Tax Clearance Application Online Form

Completing the Hawaii Tax Clearance Application Online Form requires following specific steps to ensure accuracy and compliance. Begin by gathering necessary documentation, such as your Social Security number or Employer Identification Number. Then, proceed to the online application portal and enter your information in the designated fields. Pay close attention to any instructions provided on the form. After filling out all sections, double-check your entries for any mistakes. Once confirmed, submit the application and await confirmation of receipt. This organized approach helps facilitate a smooth application process.

Required Documents

When preparing to submit the Hawaii Tax Clearance Application Online Form, certain documents are essential for a complete application. Typically, you will need to provide your Social Security number or Employer Identification Number, proof of identity, and any prior tax returns if applicable. Additionally, if you are representing a business, documentation proving your authority to act on behalf of the entity may also be required. Ensuring you have all necessary documents ready can expedite the processing of your application.

Legal use of the Hawaii Tax Clearance Application Online Form

The Hawaii Tax Clearance Application Online Form is legally recognized as a valid method for requesting a tax clearance certificate. The use of this form complies with state tax regulations and is accepted by various governmental and financial institutions. It is important to ensure that all information provided is accurate and truthful, as any discrepancies may result in delays or legal repercussions. By utilizing this online form, applicants can fulfill their legal obligations efficiently and securely.

Penalties for Non-Compliance

Failure to comply with tax obligations in Hawaii can lead to significant penalties. Individuals and businesses that do not obtain a tax clearance certificate may face delays in processing business licenses, permits, or loans. Additionally, non-compliance can result in fines, interest on unpaid taxes, and potential legal action from the state. It is crucial to maintain good standing with the Hawaii Department of Taxation to avoid these consequences and ensure smooth business operations.

Quick guide on how to complete hawaii tax clearance application online 2012 form

Your assistance manual on how to prepare your Hawaii Tax Clearance Application Online Form

If you’re wondering how to complete and submit your Hawaii Tax Clearance Application Online Form, here are some straightforward instructions on how to simplify tax filing.

To start, you simply need to create your airSlate SignNow account to change how you manage documents online. airSlate SignNow is an extremely intuitive and robust document solution that allows you to edit, generate, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures and return to modify information as necessary. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your Hawaii Tax Clearance Application Online Form in just a few minutes:

- Create your account and start working on PDFs in minutes.

- Use our directory to find any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Hawaii Tax Clearance Application Online Form in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to apply your legally-binding electronic signature (if necessary).

- Review your submission and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that sending paper forms can lead to more mistakes and delay refunds. Furthermore, before e-filing your taxes, consult the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct hawaii tax clearance application online 2012 form

FAQs

-

What is the procedure for filling out the CPT registration form online?

CHECK-LIST FOR FILLING-UP CPT JUNE - 2017 EXAMINATION APPLICATION FORM1 - BEFORE FILLING UP THE FORM, PLEASE DETERMINE YOUR ELIGIBILITY AS PER DETAILS GIVEN AT PARA 1.3 (IGNORE FILLING UP THE FORM IN CASE YOU DO NOT COMPLY WITH THE ELIGIBILITY REQUIREMENTS).2 - ENSURE THAT ALL COLUMNS OF THE FORM ARE FILLED UP/SELECTED CORRECTLY AND ARE CORRECTLY APPEARING IN THE PDF.3 - CENTRE IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF. (FOR REFERENCE SEE APPENDIX-A).4 - MEDIUM OF THE EXAMINATION IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.5 - THE SCANNED COPY OF THE DECLARATION UPLOADED PERTAINS TO THE CURRENT EXAM CYCLE.6 - ENSURE THAT PHOTOGRAPHS AND SIGNATURES HAVE BEEN AFFIXED (If the same are not appearing in the pdf) AT APPROPRIATE COLUMNS OF THE PRINTOUT OF THE EXAM FORM.7 - ADDRESS HAS BEEN RECORDED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.8 - IN CASE THE PDF IS NOT CONTAINING THE PHOTO/SIGNATURE THEN CANDIDATE HAS TO GET THE DECLARATION SIGNED AND PDF IS GOT ATTESTED.9 - RETAIN A COPY OF THE PDF/FILLED-IN FORM FOR YOUR FUTURE REFERENCE.10 - IN CASE THE PHOTO/SIGN IS NOT APPEARING IN THE PDF, PLEASE TAKE ATTESTATIONS AND SEND THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION BY SPEED POST/REGISTERED POST ONLY.11 - KEEP IN SAFE CUSTODY THE SPEED POST/REGISTERED POST RECEIPT ISSUED BY POSTAL AUTHORITY FOR SENDING THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION FORM TO THE INSTITUTE/ RECEIPT ISSUED BY ICAI IN CASE THE APPLICATION IS DEPOSITED BY HAND.Regards,Scholar For CA089773 13131Like us on facebookScholar for ca,cma,cs https://m.facebook.com/scholarca...Sambamurthy Nagar, 5th Street, Kakinada, Andhra Pradesh 533003https://g.co/kgs/VaK6g0

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out the application for a Schengen visa?

Dear Rick,A Schengen visa application form requires the information about your passport, intended dates and duration of visit, sponsor’s or inviting person's details, previous schengen visa history etc. If you have these details with you, it is very easy to fill out the visa application.

-

How should I fill out an online application form for the KVPY exam?

KVPY Registration 2018 is starting from 11th July 2018. Indian Institute of Science (IISC), Bangalore conducts a national level scholarship programme.How to Fill KVPY Application FormVisit the official and register as a new user by mentioning Name, date of birth, stream, nationality etc.Enter the captcha and click on submit.Enter your basic details such as Name, Date of Birth, Age, E-mail id, the Mobile number for registration, etc. Also select from the drop down menu your class, gender, category & nationality.Now click on the ‘Submit’ tab.

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

Create this form in 5 minutes!

How to create an eSignature for the hawaii tax clearance application online 2012 form

How to make an electronic signature for your Hawaii Tax Clearance Application Online 2012 Form in the online mode

How to create an electronic signature for the Hawaii Tax Clearance Application Online 2012 Form in Chrome

How to make an eSignature for putting it on the Hawaii Tax Clearance Application Online 2012 Form in Gmail

How to generate an electronic signature for the Hawaii Tax Clearance Application Online 2012 Form right from your smart phone

How to generate an electronic signature for the Hawaii Tax Clearance Application Online 2012 Form on iOS devices

How to generate an electronic signature for the Hawaii Tax Clearance Application Online 2012 Form on Android OS

People also ask

-

What is the Hawaii Tax Clearance Application Online Form?

The Hawaii Tax Clearance Application Online Form is a digital tool that allows individuals and businesses to request a tax clearance certificate online. This streamlined process makes it easier to ensure all tax obligations are met before doing business in Hawaii, ultimately saving time and reducing the hassle of paperwork.

-

How do I complete the Hawaii Tax Clearance Application Online Form?

To complete the Hawaii Tax Clearance Application Online Form, simply visit our official site and follow the step-by-step instructions. You'll need to provide your tax identification information and other relevant personal or business details, making it simple to submit your application electronically.

-

Is there a fee associated with the Hawaii Tax Clearance Application Online Form?

Yes, there is a nominal processing fee for submitting the Hawaii Tax Clearance Application Online Form. The fee varies depending on the type of application and is designed to cover the costs involved in processing your request efficiently.

-

What are the benefits of using the Hawaii Tax Clearance Application Online Form?

The Hawaii Tax Clearance Application Online Form offers numerous benefits, including convenience, speed, and reduced paper usage. By using our online platform, you can complete your application from anywhere and track its status in real-time, ensuring you receive your clearance certificate without delay.

-

How long does it take to process the Hawaii Tax Clearance Application Online Form?

Processing time for the Hawaii Tax Clearance Application Online Form can vary, but it typically takes between 5 to 10 business days. Factors such as the volume of applications and the completeness of your submission can impact the processing speed, so be sure to provide all required information.

-

Can I submit the Hawaii Tax Clearance Application Online Form as a business entity?

Absolutely! The Hawaii Tax Clearance Application Online Form is designed for both individuals and business entities. Businesses can easily submit their applications online, ensuring they meet all tax requirements for permits and licenses without unnecessary delays.

-

What documents do I need to upload with the Hawaii Tax Clearance Application Online Form?

When submitting the Hawaii Tax Clearance Application Online Form, you may be required to upload supporting documents, such as your tax identification number and any previous tax returns. Having these documents ready will facilitate a smoother application process and help avoid potential setbacks.

Get more for Hawaii Tax Clearance Application Online Form

Find out other Hawaii Tax Clearance Application Online Form

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate