Form a 6 Tax 2017

What is the Form A 6 Tax

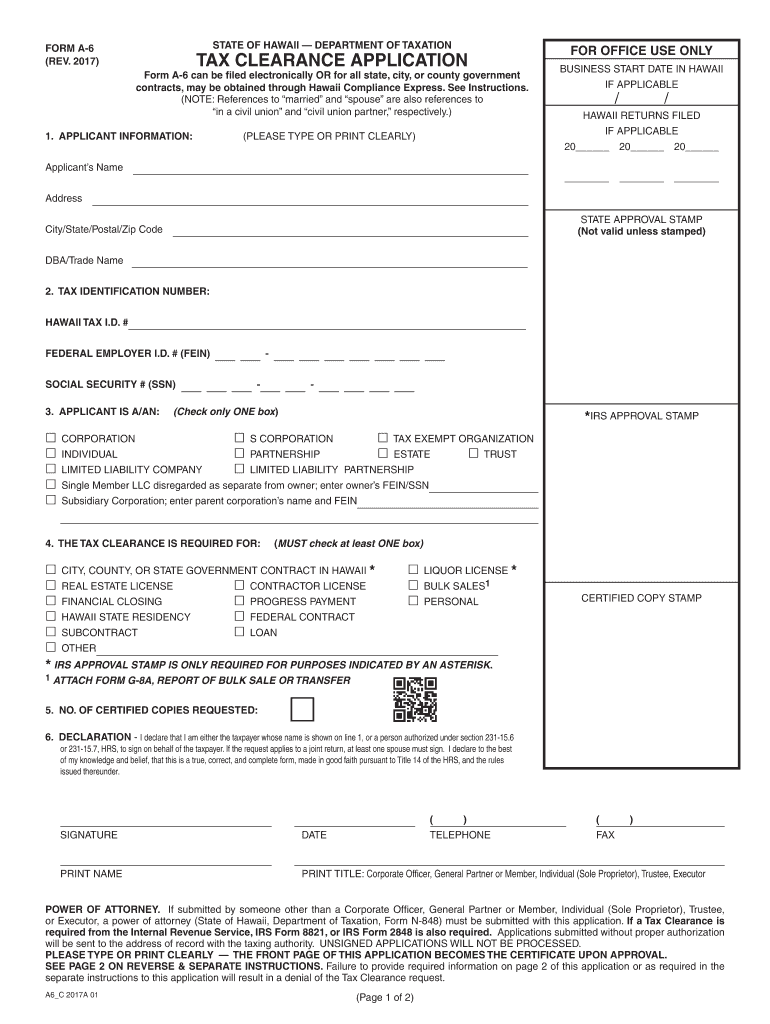

The Form A 6 Tax is a specific tax document utilized by individuals and businesses in the United States for reporting certain financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations. It typically includes sections for income reporting, deductions, and credits, allowing taxpayers to accurately calculate their tax obligations. Understanding the purpose and structure of the Form A 6 Tax is crucial for effective tax management and compliance.

How to use the Form A 6 Tax

Using the Form A 6 Tax involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax information. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before signing and dating it. Finally, submit the form according to the IRS guidelines, either electronically or by mail, depending on your preference and the requirements for your specific situation.

Steps to complete the Form A 6 Tax

Completing the Form A 6 Tax can be streamlined by following these organized steps:

- Collect all relevant financial documentation, such as W-2s, 1099s, and receipts.

- Review the instructions provided with the form to understand each section.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately in the designated sections.

- Include any applicable deductions or credits to reduce your taxable income.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submitting it to the IRS.

Legal use of the Form A 6 Tax

The legal use of the Form A 6 Tax is governed by IRS regulations, which mandate that all information provided must be truthful and accurate. Falsifying information on this form can result in penalties, including fines and potential legal action. It is important to ensure that all entries comply with federal tax laws. Additionally, the IRS has made provisions for electronic signatures, allowing taxpayers to sign the form digitally, which is legally binding and compliant with the ESIGN Act.

Filing Deadlines / Important Dates

Filing deadlines for the Form A 6 Tax are crucial for compliance and avoiding penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year being reported. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any specific extensions that may apply, such as filing for an extension to submit the form later in the year. Keeping track of these important dates is essential for timely tax filing.

Form Submission Methods (Online / Mail / In-Person)

The Form A 6 Tax can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to file electronically through IRS-approved software, which can simplify the process and reduce errors.

- Mail Submission: For those preferring traditional methods, the form can be printed and mailed to the appropriate IRS address, ensuring it is sent well before the deadline.

- In-Person Submission: Taxpayers may also visit local IRS offices to submit their forms directly, although this option may require an appointment.

Quick guide on how to complete form a 6 tax 2017 2019

Your assistance manual on how to prepare your Form A 6 Tax

If you’re interested in learning how to complete and submit your Form A 6 Tax, below are a few concise recommendations on how to facilitate tax filing.

To start, you just need to create your airSlate SignNow profile to modify how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to alter, generate, and finish your tax documents effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures while returning to modify details as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Form A 6 Tax in moments:

- Establish your account and start working on PDFs within moments.

- Utilize our directory to discover any IRS tax form; explore different versions and schedules.

- Click Get form to access your Form A 6 Tax in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if required).

- Review your document and rectify any mistakes.

- Save changes, print your copy, deliver it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper can increase return errors and delay reimbursements. Naturally, before e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form a 6 tax 2017 2019

FAQs

-

What is your reaction to Mayawati's statement: "If Ram statue OK, why not mine"?

Do you remember these guys?Suresh Raina, Piyush Chawla, RP Singh (Photo Credits left to right: Wikipedia, Wikimedia, Vimeo[1] )Surprised at what this has to do with the question? Please allow me to explain.FLASHBACKThe 700 crore Ambedkar Memorial Park at Lucknow is probably the most ambitious project among all the memorials and statues built by Mayawati Government across Uttar Pradesh. Total cost: 2,600 crore INR.In 1994 Mayawati inaugurated the Dr. BR Ambedkar Sports Complex in Lucknow. The stadium boasted of 72 crore worth of infrastructure: — 6 tennis courts, 4 basketball courts,— the only Olympic-sized swimming pool in the state at that time!— cricket ground with good seating capacity,— indoor stadium housing Table Tennis area, Badminton courts, Gymnasiums— hostels for athletes and residence for coaches;Suresh Raina, R.P. Singh and Piyush Chawla were among some of the athletes who were nurtured by the complex. It also hosted some reputed state and national level tournaments. The lush green sprawling complex also became a part of the lives of the locals who could be seen jogging, playing and witnessing sports activities.The complex’s only fault was that it shared its boundaries with an old Ambedkar Memorial which was constructed in 2003.END OF GAMESIn 2007 when Mayawati became the Chief Minister of U.P., she announced the re-construction of the old memorial into an even larger and more elaborate one. In July 2007 the complex staff and their families were given 4 hours to vacate the premises to facilitate its demolition!A legal battle ensued.[2]No prizes for guessing on who won.The officials and athletes were moved to hostels and complexes in other cities that failed to measure up to their old home. Who knows how many blooming careers got trampled that day? It was a sad time for sports in the state, whose infrastructure was already in shambles.[3]AFTERMATHIn return for their tax money the public got a brand new ‘Ambedkar Memorial’.With many Mayawati statues and her handbagMayawati ‘emblem’ with the HandbagsHandbag, Handbag, Handbag…(Image Sources [4][5])Seriously, what is with the bag?!Some of these statues are estimated to have costed 3.5–7 crores.‘The Elephant Corridor’: Featuring 62 giant elephants on either side, each of which costed around 70 lakhs each.Oh by the way.. this is her political party symbolTo be honest there are other statues as well, honoring those who worked for equality and justice - Jyotirao Phule, Narayana Guru, Birsa Munda, Shahuji Maharaj, Bhimrao Ambedkar, Kanshi Ram and others.[6]But, you now know who the star of the show was.TOURISMThe memorial has become popular, but visitors are mostly from within the city and nearby towns.A couple of Bollywood songs have been shot at this place.[7]The memorial was constructed in a posh residential area of the city, with Taj Mahal Hotel and Sahara City nearby. Due to high property rates it wasn’t lucrative for small businesses to flourish here.The memorial is not the sole cause of tourism growth. Other contributors in the vicinity include two massive green parks, a badminton academy which can hold national & international tournaments, a beautiful riverfront, theaters, shopping malls, private and government offices.[8]THE BIGGEST BENEFICIARIES?Mayawati’s assets have always been in question but she has always claimed that her wealth comes through gifts donated by faithful supporters of her party.[9]Her regime saw her brother also benefiting exponentially - from net worth of 7.5 crores to 1316 crores. That is roughly 18000% in 7 years![10]He opened several companies (5 in below pic) who received funding from a host of ‘shell’ companies, ghost investors and ‘sweetheart’ deals.[11] Whether this has any relation to the memorials and statues has NOT been established.After Mayawati’s term ended and Akhilesh Yadav’s Government took over, the police started investigating an alleged 40,000 crore statue scam.The former Lokayukta of U.P., submitted his report to former CM Akhilesh Yadav in which Mayawati was exonerated but 199 other individuals were indicted.The UP Lokayukta said that around Rs 4,188 crore was spent on the purchase and finishing of stones for the memorials, out of which around 35 percent went into the pockets of ministers, bureaucrats, politicians, contractors and engineers.In latest developments the High Court and Supreme Court have tightened their noose around Mayawati over the matter.[12] [13]The sweet irony is that the inquiry which was started by Akhilesh Yadav’s Government has come back to haunt Mayawati now, when she is all set to form a coalition with him in the upcoming Loksabha Elections.Akhilesh Yadav too is being probed under an illegal mining scam and irregularities worth 97,000 crores during his regime.[14] [15]I am no fan of statue building, but to answer the question:The Ram statue is Lord Ram’s statue and not Yogi’s statue.CSR funds for tourism and other private donations will be used to construct the statue (not taxpayer’s money). [16] Under Companies Act 2013, organizations can choose to donate these funds on a variety of projects such as education, health, water, poverty, sanitation, tourism, etc. (Below - U.P. CSR fund spending in 2017–18)[17]The State Government will be spending on the infrastructure around the statue. This is one of the several projects of Yogi’s Government for improving religious tourism in the state.[18] Given the success of Kumbh 2019, this claim may have some weight.Hopefully Yogi’s sister, who sells flowers, will not see an exponential rise in her net-worth like Mayawati’s brother.[19]Speaking of flowers…5 crore cash garlandGift Courtesy: ‘Faithful Party Supporters’Pic Courtesy: The Citizen[20](All images above without credits are from Wikipedia/Wikimedia under ‘labeled for reuse’ license)Footnotes[1] DSS Little Masters Cricket Championship[2] UP: Demolition of Ambedkar Stadium for Mayawati's dream project[3] Demolished stadium left a void hard to fill[4] UP Assembly polls: BSP banks on Mayawati’s statues for campaigning[5] Mayawati statues to be included and counted in census 2011[6] Ambedkar Memorial Park - Wikipedia[7] Ambedkar park - it doesn't get grander than this - Times of India[8] Gomti Nagar - Wikipedia[9] Mayawati pays Rs 15 crore advance tax[10] Rs 1,300 crore rise in assets of Mayawati’s brother under income tax lens[11] Massive setback to Mayawati, brother Anand Kumar’s Rs 1,300 crore wealth under IT scanner[12] Do Not Spare BSP Leaders Accused in Rs 1,420 cr Memorial Scam: Allahabad HC to UP Govt[13] Mayawati has to deposit money used for erecting her statues, BSP's symbol elephant: Supreme Court[14] Irregularities worth Rs 97,000 crore under Akhilesh Yadav government: CAG[15] Illegal mining scam: The corruption case against Akhilesh Yadav[16] Uttar Pradesh aims to tap CSR funds for 100-metre Ram Statue in Ayodhya[17] https://csr.gov.in/CSR/state.php...[18] Gurudutt Mallapur's answer to What do you think of Yogi Adityanath government's plan for a grand Ram statue in Ayodhya?[19] Meet the sister of CM Yogi Adityanath who sells flowers and lives simple life[20] Vemula Impact: Dalit-MBC Tailwind for Mayawati Campaign in UP

-

Why is the alternative minimum tax form of 6251 so onerous to fill out?

To make things simpler, ironically.The purpose of the AMT is to ensure that the uber rich pay at least a minimum amount of taxes, but has since morphed into something that hits the upper middle classes*. It does that by having fewer tax brackets, fewer allowed deductions and a higher standard deduction. What you owe is whatever causes you to pay more taxes.However, this needs to be done in addition to the traditional tax calculation. So you need to take your calculations of your various income measures, and put back in various deductions that are disallowed under AMT rules. Or have to be recalculated. It’s a pain.Either someone decided that this was easier than having a completely separate tax form to calculate your AMt tax or someone lobbied to have mor complicated taxes so you’d go to one of the tax places or download tax software.*With the Trump tax changes, AMT affects fewer people.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

Create this form in 5 minutes!

How to create an eSignature for the form a 6 tax 2017 2019

How to generate an electronic signature for the Form A 6 Tax 2017 2019 online

How to generate an eSignature for your Form A 6 Tax 2017 2019 in Chrome

How to generate an electronic signature for putting it on the Form A 6 Tax 2017 2019 in Gmail

How to create an electronic signature for the Form A 6 Tax 2017 2019 straight from your mobile device

How to generate an eSignature for the Form A 6 Tax 2017 2019 on iOS devices

How to create an electronic signature for the Form A 6 Tax 2017 2019 on Android devices

People also ask

-

What is Form A 6 Tax and why is it important?

Form A 6 Tax is a crucial document used for reporting specific tax-related information. Understanding this form is essential for complying with tax regulations and ensuring accurate filings. By utilizing airSlate SignNow, you can easily eSign and send your Form A 6 Tax efficiently.

-

How does airSlate SignNow simplify the signing process for Form A 6 Tax?

airSlate SignNow streamlines the signing process for Form A 6 Tax by providing an intuitive platform that allows users to eSign documents seamlessly. With features like templates and reminders, you can avoid delays and ensure timely submissions. This efficiency helps businesses save time and reduce stress.

-

Is airSlate SignNow a cost-effective solution for handling Form A 6 Tax?

Yes, airSlate SignNow offers a cost-effective solution for managing all your eSign and document needs, including the Form A 6 Tax. Our pricing plans cater to businesses of all sizes, ensuring you get excellent value while meeting your compliance requirements. Choose airSlate SignNow to optimize your document workflow without breaking the bank.

-

What security features does airSlate SignNow provide for Form A 6 Tax documents?

Security is paramount when dealing with sensitive documents like the Form A 6 Tax. airSlate SignNow ensures your data is protected through bank-level encryption, secure storage, and compliance with global security standards. This means you can confidently send and eSign your tax documents without worrying about data bsignNowes.

-

Can I integrate airSlate SignNow with other software for managing Form A 6 Tax?

Absolutely! airSlate SignNow integrates with a variety of third-party applications, making it easy to manage your Form A 6 Tax and other documents seamlessly. Whether you use CRM systems or accounting software, our integration capabilities enhance your workflow and ensure all your data is connected.

-

What are the benefits of using airSlate SignNow for Form A 6 Tax compliance?

Using airSlate SignNow for Form A 6 Tax compliance offers numerous benefits, including quicker turnaround times, reduced paperwork, and improved organization of your tax documents. The easy-to-use platform aids in navigating tax regulations while ensuring you never miss a deadline. Choose airSlate SignNow for enhanced efficiency in your tax processes.

-

How does the template feature work for the Form A 6 Tax in airSlate SignNow?

The template feature in airSlate SignNow allows you to create a pre-filled Form A 6 Tax that can be reused as needed. This saves time and minimizes errors, ensuring that each version of the form is compliant and accurately filled out. You can set up templates tailored to your business needs for swift access at any time.

Get more for Form A 6 Tax

- Nova magnetic storm answer key form

- Skills worksheet active reading answers form

- Standard agreement between design builder and design professional form

- Nawamintrachinuthit satriwitthaya phutthamonthon school basic verbs and conversation m form

- Form 5498 sa

- South carolina department of motor vehicles golf scdmv form

- Marriage license application information review vermillion county

- Restricted stock agreement template form

Find out other Form A 6 Tax

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form